Setting up an offshore company in the UAE is a savvy move for global entrepreneurs. It offers a powerful way to protect assets, ensure confidentiality, and run an international business efficiently, all without the usual red tape of local operations.

This corporate structure is built specifically for international business. It allows for 100% foreign ownership and charges zero corporate tax on income earned abroad, all within a stable and thriving economic environment. It's the perfect vehicle for handling international trade, holding investments, or owning real estate in designated areas.

Why Global Entrepreneurs Choose a UAE Offshore Company

When investors look to expand their global footprint, the UAE consistently tops the list. But what makes its offshore structure so compelling? Unlike a mainland or free zone company, a UAE offshore entity is a non-resident company. This means it operates outside the country's borders while still benefiting from its world-class legal and financial framework.

Think of it as a legal instrument crafted for global business. It can't trade within the UAE, lease a physical office, or get residence visas for its owners. Its real strength is its international scope, providing a secure and tax-efficient home base for managing worldwide assets and transactions.

The Strategic Advantages of a UAE Offshore Setup

The perks go far beyond just having a prestigious registered address. For many entrepreneurs I've worked with, it’s about creating a corporate structure that is both private and built to last.

Here's a quick rundown of the benefits of setting up an offshore company in the UAE:

| Feature | Description |

|---|---|

| Full Ownership | Enjoy 100% foreign ownership with no need for a local Emirati sponsor or partner. |

| Tax Exemption | Pay 0% corporate tax on income generated outside the UAE and no VAT on international activities. |

| Privacy | The names and personal details of directors and shareholders are kept confidential and are not part of any public record. |

| Asset Protection | Legally separate your personal wealth from business liabilities, protecting assets like real estate or intellectual property. |

| Global Credibility | Operate under a globally respected jurisdiction known for its stable political climate and strong banking system. |

These advantages combine to create a powerful, flexible, and discreet corporate tool for managing international business affairs.

The UAE's reputation as a secure and forward-thinking business hub adds another layer of credibility. Its robust banking system, stable political climate, and extensive network of Double Taxation Avoidance Treaties (DTAAs) make it a trusted jurisdiction globally. This environment is precisely why so many entrepreneurs see the UAE as a haven for their international ventures.

The core appeal of a UAE offshore company is its simplicity and power. It allows you to operate globally under a respected jurisdiction, with minimal compliance burdens and maximum financial benefits, all while ensuring your ownership details remain private.

A Thriving Hub for International Business

The UAE's economic dynamism isn't just a talking point; the numbers speak for themselves. In the first half of 2025 alone, the Dubai Chamber of Commerce reported an incredible 35,500 new company registrations—a record that highlights the nation's explosive growth as a global business centre.

This boom, along with $47 billion in exports during the same period, shows how the country's strategic moves are drawing in entrepreneurs from all over the world. Many are choosing to set up operations in prime offshore zones like JAFZA and RAK ICC to tap into this growth.

Choosing the Right Jurisdiction: RAK ICC vs JAFZA

Picking the right jurisdiction for your UAE offshore company is easily the most critical decision you'll make at the outset. This isn't just about comparing a price list; it's a strategic move that will define your company's prestige, its operational freedom, and even the types of assets it can hold.

In the UAE, the conversation almost always narrows down to two heavyweights: Ras Al Khaimah International Corporate Centre (RAK ICC) and Jebel Ali Free Zone Authority (JAFZA).

Each has its own distinct purpose. I often tell clients to think of RAK ICC as the agile, cost-effective workhorse. It’s perfect for holding international assets, managing global trade, or protecting intellectual property. JAFZA, on the other hand, is the premium, globally recognised powerhouse. You'll find it's often a non-negotiable requirement for specific high-value transactions, like owning property in certain prime areas of Dubai.

RAK ICC: The Flexible and Affordable Choice

For the vast majority of entrepreneurs I work with, RAK ICC is the perfect fit. Its main draw is a powerful combination of affordability, speed, and flexibility that’s hard to beat.

If your main goal is to set up a straightforward holding company for your international investments or to manage consulting services for clients outside the UAE, RAK ICC is almost certainly your best option. The setup is remarkably efficient, and the annual renewal fees are much lower than its counterparts. This makes it an excellent starting point for those new to offshore structures or for businesses where keeping overheads lean is a priority.

Key advantages of RAK ICC include:

- Cost-Effectiveness: Lower incorporation and annual renewal fees.

- Speed: The registration process is typically faster, often wrapped up in just a few days with less complex paperwork.

- Flexibility: It supports a wide range of international business activities and is extremely well-suited for holding companies.

JAFZA: The Premium and Prestigious Option

JAFZA plays in a different league. As one of the world's oldest and most respected free zones, a JAFZA offshore company carries serious weight and credibility. This isn't just for show—it's a practical necessity in certain high-stakes scenarios.

For example, if your primary goal is to own real estate in Dubai's freehold areas managed by major developers like Nakheel or Emaar, a JAFZA offshore company is often mandatory. Its rock-solid regulatory framework and global reputation make it the go-to vehicle for complex corporate structuring and holding significant assets.

Yes, the costs are higher, but what you're buying is unparalleled credibility and access.

A common scenario we see is an investor looking to purchase a villa on the Palm Jumeirah. The developer requires the property to be held by a corporate entity, and only a JAFZA offshore company is accepted. In this case, the higher cost of JAFZA is a necessary part of the investment strategy.

Making a Decision Based on Your Goals

Ultimately, your choice between RAK ICC and JAFZA must be driven entirely by your business objectives. Don't just default to the cheaper option without thinking about your long-term needs. For a deeper analysis, our detailed comparison of JAFZA vs RAK ICC can provide more insights to help steer your decision.

To help you visualise the difference, let’s put them side-by-side.

RAK ICC vs JAFZA: A Head-to-Head Comparison

A detailed comparison of the two leading UAE offshore jurisdictions to help you choose the right one for your business goals.

| Attribute | RAK ICC | JAFZA |

|---|---|---|

| Primary Use Case | International trade, asset holding, consulting, IP protection | Owning Dubai real estate, high-value corporate structuring |

| Global Prestige | Well-regarded and globally compliant | Highly prestigious and globally recognised |

| Annual Audit | Not mandatory for most companies | Generally required, adding to compliance costs |

| Incorporation Speed | Very fast, often completed within a few days | Can be slightly longer due to stricter due diligence |

This table gives a quick snapshot, but the right choice always comes down to the specifics of your business plan.

What About Other Jurisdictions Like Ajman?

While RAK ICC and JAFZA get most of the attention, you might hear about other options like Ajman Offshore. Ajman offers a competitive cost structure, much like RAK ICC, and can be a solid alternative for general international trading or holding purposes.

However, it simply doesn't have the same level of global recognition as JAFZA or the widespread popularity of RAK ICC. For most investors, the choice really does boil down to the two main players.

The right jurisdiction is the one that aligns perfectly with your business model, budget, and future ambitions. The cost-effectiveness of setting up offshore in the UAE is a major attraction, especially in places like RAK ICC where setup fees can start from AED 5,000 and be done in as little as two weeks. While RAK ICC's annual renewals often land between AED 4,000–6,000, JAFZA's are typically higher at AED 7,000–10,000, reflecting its premium status. This competitive landscape makes the UAE a top destination for foreign investors who want 100% ownership without needing a local partner.

The Offshore Incorporation Blueprint

Alright, you've made the decision. Now it’s time to turn that plan into a reality and bring your UAE offshore company to life. This process is structured, yes, but don't mistake it for a simple checklist exercise. The real key to success is in understanding the details at each stage, from getting your company name approved right through to finalising the legal documents that will form the bedrock of your new entity.

This isn’t just about filling in forms; it's about building a solid legal foundation for your international business. A single misstep can cause frustrating delays, so a clear approach—and the right support—is everything.

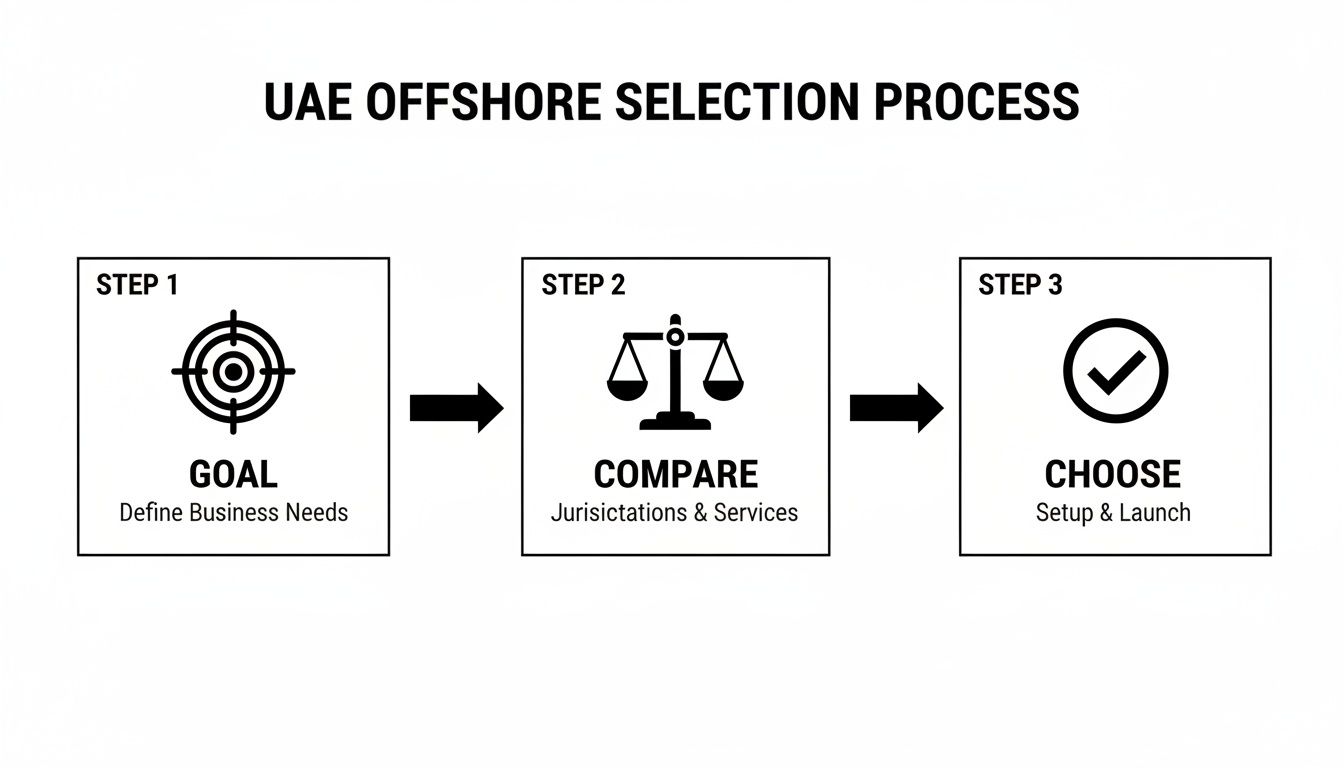

This visual guide breaks down the initial selection process into three core phases: defining your goal, comparing jurisdictions, and making your final choice.

As you can see, a successful setup starts with a clear business objective, not just a price comparison.

Nailing the Company Name and Structure

First on the practical to-do list: choosing a company name. It sounds simple, but this is a surprisingly common holdup. UAE offshore registries have pretty strict naming conventions. For starters, your proposed name can't imply any connection to local UAE operations or government bodies. It also can’t suggest restricted activities like banking, insurance, or education without getting special permissions.

To avoid a back-and-forth with the registrar, a smart move is to propose three to five name options in order of preference. The name must also end with "Limited" or "Ltd." to signify its legal status. Once the registrar gives you the green light on a name, you can move on to defining the company structure.

This part involves deciding on:

- Shareholders: Who will own the company? You'll need at least one, which can be a person or another company.

- Directors: Who's going to manage things? You have to appoint at least one director. The director and shareholder can absolutely be the same person.

- Share Capital: While most UAE offshore jurisdictions don’t make you physically deposit share capital, you do need to declare an amount in your incorporation documents.

Assembling the Essential Documentation

With the structure mapped out, the next step is gathering the required paperwork. This is where you need to be meticulous. Any little inconsistency or a single missing document will bring the offshore company registration UAE process to a dead stop.

For each shareholder and director, you'll typically need to get these core documents together:

- Passport Copy: A clear, colour copy of the passport for every individual involved. It must have at least six months of validity left.

- Proof of Address: A recent utility bill (like electricity or water) or a bank statement that clearly shows the person's residential address. Make sure it’s no more than three months old.

- Bank Reference Letter: A simple letter from your personal bank confirming a satisfactory relationship. Some jurisdictions, like JAFZA, can be a bit more particular about this.

- Brief CV or Profile: A quick summary of the professional background of the key people involved in the company.

One of the most common pitfalls we see is with document attestation. Depending on the jurisdiction and your corporate structure, some documents might need to be notarised or even attested at a UAE embassy in your home country. Getting this wrong can easily add weeks to your timeline.

The Role of Your Registered Agent

Here’s a crucial point: in the UAE, you can't register an offshore company by yourself. You have to work through a licensed registered agent, like Smart Classic Business Hub. This isn't just red tape; it's actually your biggest advantage. Your agent is the official go-between connecting you and the registry.

Their most critical job is drafting the Memorandum and Articles of Association (MOA & AOA). Think of these as the constitution for your company. They outline its purpose, how shares are structured, and the internal rules for how it will be run. A well-drafted MOA & AOA provides clarity and helps prevent headaches and disputes down the road.

Once all the documents are prepared and signed, your registered agent submits the complete application to the relevant authority, whether that's RAK ICC or JAFZA. They handle all the communication, field any questions from the registrar, and keep you in the loop until your application gets the final nod.

From the moment you provide all the correct documents, a realistic timeline for receiving your Certificate of Incorporation is usually between 3 to 10 working days. This efficiency is a real hallmark of the UAE's business-friendly approach, letting you get your international operations up and running without delay.

Managing Your Finances: Costs, Banking, and Taxes

This is where the rubber meets the road. Understanding the financial side of your offshore company registration in the UAE is what turns a good idea into a viable reality. It’s easy to get fixated on the headline registration price, but a smart entrepreneur looks at the total picture—setup costs, annual maintenance, banking, and tax obligations. Getting this right from day one prevents nasty surprises later on.

Your financial journey breaks down into three core areas: nailing down the costs, the all-important task of opening a corporate bank account, and getting to grips with the UAE's tax rules. Let's walk through each one.

A Transparent Breakdown of Costs

Budgeting for your offshore company isn't just about the initial fee. You need to account for both the one-time setup charges and the recurring annual costs to keep your company active and compliant. One of the most common mistakes we see is clients focusing only on the incorporation fee and forgetting about everything else.

Here’s what you should realistically factor into your budget:

- One-Time Registration Fees: This is the core government fee paid to the offshore authority, whether it's RAK ICC or JAFZA, to officially bring your company into existence.

- Registered Agent Fees: You can't do this alone; a registered agent is mandatory. Their professional fees cover the expert handling of the incorporation process and are a key part of your initial outlay.

- Document Attestation: This is a variable cost. Depending on where the shareholders are from and your company structure, some documents will need to be notarised and legalised. These official stamps come with their own price tag.

Once you're set up, the costs don't stop. You must plan for annual renewal fees to maintain your company's good standing. This typically includes the government licence renewal and your registered agent's yearly service charge. Ignoring these can result in hefty penalties or, in the worst-case scenario, your company being struck off the register entirely.

The Challenge of Opening a Corporate Bank Account

Let’s be blunt: securing a corporate bank account is often the single most difficult part of the entire offshore process. A company without a bank account is just a piece of paper; it can't send invoices, receive payments, or manage its funds. UAE banks have become incredibly stringent with their compliance and due diligence checks.

The days of walking into a bank and opening an account in an afternoon are long gone. Banks today need to see a legitimate, viable business with a clear purpose. They will put your business plan, source of funds, and the professional history of the shareholders under a microscope.

We’ve seen countless entrepreneurs get taken by surprise when their bank application is rejected. The number one reason? A weak or incomplete application that fails to tell a convincing story about the business. Banks need to see a clear, logical, and lawful reason for the company to exist.

To give yourself the best shot at approval, your application needs to be rock-solid. This means preparing a detailed company profile, a thorough business plan that clearly outlines your activities, and comprehensive paperwork for every single shareholder and director. This is where working with a consultant who has strong, established relationships with local banks can make all the difference.

Navigating UAE Corporate Tax and Residency

The introduction of UAE Corporate Tax in June 2023 was a game-changer for all businesses here, offshore entities included. While the headline benefit of 0% tax on foreign-sourced income still stands, you absolutely must understand the new framework.

Generally, an offshore company is not subject to the 9% corporate tax on profits over AED 375,000, as long as it conducts zero business within the UAE mainland. But here's the crucial part: you are still required to register with the Federal Tax Authority (FTA) to get a Tax Registration Number (TRN) and meet any filing obligations. For companies that might interact with local suppliers, understanding Value Added Tax is also key. You can get the full rundown in our guide on how to register for VAT in the UAE.

One of the most powerful tools for offshore company owners is the Tax Residency Certificate (TRC). This is an official document from the UAE government confirming your company is a tax resident here. It's incredibly valuable for accessing the UAE’s vast network of Double Taxation Avoidance Treaties (DTAAs), which can protect your company’s profits from being taxed a second time in your home country.

Keeping Your Offshore Company in Good Standing

Getting your offshore company registered is a huge step, but honestly, that’s just the starting line. The real challenge—and where many people stumble—is keeping up with the annual compliance requirements. Neglecting this is the fastest way to see your hard work and investment go down the drain.

Think of it this way: your offshore company is a high-performance vehicle. You wouldn't drive a supercar without regular maintenance, right? Annual compliance is that essential service. It’s not just about ticking boxes; it's about protecting the legal integrity of your entire structure.

Your Annual Non-Negotiables

First and foremost, you have to renew your company's registration every single year. This isn't optional. If you miss the deadline, you'll face fines, lose your company's good standing, and could even have it struck off the register entirely.

This is where your registered agent comes in. They’re more than just a setup service; they are your official link to the offshore authority. A good agent, like us at Smart Classic Business Hub, will manage the whole renewal process for you—sending reminders, filing the paperwork, and handling the government fees. This relationship is crucial for keeping things running smoothly year after year.

Then there's record-keeping. While a formal audit isn't required for most RAK ICC companies, it’s a massive mistake to let your finances become a mess. Keeping organised accounts of all your income and expenses is just good business hygiene. You'll need these records if you ever want to open another bank account or if a regulator asks questions down the line.

Common Pitfalls We See All the Time (And How to Avoid Them)

After years in this business, we’ve seen where new offshore owners most often go wrong. The good news is that these aren't complex legal traps. They're simple, costly oversights that you can easily sidestep with a little awareness.

Here are the mistakes that trip people up the most:

- Dipping into the Local Market: This is the cardinal sin of owning a UAE offshore company. Your license is strictly for international business. You cannot invoice a client in Dubai or sell anything within the UAE. Doing so is a direct violation and brings serious penalties.

- Forgetting Renewal Deadlines: This is such an easy one to avoid, yet it happens all the time. Late fees from the authorities add up fast, and worse, a lapsed registration can get your corporate bank account frozen without any warning.

- Ignoring Economic Substance Rules (ESR): If your company is involved in certain activities—like holding intellectual property or functioning as a holding company—you might be subject to ESR. Failure to file the right reports leads to hefty fines.

- Using the Company Account Like a Personal Wallet: Never, ever mix your personal and business funds. The bank account is for legitimate company transactions only. Banks are always watching for suspicious activity, and they won't hesitate to shut down an account that's being misused.

The most important thing to remember is this: your offshore company is a precision tool built for one job—international business. Using it for anything else, especially for local dealings, undermines its entire purpose and puts you at significant legal and financial risk.

To keep things simple and stay on the right track, just follow this checklist.

Your Annual Compliance Checklist

Think of this as your company’s yearly health check.

- Know Your Renewal Date: Mark it on your calendar. You should get a reminder from your registered agent about 90 days before it’s due.

- Pay Renewal Fees on Time: Get the government and agent fees settled promptly to avoid any late penalties.

- Keep Your Agent Updated: If there are any changes to your directors, shareholders, or even just your contact details, let your agent know right away.

- Stay on Top of Your Books: Even without a mandatory audit, keep your financial records clean and current throughout the year.

- Do an Annual Activity Review: At the end of each year, take a moment to confirm that all your business was conducted strictly outside the UAE.

Your Top UAE Offshore Company Questions Answered

When you start looking into a UAE offshore company, a lot of practical questions come up. After helping countless clients navigate this landscape, we've found that the same handful of queries always surface. These aren't just technicalities; they're the real-world concerns that determine whether this is the right move for you.

Let's cut through the jargon and tackle these head-on. Getting clear, straightforward answers is the only way to feel confident that the structure you build will actually serve your goals.

Can I Get a UAE Residence Visa with an Offshore Company?

This is probably the most common question we get, and the answer is a simple, unambiguous no.

A UAE offshore company is, by its very nature, a non-resident entity. It's designed for business conducted entirely outside the Emirates. Since it's not permitted to lease a physical office or run local operations, it can't serve as a basis for a residence visa.

If a UAE residence visa for you or your family is a key objective, you'll need to explore either a free zone or a mainland company. Those structures are specifically designed to support a physical presence in the UAE and, therefore, visa eligibility.

Is an Audit Required for My UAE Offshore Company?

Whether you need to conduct a formal annual audit really comes down to which jurisdiction you choose. This is one of those details that makes the initial choice so important.

- JAFZA Offshore: JAFZA operates with a more stringent compliance framework. An annual audit is generally required here. This reflects its standing as a premium, highly regulated jurisdiction often used for holding significant assets.

- RAK ICC: This is where you find more flexibility. For most companies registered with RAK ICC, a formal audit is not mandatory.

But here’s a critical piece of advice: just because an audit isn't required doesn't mean you can slack on your bookkeeping. Maintaining clean, accurate financial records is non-negotiable. It's just good business practice, and it ensures you're always ready for any bank compliance reviews or unexpected regulatory questions.

What Business Activities Can My Offshore Company Perform?

Think of a UAE offshore company as your global business vehicle. It's incredibly powerful, but it must operate internationally. The range of permitted activities is broad, as long as they take place outside the UAE.

Here are some of the most common uses we see:

- International Trading: You can buy goods from China and sell them to a client in Europe, all without the products ever touching UAE soil.

- Consulting Services: Providing professional expertise to clients located anywhere in the world, except within the UAE itself.

- Investment Holding: Using the company to own shares in other international businesses or to hold a portfolio of financial assets.

- Real Estate Ownership: This is a popular use case, especially for JAFZA entities, which can hold property in designated freehold areas across Dubai.

The one hard-and-fast rule is that you cannot conduct any business within the UAE mainland. That means no invoicing local companies, no renting an operational office, and definitely no engaging in regulated fields like banking or insurance without very specific, high-level permissions.

How Private Is the Ownership of a UAE Offshore Company?

Confidentiality is a cornerstone of the UAE offshore structure. For many entrepreneurs and investors, this is one of its most attractive features.

The names and details of a company's shareholders and directors are not available on any public register. This information is held securely by the official registrar (like RAK ICC or JAFZA). It is only ever disclosed under strict legal conditions, such as a formal court order, a request from law enforcement, or as part of a bank's mandatory due diligence.

This level of discretion makes a UAE offshore company an excellent tool for protecting assets and managing global operations without broadcasting your personal details to the public. It gives you a secure, private, and legally sound foundation for your international ventures.

Getting the details right is what makes an offshore company work for you. The team at Smart Classic Business Hub provides practical, hands-on support for every step, from picking the right jurisdiction to handling your ongoing compliance. Start your journey with confidence by visiting https://smartclassic.ae.