A tax residency certificate in the UAE is an official document from the Federal Tax Authority (FTA) that confirms you—or your company—are a tax resident here. Its main job? To help you take advantage of Double Taxation Avoidance Agreements (DTAAs), which stop your income from being taxed in two different countries. It's an absolutely critical piece of paper for anyone with international financial interests.

What a UAE Tax Residency Certificate Means for You

Let's cut through the official jargon. The simplest way to think of a Tax Residency Certificate (TRC) is as your financial passport. It's the document that officially tells the world that your economic home base is the United Arab Emirates. This certificate is your key to unlocking the benefits of the UAE's huge network of international tax treaties.

The whole point of a TRC is to prevent double taxation. Imagine earning income from another country, only to have it taxed there and again in your home country. It’s a massive hit to your earnings. The TRC acts as undeniable proof to foreign tax authorities that you're a UAE tax resident, letting you claim relief under the relevant DTAA.

A Practical Example of the TRC in Action

Let’s say you're a UK consultant who has relocated and is now living and working from a Dubai free zone. You land a project with a client based in Germany. When that German client goes to pay your invoice, their local tax laws might force them to withhold a big chunk of your payment—maybe 20%—as tax.

This is exactly where the tax residency certificate UAE becomes your best friend. By showing your valid TRC to the German tax authorities, you prove where you are a tax resident. Under the UAE-Germany DTAA, this can slash that withholding tax or even get rid of it completely, making sure you get the full payment you've earned. For freelancers, investors, and business owners, this isn’t a small saving; it's a core part of managing international cash flow.

A Tax Residency Certificate transforms your UAE residency from a lifestyle choice into a recognised financial status. It provides the official validation needed to legally optimise your global tax obligations and protect your cross-border income.

Who Truly Needs This Certificate

It’s not just consultants who need a TRC. The certificate is essential for a whole range of people and businesses with international dealings.

- Investors: If you own shares or get dividends from companies in other countries.

- Entrepreneurs: For companies that provide services or sell goods to clients abroad.

- Digital Nomads & Freelancers: When you’re getting paid by international clients.

- Property Owners: For anyone earning rental income from properties located overseas.

The certificate applies to both individuals (natural persons) and companies (juridical persons). Official guidance is clear: companies can apply for a TRC after just three months from the start of a tax period, while individuals can apply as soon as they meet the residency criteria. The process is now straightforward and online, with clear fees—AED 500 for tax registrants and AED 1,000 for non-registrant individuals—which has made it much more accessible.

For a firm like Smart Classic Business Hub, getting a TRC for our clients is a direct way to reduce their exposure to foreign withholding taxes, which can be anywhere from 5% to 30%. You can dig deeper into the latest tax residency guidance and its impact from top legal and accounting firms.

Ultimately, getting a TRC is a smart, proactive move to secure your financial position in the UAE. It’s about making sure your international business is as smooth and profitable as it can be. Working with a partner like Smart Classic Business Hub makes this vital process simple, ensuring your application is correct and complete right from the start.

Qualifying for Your UAE Tax Residency Certificate

Before you jump into the application, you first need to be sure you actually qualify for a tax residency certificate in the UAE. The rules are clearly laid out in Cabinet Resolution No. 85 of 2022, offering specific paths for both individuals and companies. Getting this right from the start is absolutely crucial.

Understanding which route applies to you saves the headache of a rejected application later on. The Federal Tax Authority (FTA) doesn't just tick one box; they look at your entire connection to the UAE to make a decision.

Eligibility Pathways for Individuals

For individuals, what the authorities call ‘natural persons,’ there are three distinct ways to prove your tax residency. The good news is you only need to meet the criteria for one of them, which gives you flexibility based on your personal and professional situation.

The most common and straightforward path is the 183-day physical presence test. If you’ve spent 183 days or more in the UAE within any consecutive 12-month period, you've met the main requirement. Simple as that.

What if you travel a lot? There's also the 90-day test, which is a bit more nuanced. It’s designed for people who have solid ties to the UAE but don't quite hit the 183-day mark. To qualify this way, you must:

- Be physically present in the UAE for at least 90 days in a 12-month period.

- Hold a valid UAE residence visa or be a GCC national.

- Have either a permanent home here (owned or rented) or a job or business in the UAE.

This second option is a practical acknowledgement of today’s complex work and travel schedules.

The Centre of Financial Interests Test

The third route is less about counting days on a calendar and more about proving that the UAE is, without a doubt, your home base—your "centre of financial and personal interests."

Think of a consultant who travels constantly for client meetings abroad. They might not meet the 183-day rule, but they can still qualify for a tax residency certificate if they can show that:

- Their primary home and family are in Dubai.

- Their main business operations and bank accounts are based in the UAE.

- Their social life and community connections are strongest here.

In a situation like this, even with all the travel, their life's anchor is clearly in the UAE. A valid UAE residence visa is a non-negotiable part of this picture. For a deeper dive, check out our guide on the latest updates for https://smartclassic.ae/uae-residence-visa-renewal-new-rules/.

The goal is to build a strong case, backed by solid documents, showing that your connection to the UAE is substantial and permanent, not just a flag of convenience.

Clear-Cut Rules for Companies

For companies, or ‘juridical persons,’ the criteria are much more direct. It's a two-part test, and you have to meet both conditions.

- Incorporation and Recognition: The company must be legally established, incorporated, or recognised under UAE law.

- Management and Control: The business must be effectively managed and controlled from within the UAE.

This means the big decisions—board meetings, strategic planning, executive management—all need to happen here. Having a physical office and senior leadership on the ground are key indicators that you meet this standard.

Eligibility Routes for Individuals vs Companies

To make it even clearer, here's a direct comparison of how individuals and companies qualify for a UAE Tax Residency Certificate.

| Criterion | Individual Applicant | Company (Juridical Person) |

|---|---|---|

| Primary Test | Physical presence (183+ days) in a 12-month period. | Incorporated or legally recognised under UAE law. |

| Secondary Test | 90+ day presence plus a UAE residence visa/GCC nationality, and either a permanent home or job/business in the UAE. | Effective management and control from within the UAE (key decisions made locally). |

| Alternative Test | "Centre of financial and personal interests" is in the UAE. | Not applicable. The two primary tests are mandatory. |

| Key Supporting Documents | Entry/Exit reports, tenancy contract (Ejari), utility bills, employment contract, bank statements. | Trade licence, Memorandum of Association (MoA), physical office lease, details of board members. |

As you can see, the path for individuals offers more flexibility, while the route for companies is firmly tied to their legal and operational base in the UAE.

Cabinet Resolution No. 85 of 2022 formalised these rules, making sure all full and part days count towards the physical presence tests. When you apply through the FTA portal, you'll need evidence like your entry/exit report, Emirates ID, tenancy contract, and proof of income.

Budget-wise, the fees are straightforward: there's an AED 50 submission fee, plus a processing fee of AED 1,000 for individuals not registered for corporate tax, or AED 500 for those who are. These figures, as detailed by sources like KPMG's guide on UAE tax residency, are what you should plan for. At Smart Classic Business Hub, we can help you navigate every one of these requirements to make sure your application is perfect the first time.

Your Document Checklist for a Smooth Application

Knowing the eligibility rules is one thing, but successfully gathering and submitting your documents is where the real work begins. Getting this right is critical. A perfect application for your tax residency certificate in the UAE depends on having every single piece of paperwork in order, building an undeniable case for your residency status.

Instead of just giving you a list, I want to walk you through the 'why' behind each document. When you understand what the Federal Tax Authority (FTA) is looking for, you can anticipate their questions and dramatically cut the risk of rejection. Let’s break this down for both individuals and companies.

Essential Documents for Individual Applicants

For individuals, your goal is simple: paint a clear, undeniable picture that your life and financial world are centred here in the UAE. Each document is a piece of that puzzle.

First, let's cover the basics—your core identity documents. These are non-negotiable and confirm exactly who you are and your legal standing in the country.

- Valid Passport Copy: Your main form of identification.

- Valid Emirates ID Copy: Proof of your official status within the UAE system.

- Valid Residence Visa Copy: This confirms your legal right to actually live here.

Here’s a crucial tip from our experience at Smart Classic Business Hub: double-check that your passport and visa have at least six months of validity before you apply. The authorities see an expiring document as a potential red flag, and it can stop an application in its tracks.

Proving Your Physical Presence and Home Base

Next up is providing hard evidence that you have a permanent home here and have spent enough time in the country. This is often the make-or-break part of the application.

The official Entry/Exit Report from the Federal Authority for Identity, Citizenship, Customs & Port Security (ICP) is the single most important document for proving you’ve met the 183-day rule. It’s an official log of your movements, leaving no room for argument.

Equally important is showing you have a permanent home. This proves you don't just visit the UAE; you live here. You'll need:

- A certified copy of your tenancy contract (Ejari) or title deed.

- A recent utility bill (like a DEWA or SEWA bill) in your name.

Your Ejari is especially powerful. It demonstrates a long-term commitment to a residence in the UAE, directly backing up your claim to have a "permanent home."

Securing a tax residency certificate is about storytelling through documentation. Each paper, from your Ejari to your salary certificate, adds a vital chapter that proves the UAE is not just where you work, but where your life is anchored.

Demonstrating Your Economic Ties

Finally, you need to show that your financial life is firmly planted in the UAE. This connects your economic interests to your physical presence, completing the picture.

The key documents here are:

- A source of income document, which could be a recent salary certificate from your employer or your trade licence if you're a business owner.

- Bank statements for the last six months from a UAE-based bank.

While major firms like KPMG and PwC have noted that bank statements are less of a focus recently, solid proof of economic ties is still essential. The 183-day physical presence test remains the most common route, and for that, the entry/exit report is mandatory. This report, combined with proof of your home and income, is what ultimately convinces foreign tax authorities to grant you treaty benefits. For our clients, we make it standard practice to submit passport movement records, tenancy contracts, and salary certificates to meet the FTA’s strict standards. You can get a deeper dive into how these rules affect entrepreneurs by reviewing expert analysis on the UAE's new tax residency rules.

Key Documents for Companies (Juridical Persons)

When it comes to companies, the focus shifts from personal ties to corporate substance. The FTA wants to see that your business is a real, operating entity managed from within the UAE, not just a name on a piece of paper.

Here’s what you’ll need to have ready for a corporate application:

- A valid copy of the company's Trade Licence. This is the cornerstone—it proves your company legally exists and can operate.

- The company’s Memorandum of Association (MoA). This document details your company’s structure, who owns it, and what it does.

- A copy of the company establishment card.

- Passport and Emirates ID copies of the company director or manager.

- Audited financial statements. This is absolutely crucial. It proves genuine economic activity and shows your company isn't just a "shell."

- A physical office lease agreement (Ejari). This shows you have a real, physical footprint, not just a mailbox.

- Bank statements for the last six months from the company's UAE bank account, proving active financial operations in the country.

One last piece of advice: if any of your documents are not in Arabic or English, get them professionally translated and certified before you even think about starting the application. It’s a simple step that can save you from major delays down the line. A meticulously prepared file is your best strategy for ensuring your application sails through without a hitch.

How to Navigate the EmaraTax Application Portal

With your documents organised, the next stage is the digital submission. This happens on the Federal Tax Authority's (FTA) official online platform, EmaraTax. This portal is the central hub for all tax-related services in the UAE. While it's designed to be user-friendly, knowing the layout before you start can save you a lot of time and help you sidestep common errors.

Submitting your application for a tax residency certificate in the UAE yourself is definitely possible. Let's walk through the key stages, from setting up your account to finalising your payment, to make the process feel much more manageable.

Creating and Accessing Your EmaraTax Account

First things first, you'll need an EmaraTax account. If you don't already have one from previous tax dealings, you’ll need to register. The system is pretty straightforward—just head to the EmaraTax website and follow the sign-up prompts. You'll need your Emirates ID and other personal details on hand to get this done.

Once you’re logged in, the dashboard presents various services. It can look a bit busy at first, but your focus will be on a specific area. Look for the ‘Other Services’ tab or a similarly named section. This is where the TRC application lives, separate from regular tax filings like VAT or Corporate Tax.

Finding the Correct Application Form

Inside the services section, you need to choose the correct form. This is a critical step and a point where we often see people get confused. The portal will show options for different certificates and for different applicant types (individual vs. company).

You’ll want to select the option for "Issuance of Tax Residency Certificate." The system will then ask you to specify if you are applying as a natural person (an individual) or a juridical person (a company). It also distinguishes between certificates needed for Double Taxation Avoidance Agreement (DTAA) purposes versus domestic use. For any kind of international tax relief, make sure you select the DTAA option.

A common mistake is selecting the wrong certificate type. Double-check that you've chosen the "Tax Residency Certificate" for DTAA purposes. Picking the incorrect form will lead to an immediate rejection and force you to start the entire process over from scratch.

Completing the form is a methodical process of entering your personal and residency details and uploading the documents you've already prepared. The interface guides you through each field, but pay close attention. Ensure the information you type exactly matches what's on your supporting documents. Any discrepancy, no matter how small, can trigger a query from the FTA and delay your application.

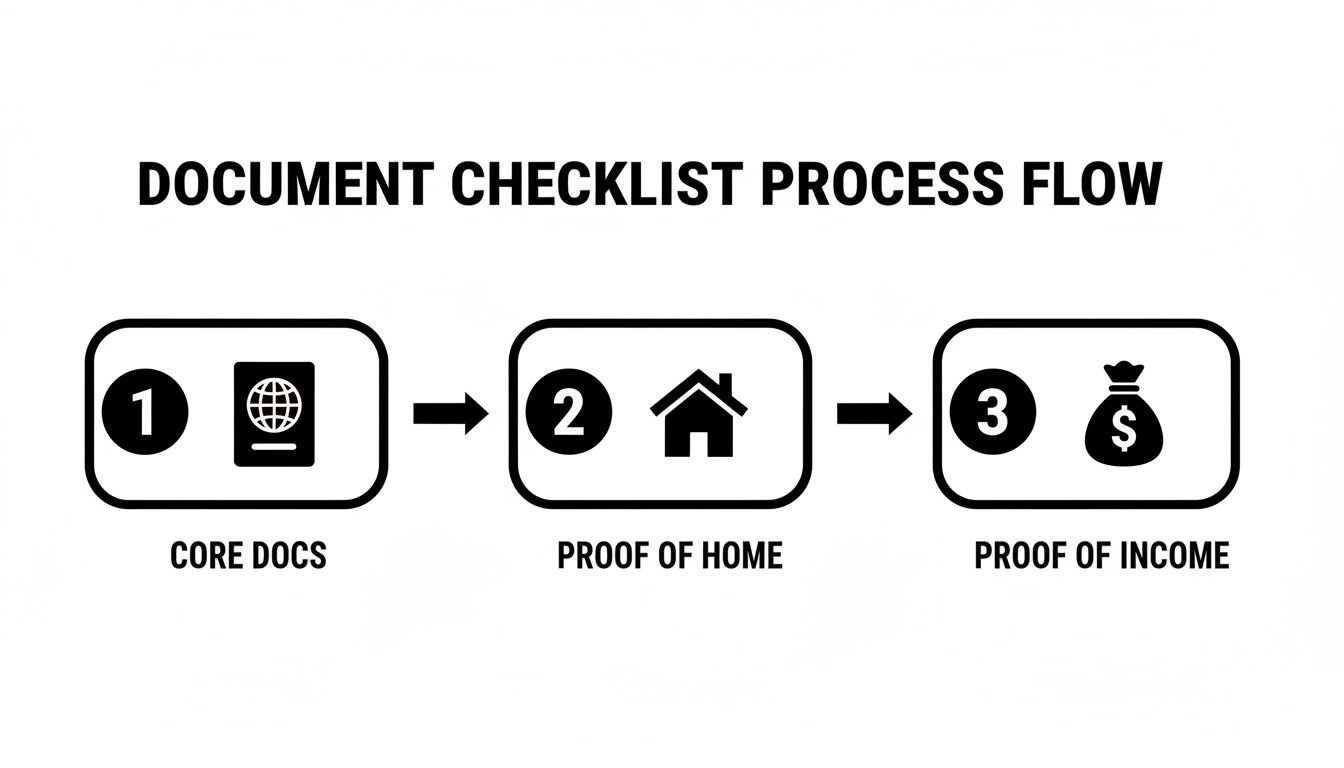

This flow diagram breaks down the core document categories you'll be asked to upload.

As you can see, having your identity, home, and income documents ready simplifies the digital submission, turning it into a straightforward upload task.

Understanding Fees and Timelines

The fee structure for the TRC application is transparent. There's a non-refundable application fee of AED 50 that you pay right after you submit. Once the FTA reviews and approves your application, a final certificate issuance fee is required. For individuals not registered for corporate tax, this fee is AED 1,000.

Payment is made directly through the EmaraTax portal with a valid credit or debit card. Make sure the payment goes through successfully to avoid your application stalling at the final hurdle.

After you hit 'submit,' the waiting game begins. The standard processing time is usually around 5 to 7 business days. However, this timeline assumes your application is perfect. If the FTA has any questions or needs more information, you'll get a notification through the portal, and the clock pauses until you provide what they've asked for.

After You Submit Your Application

Submitting the form isn't the end of it. It’s important to monitor your application's status through your EmaraTax account. The portal will show its progress, moving from 'Submitted' to 'Under Review' and finally to 'Approved' or 'Requires More Information.'

- Check your portal regularly: Don't just wait for an email. Log in every couple of days to check for updates or requests.

- Respond to requests promptly: If the FTA asks for another document or a clarification, get it to them as quickly as possible to get your application back on track.

- Download your certificate: Once approved and the final fee is paid, your digital tax residency certificate will be available to download straight from the portal.

Navigating this process requires careful attention to detail, much like other financial compliance tasks. Many business owners, for example, find parallels between this and their regular tax obligations. You can learn more about handling other responsibilities in our guide to VAT filing services in the UAE.

Managing the entire EmaraTax workflow, from the initial submission to handling any back-and-forth with the FTA, is precisely where a partner like Smart Classic Business Hub adds immense value. We handle every step for you, ensuring accuracy and liaising with the authorities so you can stay focused on your business, confident that your application is in expert hands.

Putting Your Tax Residency Certificate to Work

Getting your hands on a tax residency certificate in the UAE is a huge win, but its real value comes from knowing how to use it. This isn't just another document to file away; it's an active financial tool that shields your international income, confirms your status with banks, and ultimately, puts money back in your pocket.

The biggest and most immediate impact of the TRC is claiming benefits under Double Taxation Avoidance Agreements (DTAAs). The UAE has a massive network of these treaties with countries all over the world, and your certificate is the key to unlocking them.

Real-World Savings with Your TRC

Let's walk through a real-world example. Picture a Dubai-based e-commerce business selling high-end electronics. A good chunk of its sales, say €200,000 a year, comes from customers in Spain.

Without a TRC, the Spanish tax authority could force the payment processor to withhold 19% of that income as tax. That's a painful €38,000 gone before the money even lands in the company's UAE bank account.

But by presenting a valid tax residency certificate, the company proves it’s a tax resident of the UAE. Under the UAE-Spain DTAA, the withholding tax on these payments can drop all the way to 0%. Just like that, the certificate translates into an extra €38,000 in annual revenue. It's that powerful.

Beyond Tax Treaties: A Tool for Global Banking

The usefulness of your TRC doesn't stop at tax treaties. It's become an essential document for navigating international banking and investment compliance.

Think of your TRC as your official financial passport. It proves your UAE residency status to foreign banks, investment platforms, and financial regulators, making international transactions and compliance checks significantly smoother.

Financial institutions everywhere are operating under the Common Reporting Standard (CRS), a global protocol for sharing information to fight tax evasion. When you go to open an account or invest abroad, they have to verify your tax residency. Handing over your TRC gives them official, undeniable proof of where you stand.

This is especially important if you need to maintain accounts outside the UAE. For anyone weighing their options, knowing the required documentation is half the battle. Our guide on opening a non-resident bank account in Dubai dives deeper into these kinds of proof-of-status requirements.

Planning for Annual Renewal

Here’s a critical detail many people overlook: your tax residency certificate is only valid for one year from its issue date. It covers a specific tax period and is not a permanent document. Forgetting to renew it can create a sudden—and expensive—gap in your treaty benefits.

The best practice is to start the renewal process about a month before your current certificate expires. This proactive step ensures you always have a valid TRC ready for any international dealings. Working with a partner like Smart Classic Business Hub can take this off your plate entirely, as we manage the annual cycle for you, so your financial protections never lapse.

Common Questions About the UAE Tax Certificate

When you're dealing with something as important as a tax residency certificate in the UAE, a lot of practical questions come up.## Common Questions About the UAE Tax Certificate

When you're dealing with something as important as a tax residency certificate in the UAE, a lot of practical questions come up. Based on our experience at Smart Classic Business Hub, we've compiled the questions we hear most often from our clients. Getting these details right from the start can make a huge difference in how smoothly your application goes.

Can I Get a Tax Residency Certificate with a Freelance Visa?

Yes, absolutely. Holding a freelance permit makes you eligible to apply for a TRC, as long as you meet one of the main residency tests we've covered. For most freelancers, the easiest and most direct path is proving you've been physically present in the UAE for 183 days or more.

When you put together your application, you’ll just need to include your freelance permit along with the usual documents, like your entry/exit report and proof of your freelance income. This helps build a strong, complete case for the authorities.

What Are the Top Reasons Applications Get Rejected?

From what we've seen over the years, the most common reasons for rejection are surprisingly simple. It almost always boils down to incomplete documents, not quite hitting the day-count requirement, or having obvious inconsistencies in the paperwork you submit.

For instance, we often see issues like a tenancy contract that isn't under the applicant's name or an entry/exit report that shows someone is just a few days short of the threshold. These are immediate red flags. This is exactly why having a professional pair of eyes review every single document before you hit ‘submit’ is so crucial—it saves you from frustrating delays or an outright rejection.

A Tax Residency Certificate is valid for one year from the date it's issued and covers a specific, past tax period. To avoid any gaps in your tax treaty coverage, it's a good idea to start the renewal process about a month before your current certificate expires.

Do I Need a Different Certificate for Every Country?

No, and that’s one of the best things about it. The TRC issued by the UAE's Federal Tax Authority is a single, universally recognised document across the entire treaty network. You can provide certified copies of this one certificate to the tax authorities in any country where the UAE has a Double Taxation Avoidance Agreement to claim your benefits.

It’s a very efficient system that proves your tax residency status to multiple jurisdictions at once, which really helps simplify your international financial life.

Getting a tax residency certificate in the UAE doesn't have to be a complicated headache. With an expert partner like Smart Classic Business Hub, you can be confident the entire process is handled correctly. We take care of everything for you, from preparing the documents to the final submission, making sure your application is accurate and successful. Let us manage the details so you can stay focused on what matters most. Contact us today to secure your tax residency status.