Before you even think about a business plan or chase down funding, you need to answer one fundamental question: where will your business legally live in the UAE? This is the most critical decision you'll make right out of the gate. Your choice between a Mainland, Free Zone, or Offshore setup will define everything from your market access and ownership structure to how you operate daily.

This isn't just about paperwork; it's a strategic move that needs to align perfectly with your business goals. Getting it wrong can lead to expensive restructuring down the line or, worse, completely stall your growth. Let's break down what these options actually mean for you on the ground.

Mainland: Your Gateway to the Local UAE Market

If your business plan involves trading directly with customers and other companies inside the UAE, a Mainland company is your ticket in. Registered under the Department of Economic Development (DED) in your chosen emirate, this setup gives you unrestricted access to the local economy.

Think about it: launching a boutique coffee shop in Jumeirah, a local e-commerce brand delivering across the Emirates, or a construction firm bidding on government projects. For these, a Mainland licence is essential. It gives you the freedom to set up shop anywhere, open multiple branches, and compete for those lucrative government tenders.

Years ago, this meant finding an Emirati sponsor to hold 51% of your company. But times have changed. Recent legal reforms now grant 100% foreign ownership for over a thousand commercial and industrial activities, making the Mainland path more attractive than ever.

Free Zone: The Hub for Global Ambitions

Free Zones are special economic areas, each with its own independent governing authority and regulations. With over 40 Free Zones across the UAE, many are tailored to specific industries—think Dubai Media City for creatives, DIFC for finance, or DMCC for commodities trading.

Imagine you’re running a software development firm with clients in Europe and Asia. Setting up in a tech-focused Free Zone is a no-brainer. The benefits are compelling:

- Complete Foreign Ownership: You maintain 100% control of your business.

- Tax Efficiency: Enjoy 0% corporate and personal income taxes.

- Full Profit Repatriation: Send 100% of your profits and capital back to your home country, no questions asked.

The trade-off? A Free Zone company typically can't trade directly with the Mainland market. You'd need a local distributor or agent to bridge that gap. This makes it the perfect setup for businesses with an international client base.

Still weighing your options? I highly recommend digging deeper into the key differences between Mainland and Free Zone setups in Dubai to see which aligns better with your model.

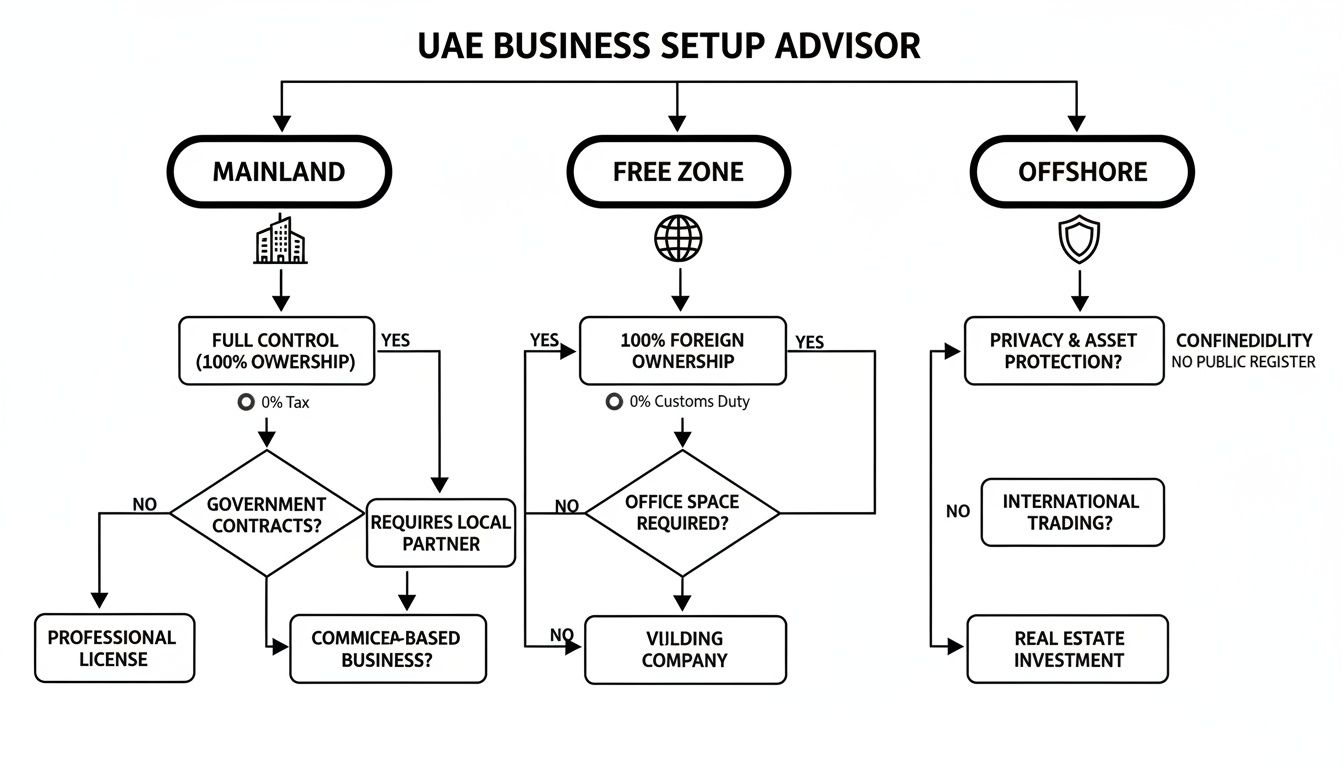

This flowchart gives you a quick visual guide to help point you in the right direction.

As you can see, it really boils down to who your target market is: local, global, or simply holding assets.

Offshore: For Asset Protection and International Trade

Finally, there’s the Offshore company, also known as an International Business Company (IBC). This is a completely different beast. It’s not a vehicle for doing business within the UAE but rather a powerful legal tool for managing international affairs.

An Offshore company is a non-resident entity. It can't conduct business inside the UAE, lease physical office space, or apply for visas. Its purpose is to hold assets, facilitate global trade, and protect investments from a secure, tax-neutral jurisdiction.

For instance, an international investor might use a JAFZA Offshore company to hold shares in various global businesses or to manage a property portfolio across different countries. It offers confidentiality, simplifies cross-border transactions, and provides a robust framework for asset protection, all without the operational overhead of a typical company.

Mainland vs Free Zone vs Offshore At a Glance

To simplify things, let's put the key differences side-by-side. This table breaks down the core features of each jurisdiction so you can quickly compare what matters most for your business.

| Feature | Mainland Company | Free Zone Company | Offshore Company |

|---|---|---|---|

| Primary Market | Local UAE market | International markets | Global asset holding & trade |

| Ownership | 100% foreign ownership for most activities | 100% foreign ownership | 100% foreign ownership |

| Office Space | Physical office space required | Flexi-desk, office, or warehouse | No physical office permitted |

| Visas | Eligible for employee & investor visas | Eligible for employee & investor visas | Not eligible for visas |

| Corporate Tax | 9% on profits over AED 375,000 | 0% for qualifying income | 0% corporate tax |

| Auditing | Mandatory annual audit | Required by most Free Zones | Not typically required |

| Trading Scope | Unrestricted trade within the UAE | Restricted to Free Zone/international | No trading within the UAE |

Ultimately, choosing the right jurisdiction is about matching your business model to the legal framework that best supports it. Taking the time to get this right from the start will save you countless headaches and pave the way for a smoother, more successful launch in the UAE.

Right, once you’ve pinpointed your ideal jurisdiction, it’s time to get into the nitty-gritty: the licences, legal structures, and paperwork that will turn your business idea into a real, legally recognised company in the UAE. Getting this stage right from the very beginning is absolutely critical for a smooth launch. Don't underestimate it.

The UAE is buzzing with entrepreneurial energy right now. We've seen a massive influx of new businesses, with a staggering 250,000 new companies setting up shop recently. This has pushed the total number of businesses towards the 1.4 million mark since the game-changing legal updates in 2021. This growth spurt, driven by simplified rules for LLCs and a government vision aiming for two million companies in the next decade, is a testament to the country's pro-business climate. You can get the full story on this economic boom over at The National News.

This isn't just a statistic; it's a clear signal that understanding these foundational elements is your ticket to being part of this incredible success story.

Choosing the Right Business Licence

Think of your business licence as the official permission slip that allows you to operate. It’s directly tied to the specific activities your company will perform. Picking the wrong one is a classic rookie mistake that can bring your operations to a grinding halt before you even start.

There are three main categories you’ll encounter:

- Commercial Licence: This is your go-to for any business involved in trading goods. If you’re buying and selling products, whether through an e-commerce site, a retail shop, or a general trading company handling imports and exports, this is the one for you.

- Professional Licence: This licence is designed for service-based businesses and skilled professionals. It’s for the consultants, designers, accountants, lawyers—anyone whose business is built on their expertise rather than a physical product.

- Industrial Licence: If your business involves manufacturing, processing, or any form of industrial production—essentially, turning raw materials into finished goods—you’ll need an Industrial Licence.

To put it simply, a digital marketing agency would need a Professional Licence, while a company importing and selling furniture would require a Commercial Licence. It’s a fundamental choice that defines exactly what you can and can’t do.

Selecting Your Legal Structure

Hand-in-hand with your licence is your company's legal structure. This decision dictates crucial things like ownership rules and, most importantly, your personal liability. It has serious long-term consequences for your personal assets, so choose wisely.

For most entrepreneurs, the choice boils down to two common structures: the Sole Proprietorship and the Limited Liability Company (LLC).

A Sole Proprietorship is the simplest setup, owned and operated by a single person. While it's straightforward, there’s no legal distinction between you and your business. This means your personal assets—your car, your home—are on the line if the business runs into debt. It's often a fit for individual freelancers or professionals who are just starting out.

An LLC, on the other hand, creates a separate legal entity. This is a big deal. It builds a protective wall between your personal assets and the business's liabilities, meaning the most you can lose is the capital you’ve invested. It’s far more flexible for growth, allows for multiple shareholders, and is overwhelmingly the preferred structure for anyone serious about building a scalable, long-term business.

The key difference boils down to liability. An LLC creates a protective barrier between your personal finances and the business's obligations, which is a critical consideration for any serious entrepreneur.

The Essential Document Checklist

Nothing slows down a business setup like missing paperwork. Getting your documents organised from the start is non-negotiable if you want to avoid frustrating delays. While the exact list can differ slightly between mainland and free zones, there’s a core set of documents you’ll almost certainly need.

Here’s a practical checklist to get you started:

- Passport Copies: Clear, valid copies for every shareholder and the company manager.

- Visa and Emirates ID Copies: If you’re already a UAE resident, you'll need copies of your current residence visa and Emirates ID.

- Application Forms: The official licence application form from the relevant authority (like the DED for Mainland or the specific Free Zone authority).

- Business Plan: Some jurisdictions, especially certain free zones, will ask for a brief business plan outlining your goals, activities, and financial forecasts.

- Memorandum of Association (MOA): Absolutely essential for an LLC. This document needs to be notarised and details the agreement between all shareholders.

- Tenancy Contract (Ejari): A registered tenancy contract for your office is mandatory for most Mainland setups.

- Attested Educational Certificates: For certain Professional Licences, you may need to have your university degree or other qualifications officially attested.

Having this folder ready to go doesn't just speed things up; it shows the authorities you’re serious and prepared, making your journey to launching in the UAE that much smoother.

Mapping Out Your Costs, Timelines, and Financials

This is where the dream of starting a business in the UAE meets reality. A well-researched budget and a realistic timeline aren’t just good practice; they're the bedrock of a successful launch. Getting these numbers wrong can put your entire venture at risk before you even open your doors.

So, let's break down the tangible costs and timelines you can realistically expect. This isn’t about guesswork; it's about giving you a clear financial roadmap.

A Transparent Look at Business Setup Costs

One of the first questions on every entrepreneur's mind is, "What's the real cost?" While a single figure is impossible to give, we can definitely outline the primary expenses you’ll face. Your final bill will depend heavily on your chosen jurisdiction (Mainland vs. Free Zone), your specific business activity, and your office needs.

Here are the core costs you absolutely need to budget for:

- Trade Name Registration: A relatively small but essential first fee to reserve your business name.

- Initial Approval: This is the fee paid to the economic department or free zone authority to get the green light for your business activities.

- Licence Fee: This is the big one. It's the most significant government fee and varies wildly based on the licence type (Commercial, Professional, Industrial) and where you set up.

- Office Rent: Mainland businesses need a physical address with an Ejari (tenancy contract). Free zones, on the other hand, offer more flexible and budget-friendly options like flexi-desks.

- Visa Processing: Don't forget the costs for your own investor visa and any employee visas you plan to sponsor.

For a much deeper dive, check out our detailed guide on the cost of starting a business in Dubai, which provides a more granular breakdown.

Understanding the Timelines

Time is money, especially when you're launching a new company. Knowing how long the setup process takes helps you plan your launch, manage your cash flow, and sort out your personal arrangements. The UAE has made incredible strides in speeding things up, but timelines still differ.

Setting up a business here is now faster than ever. You could be looking at a timeline as short as 2-3 days in some free zones and 5-7 days on the mainland. Costs typically fall between AED 7,500 and AED 30,000, depending on your licence. To give you an idea, mainland professional licences can start as low as AED 7,500, while a more specialised setup in a fintech-focused free zone might be closer to AED 30,000—all with the benefit of full foreign ownership.

Remember, getting your trade licence is just one milestone. The entire process, from start to finish—including visa stamping and opening your bank account—typically takes between three to six weeks.

Opening Your Corporate Bank Account

This is a critical step, and frankly, it's one where many new entrepreneurs get stuck. UAE banks have very strict compliance and Know Your Customer (KYC) requirements. Just having a trade licence isn't enough to guarantee a smooth account opening.

You need to come prepared with a comprehensive file. This includes:

- Certified company incorporation documents.

- Passport, visa, and Emirates ID copies for all shareholders.

- A detailed business plan that clearly explains your model and expected transactions.

- Proof of your business address (your tenancy contract or Ejari).

The bottom line is that banks need to understand your business to mitigate risk. A well-prepared file that transparently outlines your operations will massively speed up the approval process and show them you're a credible, serious venture.

Getting Your Financial House in Order

Once your business is licensed and your bank account is active, your financial obligations are really just beginning. There are two crucial areas you need to address immediately: Value Added Tax (VAT) and Corporate Tax.

You are legally required to register for VAT if your annual turnover is expected to exceed AED 375,000. My advice? Register proactively to avoid any potential penalties down the line.

Additionally, as of June 2023, the UAE has a federal Corporate Tax. A 9% tax is applied to all taxable profits that exceed AED 375,000. Understanding these obligations and maintaining meticulous, compliant accounting from day one is non-negotiable. This proactive approach ensures you stay in good standing with the authorities and build a secure foundation for growth.

Securing Your Residency and Building a Team

You've got the business licence in hand—a huge milestone. Your company is now a legal entity in the UAE. But this is where the real work begins. The next step is to transition from being a business owner on paper to actually living and operating here. It's time to secure your own residency visa and get ready to hire the people who will help you grow.

This phase is all about people, and it starts with you. Getting the right visa isn't just a formality; it's the key that unlocks everything else. Without it, you can't open a personal bank account, sign a lease for a flat, or truly settle into your new life in the UAE.

Your Pathways to UAE Residency

As a new business owner, you've got a few different routes to residency. The one you take will hinge on your level of investment, the nature of your business, and your long-term ambitions. The process is generally quite clear, but knowing your options from day one is critical.

The most well-trodden path for entrepreneurs is the Investor Visa, sometimes called a Partner Visa. This is directly tied to your ownership stake in the new company and is typically valid for two to three years. It's the standard, go-to option for most founders.

For those with bigger plans or a more significant investment, the UAE offers more prestigious, long-term options. The Golden Visa is a coveted 10-year residency permit granted to investors, entrepreneurs, and exceptional talents who meet specific criteria. As an entrepreneur, this could mean having an innovative business concept approved by an accredited incubator or demonstrating a track record of successful ventures.

The Golden Visa comes with some serious perks beyond its long duration. You can sponsor your family and an unlimited number of domestic helpers, and crucially, you can stay outside the UAE for more than six months without your visa becoming invalid.

Navigating the Visa Application Process

No matter which visa you're going for, the core process is fairly consistent. It’s a well-oiled machine run by the immigration authorities, but knowing the sequence of events will save you a lot of stress and potential delays.

Here’s a quick look at what the journey typically involves:

- Entry Permit: It starts with an entry permit (or "e-visa"). This is issued first and allows you to enter the UAE specifically to complete the rest of your residency paperwork.

- Medical Fitness Test: Once you're in the country, you’ll head to a government-approved health centre for a mandatory medical screening, which checks for certain communicable diseases.

- Emirates ID Application: Next, you'll visit an Emirates ID service centre to have your biometric data captured—that's your fingerprints and a photo.

- Visa Stamping: With a clear medical test and your biometrics done, your passport is submitted to have the final residency visa stamped inside.

The whole on-ground process, from the medical test to getting the stamp in your passport, usually takes about five to seven working days. Once the visa is stamped and your Emirates ID card arrives, you are officially a UAE resident.

Building Your Team Compliantly

With your own residency sorted, you can now focus on hiring your team. Bringing people on board in the UAE means following the country's Labour Law, which clearly defines the rights and responsibilities of employers and employees. Getting this right from the start is essential for building a healthy work environment.

A critical piece of this is the Wages Protection System (WPS). This is a mandatory electronic salary transfer system that ensures your team gets paid correctly and on time, every time. You'll need to register your company for WPS through your corporate bank.

You're also responsible for sponsoring your employees' residence visas and providing them with mandatory health insurance. The government is more focused than ever on attracting global talent, backed by powerful initiatives like the $8.7 billion investment under the Projects of the 50. This, combined with 100% foreign ownership rules, has sent foreign direct investment soaring. You can read more about the UAE's pro-business climate on Arabian Business. It all adds up to an environment that makes it easier for you to attract and retain the skilled team you need to succeed.

When Does it Make Sense to Hire a Business Setup Consultant?

Trying to start a business in the UAE on your own can feel like navigating a maze. It’s a complex process with constantly shifting rules. While the DIY route looks tempting to keep those initial costs down, there are moments when bringing in a professional business setup consultant isn't just a luxury—it’s a strategic move that saves you time, money, and a whole lot of headaches.

Knowing when to call in an expert is crucial. It’s about accepting that you can't beat local knowledge, especially in a regulatory environment as dynamic as the one here.

When Time Is Your Most Valuable Asset

For most entrepreneurs, time is far more precious than capital. If you're busy with product development, pitching to investors, or mapping out your market entry, getting tangled up in weeks of administrative work can kill your momentum. This is where a consultant steps in and takes the entire burden off your plate.

They’ll handle the whole nine yards, from reserving your trade name and submitting documents to dealing directly with government departments. This frees you up to focus on what actually grows your business, instead of getting buried in paperwork.

Dealing with Complex Business Structures

Let's face it, not every business is a simple one-person show. Things get complicated fast when you have multiple international shareholders, tricky profit-sharing agreements, or need a dual licence to operate in both a free zone and on the mainland.

In these scenarios, a consultant is indispensable. They can advise on the most effective legal structure to protect everyone's interests, draft a solid Memorandum of Association (MOA), and make sure your setup is compliant and ready to scale from day one. This kind of proactive planning helps you avoid costly disputes or having to restructure everything later on.

A common mistake I see is people underestimating the nuances of UAE commercial law. A good consultant is your first line of defence, making sure your company’s foundation is built to last and preventing simple errors that could jeopardise your licence or shareholder agreements.

When Your Business Needs Special Approvals

Certain business activities need a green light from specific ministries or external government bodies, not just the standard economic department or free zone authority. This applies to sectors like:

- Healthcare (Dubai Health Authority – DHA)

- Education (Knowledge and Human Development Authority – KHDA)

- Food and Beverage (Dubai Municipality – Food Safety Department)

- Financial Services (Securities and Commodities Authority – SCA)

Trying to navigate these extra approval layers without experience can be a real nightmare. Each authority has its own unique set of requirements, timelines, and inspection rules. A consultant who has experience in your specific sector will already have established relationships and a clear roadmap for getting these critical approvals without pointless delays. They know exactly what paperwork is needed and, more importantly, how to present it.

If you're weighing your options, take a look at how the best business setup consultants in Dubai can streamline these specialised requirements. Their expertise in these niche areas can be the difference between a quick approval and months of frustrating back-and-forth.

The Power of PRO Services

The paperwork doesn't stop once you have your trade licence. Every business in the UAE needs ongoing support for government-related tasks. This is where Public Relations Officer (PRO) services become essential. These are the people who handle everything from visa applications and renewals for you and your staff to processing labour and immigration cards.

Instead of burning hours waiting in government service centres, you can outsource these critical but time-draining tasks. A dedicated PRO service, which many setup consultancies offer, ensures your company stays compliant with visa and labour laws. This keeps your operations running smoothly, letting you focus on your actual business.

Your Questions Answered: Getting Started in the UAE

Even the most straightforward business plan runs into questions when you're setting up in the UAE. It’s a unique environment, and what’s standard practice back home often works a little differently here. Let's tackle some of the most common questions we hear from entrepreneurs, clearing the path so you can move forward with confidence.

Can I Actually Own 100% of My Business as a Foreigner?

Yes, you absolutely can. This is probably one of the biggest and best changes to UAE commercial law in recent memory. Thanks to the amended Commercial Companies Law, foreigners can now have 100% ownership of their Mainland businesses across more than a thousand different commercial and industrial activities.

This shift has made the Mainland a far more appealing option for international investors, who used to automatically default to a Free Zone for full ownership. It's worth remembering, though, that a few strategic sectors—think defence or certain financial services—might still require an Emirati partner.

And in the Free Zones? 100% foreign ownership has always been the standard. It’s a cornerstone benefit and remains one of the top reasons entrepreneurs from around the world choose to set up shop there.

What's the Real Minimum Cost to Get Started?

This is the million-dirham question, but thankfully, the answer is a whole lot less. While costs can definitely scale up depending on your ambitions, the entry point for starting a business here has become surprisingly accessible.

You could get a basic setup, like a freelance permit or a simple service licence in one of the more affordable free zones, for around AED 7,500 to AED 12,000. If a Mainland company is more your speed, the starting costs are a bit higher, typically ranging from AED 12,000 to AED 20,000 for the licence alone.

Don’t forget, these are just the baseline figures. They cover the core government fees for your trade name and licence. You’ll also need to budget for other essentials like visa processing, your office solution, and help with opening a corporate bank account, all of which will add to your initial investment.

Do I Genuinely Need a Physical Office?

Not always, and this is where you can make some smart savings. Whether you need a physical office really boils down to your chosen jurisdiction and, in some cases, your specific business activity.

- For Free Zone Companies: Most free zones are built for flexibility. You can usually satisfy the registered address requirement with a flexi-desk or a virtual office package. This gives you a legitimate business address and access to shared facilities without locking you into a costly private office lease.

- For Mainland Companies: A physical office address has traditionally been non-negotiable. You have to provide a registered tenancy contract, known as an Ejari, to get your licence finalised. The good news? Approved co-working spaces have become a popular and fully compliant alternative, letting you meet this requirement without the overhead of a conventional office.

How Long Does This Whole Process Really Take?

While patience is always a good thing, you won’t need an endless supply of it. The UAE government has done a remarkable job of accelerating the business formation process. Still, the exact timeline will depend on the complexity of your setup and where you register.

A Free Zone licence can be issued incredibly quickly—sometimes in just a few business days. A Mainland setup is more involved and takes a bit longer, usually between one and three weeks for the licence to come through.

But getting the licence is just one milestone. When you factor in the next steps—your visa application (medical test, biometrics, passport stamp) and the all-important process of opening your corporate bank account—the complete, end-to-end journey typically takes between three to six weeks. Plan for that full duration, and you'll have a much more realistic picture.

Navigating the complexities of business setup, visa applications, and financial compliance in the UAE requires local expertise. At Smart Classic Business Hub, we provide end-to-end support to ensure your journey is smooth and successful, letting you focus on what truly matters—growing your business. Discover how our tailored solutions can help you by visiting us at https://smartclassic.ae.