For any business owner in the UAE, getting to grips with Value Added Tax (VAT) is non-negotiable. It's a core part of running your company, involving everything from registering with the Federal Tax Authority (FTA) to calculating the 5% tax and filing your returns online. Honestly, mastering VAT filing in the UAE isn't just about staying compliant—it's crucial for your company's financial health.

Decoding the Essentials of UAE VAT

Before you can file anything, you need to understand the basic mechanics. At its heart, VAT is a tax on consumption. Your business essentially acts as a tax collector for the government. You charge VAT on your sales to customers and then pass it on to the FTA, but not before you subtract the VAT you paid on your own business purchases.

Since it rolled out on 1 January 2018, this system has fundamentally changed how businesses here operate. The standard rate is a clean 5%, which keeps things relatively simple. But the real starting point for any business is figuring out if you even need to register. That's all down to the registration thresholds.

If you want to see how this fits into the bigger picture, it's worth exploring the relationship between corporate tax and VAT integration in the UAE.

Mandatory vs. Voluntary Registration

The FTA has laid out very specific financial triggers for VAT registration. Miss these, and you're looking at some hefty penalties.

So, here's a quick look at the VAT registration thresholds that every UAE business needs to keep on its radar.

UAE VAT Registration Thresholds at a Glance

| Registration Type | Annual Taxable Supplies Threshold | Who It Applies To |

|---|---|---|

| Mandatory | Above AED 375,000 | Businesses whose taxable turnover exceeded this amount in the last 12 months or is expected to in the next 30 days. |

| Voluntary | Above AED 187,500 (but below AED 375,000) | Businesses that meet this lower threshold and want to register to reclaim VAT on their expenses. |

These numbers are your guide. Your business must register if your taxable supplies and imports tipped over AED 375,000 in the last year. The same applies if you have good reason to believe you'll cross that line in the next 30 days.

But what if you're in the middle? If your turnover is over AED 187,500 but still under the mandatory limit, you can choose to register voluntarily.

Why would you register if you don't have to?

It's often a smart strategic play. Registering voluntarily means you can claim back the VAT you pay on business expenses (your input tax). For a startup with big initial costs, this can be a game-changer for your cash flow. Plus, it adds a layer of professionalism when you're dealing with larger, VAT-registered companies.

What Exactly Are "Taxable Supplies"?

This term "taxable supplies" is what the registration thresholds are all about. It's a broad term, so you need to be crystal clear on what counts towards that AED 375,000 limit to make sure you register on time.

Generally, your supplies fall into one of two buckets:

- Standard-Rated Supplies: This is your bread and butter. It covers goods and services taxed at the standard 5% rate. Think retail sales, consulting gigs—most day-to-day commercial transactions land here.

- Zero-Rated Supplies: These are still taxable, but the rate is 0%. Don't let the zero fool you; these sales absolutely count towards your registration threshold. Common examples include exports outside the GCC, some educational services, and specific healthcare services.

It's critical not to mix these up with exempt supplies, like certain financial services or the sale of residential property. Exempt supplies do not count towards your VAT registration threshold. Getting your revenue streams classified correctly from day one is the foundation of accurate and stress-free VAT filing in the UAE.

Setting Up for a Smooth First VAT Filing

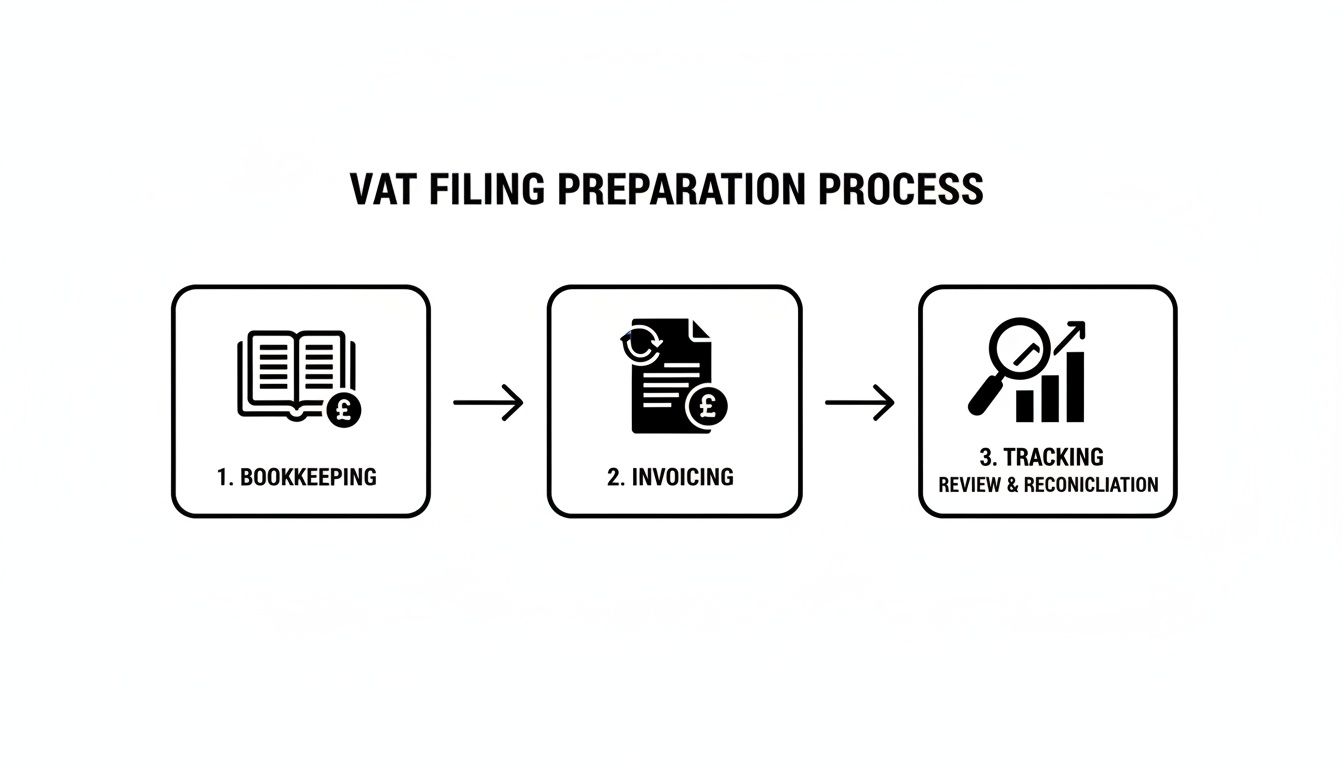

A stress-free VAT filing doesn't just happen on submission day. It's the result of groundwork you lay well in advance. Getting your systems in order beforehand is genuinely the most critical thing you can do to ensure accuracy and dodge that last-minute panic. This isn't just about collecting a few documents; it's about building a solid financial framework from the ground up.

Think of it like setting the foundation for a house. A well-organised bookkeeping system and clear, compliant invoicing are the concrete and steel that support your entire VAT structure. If those are shaky, everything else becomes a struggle and is wide open to costly errors.

Establishing Your VAT Bookkeeping System

Your current bookkeeping methods might need a bit of an overhaul to become fully VAT-compliant. At its heart, your system now needs to meticulously track two crucial streams of money: the VAT you collect on your sales (output tax) and the VAT you pay on business purchases (input tax).

This separation is non-negotiable. The difference between these two figures is exactly what determines whether you owe the government money or if you're due a refund. Many businesses quickly find that using FTA-accredited accounting software is the simplest way to manage this. These platforms are built to handle the specifics of UAE VAT, automatically sorting transactions and generating reports that make filing much easier.

Here are the essential records you absolutely must maintain, as required by the FTA:

- Sales Invoices: A copy of every single tax invoice you issue to a customer.

- Purchase Invoices: A copy of every tax invoice you receive from a supplier.

- Records of Imports and Exports: This includes all related customs documentation.

- Debit and Credit Notes: Any documents you issue or receive that adjust a transaction's value.

- VAT Account Ledgers: A clear summary of your input and output tax calculations for each tax period.

Keeping these records isn't just good practice; it's the law. The FTA mandates that all VAT-related financial records must be kept for a minimum of five years. For any business involved in real estate, this period is extended to a lengthy 15 years.

Crafting a Compliant Tax Invoice

A proper tax invoice is far more than just a bill—it's a legal document. The FTA has very specific requirements for what must be included, and failing to meet them can trigger penalties of AED 5,000 per incorrect document. That's a steep price to pay for what is often a simple oversight.

Let's break down the anatomy of a fully compliant tax invoice for your business.

Non-Negotiable Invoice Elements

To be considered valid by the FTA, every tax invoice must clearly display the following details:

- Document Title: The words "Tax Invoice" must be prominent and easy to see.

- Supplier Details: Your business’s full name, address, and your Tax Registration Number (TRN).

- Customer Details: The recipient's name and address. Crucially, if they are also VAT-registered, their TRN must be included.

- Unique Invoice Number: A sequential number that uniquely identifies the document.

- Date of Issue: The date the invoice was created.

- Date of Supply: The date the goods or services were actually delivered, if it's different from the invoice date.

- Clear Description: A detailed description of the goods or services supplied.

- Financial Breakdown: For each line item, you must show the unit price, the quantity or volume, the VAT rate applied, and the amount payable in AED.

- Total Amounts: The total gross amount payable in AED, the total VAT amount charged in AED, and the net amount (the total before VAT).

Of course, for anyone just getting started, you can't issue a compliant invoice until you're properly registered. You can get more details by exploring our complete guide on how to register for VAT in UAE. Getting this foundation right ensures you begin your journey on the right foot, fully prepared for the requirements of VAT filing in the UAE. With these systems in place, you'll be audit-ready from day one.

A Walkthrough of the FTA VAT Return Portal

Once your bookkeeping is in order and your invoices are VAT-compliant, it's time to face the main event: filing your VAT return through the Federal Tax Authority (FTA) portal. The platform, officially called e-Services, is your direct line to the FTA for all tax matters. It can look a little intimidating at first, but once you get the hang of its structure, the process is quite straightforward.

Think of it as the central hub for all your tax obligations, from submitting your returns to making payments.

As you can see, a successful filing isn't just about what you do on the portal. It's the end result of organised, consistent financial management throughout your entire tax period.

Navigating to Your VAT 201 Return Form

First things first, log into your e-Services account. Your dashboard will usually flag any returns that are due for filing, making them hard to miss.

From there, you'll head over to the VAT section and click on "VAT Returns." This is where you can see your entire filing history and, most importantly, access the current open return period. Go ahead and open the VAT 201 form—this is the official document for your declaration. The form comes pre-filled with your business details, so your main job is to plug in the correct financial figures.

Completing the VAT Sales and Output Tax Section

The first part of the form is all about the VAT you've collected on your sales, which is known as output tax. The FTA breaks this down by Emirate and the type of supply to ensure everything is reported with precision.

You’ll need to input the net value of your sales (the amount before VAT) and the corresponding VAT collected for a few different categories:

- Standard-Rated Supplies (5%): This is for sales made within the UAE that are subject to the standard 5% VAT. You have to report these figures for each Emirate where you made the sales.

- Tax Refunds for Tourists: If your business is part of the tourist refund scheme, you'll declare those amounts here.

- Supplies Subject to Reverse Charge: This applies when you've imported goods or services and are responsible for accounting for the VAT yourself.

- Zero-Rated Supplies: This is where you report the total value of sales that are taxed at 0%, like exports to countries outside the GCC.

- Exempt Supplies: Here, you'll enter the total value of sales that aren't subject to VAT at all, like certain financial services.

One of the most common trip-ups we see is confusing zero-rated and exempt supplies. Just remember, zero-rated supplies are still taxable (just at a 0% rate) and absolutely must be reported. Getting this distinction right is fundamental for accurate VAT filing in the UAE.

Reporting Purchases and Reclaiming Input Tax

After you've declared all the tax you've collected, the form shifts to the VAT you've paid on your business expenses. This is your input tax, and this section is your chance to reclaim what you're legally entitled to. It can make a huge difference to your final tax bill.

Here, you'll need to provide the total value of your expenses and the amount of VAT you want to recover. The main declaration points are:

- Standard-Rated Purchases: The total amount of your business expenses subject to 5% VAT and the input tax you're claiming back.

- Purchases Subject to Reverse Charge: The input tax connected to the reverse charge supplies you declared in the previous section.

It is absolutely crucial that you only claim VAT on legitimate business expenses. The FTA is very clear about what’s not allowed—things like entertainment for non-employees or personal use of company vehicles are off-limits. Trying to reclaim VAT on ineligible costs is a serious compliance mistake. If you want to get a better handle on the portal's features, our FTA portal guide is a great resource to dive into.

Finalising and Submitting Your Return

With all the data entered, the portal does the heavy lifting and automatically calculates your final tax position. You'll see one of two outcomes: VAT due or a net VAT refund.

- VAT Due: This is the amount you owe the FTA. The calculation is simple: Total Output Tax – Total Recoverable Input Tax.

- VAT Refundable: If your recoverable input tax is more than your output tax for the period, the FTA owes you money.

Before you hit that final submit button, pause and do one last review. Check every single number against your own accounting records. A simple typo can cause unnecessary headaches later on. Once you're confident everything is spot-on, you can submit the return. If you have a payment to make, the portal will then direct you to the payment gateway to settle your liability before the deadline.

Getting to Grips with Deadlines, Penalties, and Corrections

When it comes to VAT compliance, two things matter above all else: being on time and being accurate. The Federal Tax Authority (FTA) is crystal clear about its deadlines, and missing them isn't a small hiccup—it's a costly mistake. For most businesses, this means working with a quarterly filing cycle, although some larger companies will be on a monthly schedule.

The deadline for both submitting your VAT return and paying the tax you owe is the 28th day of the month that follows the end of your tax period. So, if your quarter wraps up on 31 March, you have until 28 April to file and pay. There’s no grace period here, so getting these dates locked into your calendar is absolutely essential for smooth VAT filing in the UAE.

Understanding the High Cost of Errors

The FTA has a strict penalty system in place, and it’s designed to make sure businesses take compliance seriously. These fines aren't just a slap on the wrist; they can pile up fast and put a real dent in your company’s finances. It pays to know exactly what’s at stake.

Here are a few of the most common administrative penalties you could face:

- Late Registration: If you go over the mandatory registration threshold but don't register in time, you're looking at a hefty AED 20,000 fine.

- Late Filing of VAT Return: The first time you miss a filing deadline, it's an AED 1,000 penalty. Do it again within 24 months, and that fine jumps to AED 2,000.

- Late Payment of VAT: This one is percentage-based and it snowballs. You'll get hit with an immediate 2% of the unpaid tax, which climbs to 4% after a week. After one month, it becomes a 1% daily penalty, capped at 300% of the tax due.

And that’s not all. Issuing an incorrect tax invoice can land you with a fine of AED 5,000 for every single incorrect document. It's also worth keeping an eye on the future; from 14 April 2026, a new penalty system is coming that will unify the rules for VAT, Corporate Tax, and excise tax. For more on this, you can discover more insights about the evolving VAT penalties on fundingsouq.com.

Real-World Scenario: How Penalties Add Up

Picture this: a small consulting firm completely forgets its quarterly filing deadline. Right off the bat, that's an AED 1,000 penalty. They also owe AED 15,000 in VAT. If they manage to pay it just one week late, they'll get an additional 4% penalty (AED 600). The total cost of that one simple mistake? AED 1,600.

Making Corrections After You’ve Filed

Let’s be honest, mistakes happen. The real test is how you deal with them. If you find an error in a VAT return you've already sent in—maybe you dug up an unrecorded invoice or realised you miscalculated your output tax—you can't just let it slide. The FTA has a formal process for this exact situation: the Voluntary Disclosure.

A Voluntary Disclosure, using Form 211, is your way of officially telling the FTA about a mistake in a previous return. Taking this proactive step shows you're acting in good faith and can help you avoid the much tougher penalties that would come your way if the FTA found the error during an audit.

You'll need to file a Voluntary Disclosure if the tax value of the error is more than AED 10,000. If it’s less than that, things are simpler—you can just correct it in your next VAT return. This is a practical approach that saves businesses from a mountain of paperwork for small adjustments.

Filing a Voluntary Disclosure means you have to submit a clear explanation of what went wrong, state which tax period it relates to, and, of course, pay any extra tax you owe. Being transparent and quick with corrections is fundamental to keeping a clean compliance record with the FTA. Trust me, it’s always better to own up to a mistake than to have someone else find it for you.

Connecting VAT and Corporate Tax for Full Compliance

With the introduction of Corporate Tax (CT), financial management in the UAE has a crucial new layer. As a business owner, you can no longer afford to think about VAT in isolation. Your VAT and CT obligations are now deeply intertwined, and you can be sure the Federal Tax Authority (FTA) is looking at them through a single lens.

This shift means your organised, VAT-compliant records are more valuable than ever. They aren't just for your quarterly VAT filing in the UAE anymore; they form the very bedrock of your CT reporting. The numbers you declare for VAT—your sales, your expenses—directly influence the profit figures you'll report for Corporate Tax.

A Unified Approach to Tax Audits

The FTA is increasingly adopting integrated, risk-based audits that scrutinise both tax types together. They can easily cross-reference the turnover you declare in your VAT returns with the revenue reported in your corporate income tax filings. Any discrepancies will raise immediate red flags, almost certainly triggering a much deeper investigation.

This integrated system makes consistent financial data an absolute necessity. A unified approach to tax compliance isn't just a good idea—it's an essential strategy for managing risk in the UAE's evolving tax landscape.

- Data Consistency is Key: Make sure the revenue figures in your VAT returns match perfectly with the financial statements you use for Corporate Tax.

- Record-Keeping is Paramount: Your VAT-compliant invoices and meticulously kept books are your primary evidence for both VAT and CT calculations.

- Integrated Systems Help: Using accounting software that can manage both VAT and CT reporting keeps your data synchronised and dramatically reduces the chance of manual errors.

The introduction of the 9% Corporate Tax, which began in 2023, has cemented this integration. It’s no coincidence that the tax-free profit threshold of AED 375,000 mirrors the mandatory VAT registration threshold. This alignment pushes all businesses with UAE-sourced income, including those in free zones, to file annual returns with figures that must stand up to scrutiny. You can read more about the convergence of UAE tax regulations on thenationalnews.com.

Practical Steps for Integrated Compliance

So, how do you put this into practice? Start by treating your financial records as a single source of truth for all tax purposes. Your accounting system needs to be robust enough to handle the specifics of both VAT and CT without creating conflicting data.

Think about it this way: when you record a sales invoice, it impacts both your output VAT liability for that quarter and your annual revenue for CT. When you log a purchase, the recoverable input VAT affects your VAT payment, while the net expense reduces your taxable profit for CT.

The bottom line is this: a mistake in your VAT records can now create a problem in your Corporate Tax filing, and vice versa. Viewing these two taxes as separate silos is a risky approach that could lead to costly penalties and complex audits down the road.

Understanding these connections is also vital when planning for your business's financial health. For instance, obtaining certain official documents requires a clean tax record. For anyone looking into long-term residency or investment, learning more about the process for a tax residency certificate in the UAE can be a crucial next step, and your compliance history will play a significant role.

Answering Your Top VAT Filing Questions

When it comes to VAT filing in the UAE, it’s the tricky, infrequent scenarios that often cause the most confusion. You’ve got the daily routine down, but what happens when something out of the ordinary pops up? Let’s tackle some of the most common questions we hear from business owners.

Getting clear on these real-world situations now can save you a world of headaches—and hefty fines—down the line.

What If My Business Crosses the VAT Threshold Late?

Missing your VAT registration deadline is a mistake the Federal Tax Authority (FTA) takes very seriously. Once your taxable supplies breach the mandatory AED 375,000 threshold over a 12-month period, the clock starts ticking.

Fail to register on time, and you're hit with an immediate administrative penalty of AED 20,000. But that’s just the start. The real pain comes from being liable for all the VAT you should have collected from the date your registration was required. This can become a huge financial burden, as you’ll likely have to pay this amount out of pocket. The key is to watch your revenue like a hawk and start the registration process before you even hit the threshold.

Can I Reclaim VAT on All Business Expenses?

Mostly, yes. You can reclaim the input VAT on expenses that are directly linked to making taxable supplies. Think office rent, the raw materials you use, or fees for professional services. This is a fundamental part of the VAT system, designed to ensure only the final consumer bears the tax cost.

However, there are some very specific "blocked" costs where the FTA does not allow you to reclaim VAT. A couple of common examples include:

- Client Entertainment: Taking clients out for a meal or entertaining other non-employees is a cost of doing business, but the VAT on it is generally not recoverable.

- Personal Use Vehicles: If a company car is available for an employee's personal use, you can’t claim back the VAT on its purchase or related running costs.

This is where meticulous record-keeping saves the day. Correctly categorising every expense helps you maximise legitimate claims and ensures you’re prepared for any potential audit.

This distinction is critical. Claiming VAT on blocked expenses is a common error that can lead to penalties. Always double-check the eligibility of an expense before including it in your input tax calculation.

Does a Free Zone Business Need to File for VAT?

Absolutely. Operating in a Free Zone doesn't give you a free pass from VAT. The rules here are nuanced and really depend on two things: whether your Free Zone is a designated ‘Designated Zone’ and the nature of your transactions.

While moving goods between two Designated Zones might fall outside the scope of VAT, providing services usually doesn't. More importantly, if you supply any goods or services to the UAE mainland, those sales are subject to the standard 5% VAT. At the end of the day, any business—including those in Free Zones—must register for VAT if their taxable supplies within the UAE cross the registration threshold.

Distinguishing Between Zero-Rated and Exempt Supplies

This is easily one of the most misunderstood areas of VAT, and getting it wrong can throw off your entire return. While both result in charging no VAT to your customer, they have vastly different impacts on your ability to reclaim input VAT.

Here’s a simple way to look at the difference:

| Feature | Zero-Rated Supplies (0% VAT) | Exempt Supplies (No VAT) |

|---|---|---|

| VAT Rate | This is a taxable supply, just at a 0% rate. | This supply is not subject to VAT at all. |

| Examples | Exports outside the GCC, some international transport, certain healthcare and educational services. | Certain financial services, the sale of residential properties after their first supply, local passenger transport. |

| Input Tax | You can reclaim the input VAT paid on your related business expenses. | You cannot reclaim the input VAT paid on your related business expenses. |

Because zero-rated supplies are still considered "taxable," you get to recover the VAT you spent on making them happen. That's not the case for exempt supplies, which means the VAT you paid on your costs becomes a direct hit to your bottom line.

Navigating these complexities is where expert guidance becomes invaluable. At Smart Classic Business Hub, we handle the details of VAT compliance so you can focus on running your business. From registration to filing, our team ensures you're accurate, on time, and optimised for your tax position. Contact us today to ensure your VAT filing is in expert hands.