Setting up an offshore company in Dubai gives you a powerful tool for handling international trade, protecting your assets, and managing global investments. It's a completely different animal compared to a mainland or free zone company. These entities are designed to operate outside the UAE market, which brings a unique set of advantages like 100% foreign ownership, solid confidentiality, and serious tax efficiencies for anyone focused on global business.

Why Set Up an Offshore Company in Dubai

Before you even think about paperwork, let's get one thing straight: a Dubai offshore company isn't what you think it is. People hear "Dubai" and assume it's for trading within the UAE. It's not. This structure is built exclusively for international business and is legally barred from trading in the local market.

Think of it as a legal headquarters registered in a top-tier UAE jurisdiction—like the Jebel Ali Free Zone (JAFZA) or Ras Al Khaimah International Corporate Centre (RAK ICC)—but without a physical office or staff in the Emirates. This distinction is everything. You're not setting up shop to sell things in Dubai malls; you're building a base to manage your worldwide assets and operations from a stable, reputable hub.

The Core Advantages for Global Investors

So, why go through the trouble? Because the appeal of a Dubai offshore setup lies in a mix of benefits that are tough to beat. These aren't just generic perks; they're tailored for specific international business goals.

Here's what draws investors in:

- Complete Foreign Ownership: You keep 100% control. There’s no need for a local Emirati partner or sponsor. For any international entrepreneur, that level of autonomy is a massive win.

- Robust Asset Protection: An offshore company acts as a legal firewall between your personal wealth and your business liabilities. It's a smart way to shield your assets from potential lawsuits, creditors, or even political instability back home.

- Enhanced Confidentiality: The names of the company's directors and shareholders are kept off public records. This level of privacy is a huge plus for anyone looking to manage their affairs discreetly.

- Significant Tax Efficiencies: When structured correctly, offshore companies in Dubai are incredibly tax-efficient, especially for international income streams. This means more of your profits stay in the business, ready for you to reinvest and grow.

A lot of people think offshore companies are just for massive corporations. That’s a total myth. I've seen them used brilliantly by individual investors holding international property, digital nomads managing global IP rights, and family businesses looking to sort out their succession plans.

Real-World Use Cases

Let’s make this practical. Imagine an e-commerce owner selling products across Europe and Asia. They could use a Dubai offshore company to bring all their international profits into one central pot, making it way easier to manage payments to suppliers worldwide.

Or think about a consultant with clients all over the globe. They can invoice through their offshore entity, which drastically simplifies their financial admin. It’s also the perfect vehicle for a holding company—you can own shares in various international businesses and manage your entire portfolio from one streamlined entity. This is the kind of strategic thinking that makes an offshore company registration in Dubai such a savvy move for the right kind of entrepreneur.

Choosing Your Jurisdiction: JAFZA vs. RAK ICC

When you're ready to set up an offshore company in Dubai, your very first decision is the most critical: picking the right jurisdiction. This isn't just a name on a certificate; it's a choice that defines your company's capabilities, ongoing costs, and strategic path. The two heavyweights in this arena are the Jebel Ali Free Zone (JAFZA) and the Ras Al Khaimah International Corporate Centre (RAK ICC).

Each has its own distinct flavour and set of advantages. Your final decision should come down to one thing: your business goals. One is a globally recognised powerhouse with a premium fee structure and exclusive property ownership perks. The other is known for its agility, modern approach, and cost-effectiveness. Let's dig into the practical differences to see which one fits your vision.

JAFZA Offshore: The Prestige and Property Powerhouse

There's no question that JAFZA is the more established and prestigious of the two. Its name carries immense weight globally, making it the default choice for larger corporations or investors who need that blue-chip reputation in international dealings.

But the real game-changer with JAFZA is its unique ability to own real estate in Dubai. This is a massive draw for international property investors. A JAFZA offshore company can legally hold freehold property in designated areas across Dubai, creating a secure and efficient vehicle for building real estate portfolios.

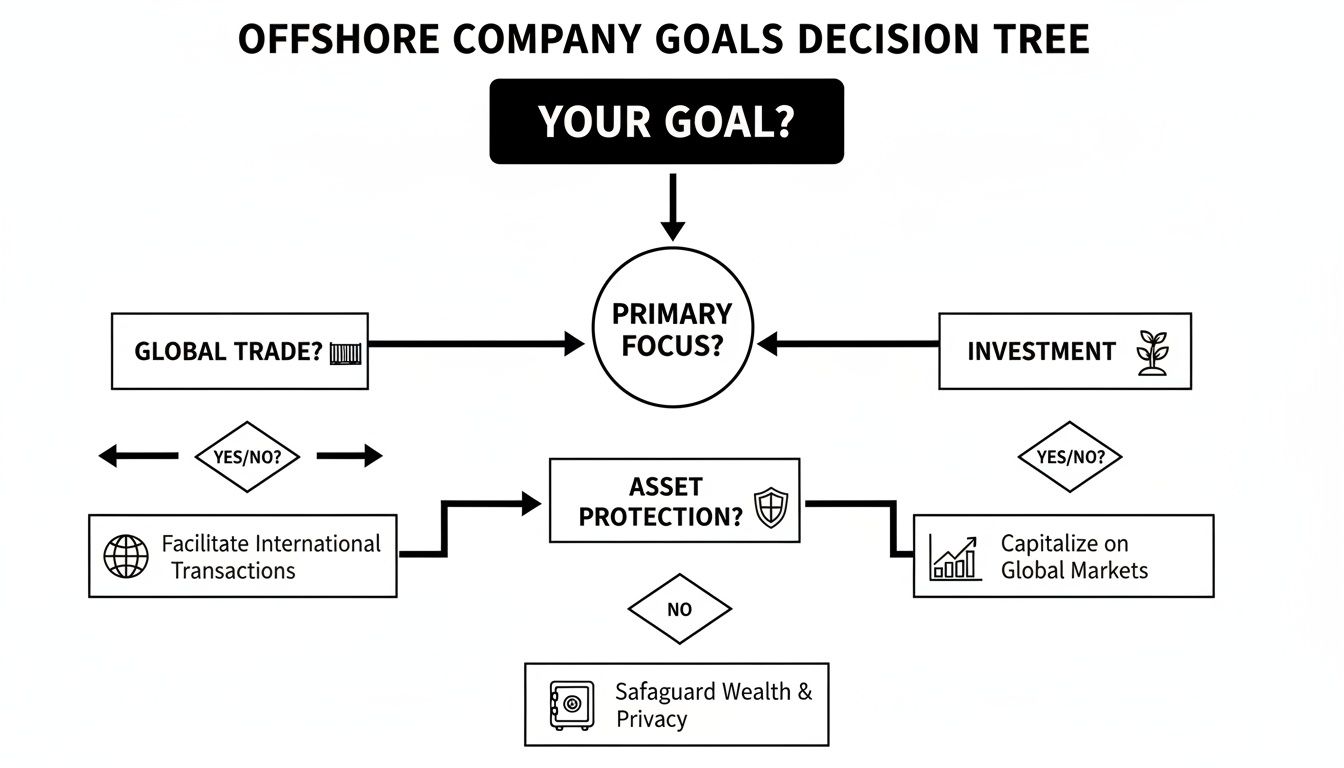

This simple decision tree helps visualise which path makes the most sense based on what you're trying to achieve.

As you can see, if your primary objective is holding property assets in Dubai, the road almost always leads to a JAFZA setup.

Of course, this prestige comes at a price. Both the initial setup fees and the annual renewal costs for a JAFZA offshore entity are noticeably higher than what you'll find at RAK ICC. You're paying a premium for its well-oiled infrastructure and global standing.

RAK ICC: The Flexible and Cost-Effective Alternative

On the other hand, RAK ICC has carved out a stellar reputation for being incredibly flexible, modern, and light on the budget. It has quickly become the go-to for entrepreneurs and businesses focused on international trade, holding diverse assets, and creating special purpose vehicles (SPVs).

RAK ICC isn't just the "cheaper" option; it's a strategically smart one for countless business models. Its corporate laws are up-to-date and built to handle a wide variety of international structures. You can form companies limited by shares, by guarantee, or even segregated portfolio companies (SPCs), which are fantastic for investment funds.

Here are a few scenarios where we see RAK ICC really shine:

- International Holding Companies: A perfect structure for owning shares in other global businesses.

- Global Trading Operations: A clean and simple vehicle for managing international invoicing.

- Intellectual Property Holding: A secure entity for protecting patents, trademarks, and copyrights.

- Family Wealth Management: Frequently used to structure family offices and manage succession planning.

The cost difference is significant. Initial registration and annual maintenance fees at RAK ICC are much lower, making it an accessible entry point for startups and SMEs wanting an international footprint without a huge upfront investment.

From our experience, clients whose main goal is international trade or holding assets outside of the UAE often find RAK ICC gives them everything they need at a fraction of the cost. The value proposition is incredibly strong if you don't need the Dubai property ownership feature.

JAFZA Offshore vs RAK ICC: A Head-to-Head Comparison

To make a clear decision, it always helps to see the key features side-by-side. Your choice will come down to which of these factors aligns best with your long-term business strategy.

| Feature | JAFZA Offshore | RAK ICC |

|---|---|---|

| Primary Advantage | Can own real estate in Dubai | Cost-effective and highly flexible corporate structures |

| Global Reputation | Excellent, globally recognised prestige | Strong and growing reputation for modern regulations |

| Setup Cost | Higher | Lower |

| Annual Renewal Fees | Higher | Lower |

| Shareholder Rules | Minimum of one shareholder required | Minimum of one shareholder required |

| Director Rules | Minimum of two directors required | Minimum of one director required |

| Best For | Real estate investors, large corporations, prestige | International traders, holding companies, SPVs, startups |

That difference in director requirements is a small but important detail. JAFZA's rule for at least two directors can add a layer of complexity for solo entrepreneurs. In contrast, RAK ICC's single-director minimum keeps things much simpler for smaller operations.

Ultimately, the choice is a strategic one. If your business plan involves Dubai property, JAFZA is your only real offshore option. For nearly every other international business purpose—from asset protection to global trade—RAK ICC offers a powerful, flexible, and far more economical solution for your offshore company registration in Dubai.

Navigating the Registration Paperwork and Process

Okay, so you’ve picked your ideal jurisdiction—maybe the prestigious JAFZA or the flexible RAK ICC. Now comes the exciting part: turning your vision into a legal reality. This stage is all about the practical steps of registration, and while it's not about drowning in paperwork, it's absolutely about precision.

The entire system is designed to be efficient, but one small error in a document can bring everything to a halt. Think of it like building with LEGOs; if one brick is out of place, you can't move forward until it’s fixed. This is exactly why working with a registered agent isn’t just a formality—it’s a massive strategic advantage.

Assembling Your Core Documentation

Your registered agent will give you a specific checklist, but the core documents needed for an offshore company registration in Dubai are pretty standard across the board. Getting these items ready ahead of time will seriously speed things up.

For each shareholder and director, you'll generally need:

- Clear Passport Copies: High-resolution colour copies are a must. Make sure they have at least six months of validity left.

- Proof of Residential Address: A recent utility bill (electricity, water) or a bank statement works perfectly. It needs to clearly show your name, full address, and be dated within the last three months.

- Bank Reference Letter: This is just a simple letter from your bank confirming you have a satisfactory relationship with them. No financial details needed—it just verifies you're in good standing.

- Curriculum Vitae (CV): A short professional bio for each director and shareholder helps the authorities understand their background and experience.

A common hiccup we see all the time is with document attestation. If any of your key documents, like a power of attorney, were issued outside the UAE, they need to be notarised in your home country and then attested by the UAE Embassy there. Skipping this is one of the quickest ways to get your application rejected.

The Registration Journey Unpacked

With your documents sorted, the actual registration process follows a clear path. Even though your agent will be doing the heavy lifting, understanding the milestones helps you keep track of where things are.

It all kicks off with selecting and reserving your company name. You'll need to provide three options, in order of preference. Just be sure they stick to UAE naming rules—no religious or political references, for example.

Next, your agent submits the full application, including the crucial Memorandum and Articles of Association (MOA/AOA), to the registrar. This is where the authorities do their due diligence. Once they're happy, you'll get an initial approval, which is the green light for the final steps.

After you pay the government registration fees, the registrar issues your final company documents. This package typically includes:

- Certificate of Incorporation: The official proof that your company legally exists.

- Memorandum & Articles of Association: Your company's rulebook, defining what it does and how it operates.

- Share Certificates: The formal record of ownership for each shareholder.

The whole process, from name reservation to getting that certificate in hand, can take anywhere from a few days to a couple of weeks. It really just depends on the jurisdiction's current workload and how accurate your initial paperwork was.

This streamlined approach is a huge reason why these setups are booming. To see how this compares to other business structures, check out our comprehensive guide on how to register a company in the UAE.

It's no surprise that Dubai's free zones are seeing explosive growth. The Dubai International Financial Centre (DIFC) alone saw a 32% surge in registrations in the first half of the year, bringing in 1,081 new companies. This isn't by chance; it's the result of highly focused ecosystems in zones like DIFC, JAFZA Offshore, and RAK ICC that are perfectly designed for global players looking to protect assets and manage international holdings efficiently.

A Transparent Breakdown of Setup Costs

Before you jump into your offshore company registration in Dubai, let's talk numbers. Nobody likes financial surprises, and getting a crystal-clear picture of the costs is non-negotiable. Vague estimates and hidden fees can sink your plans before they even set sail, so we'll break down exactly what you should expect to pay, both upfront and down the line.

The initial investment isn't a single line item. It's a package of several critical components that get your company legally established and ready for business.

Unpacking the One-Time Setup Fees

First up is the government registration fee. This is the core cost paid directly to the jurisdiction—either JAFZA or RAK ICC—to process your application and officially incorporate your new company. The fee can differ between the two, with JAFZA generally positioned as the more premium option.

Next, you have the registered agent fee. The UAE requires you to appoint a registered agent to manage the incorporation paperwork. This fee covers their expertise in preparing your documents, acting as your liaison with the authorities, and making sure every part of your application is perfect.

Finally, there are costs for document preparation and attestation. This covers things like drafting your company's essential legal documents (like the Memorandum and Articles of Association) and, crucially, getting any foreign documents legally attested for official use here in the UAE.

Budgeting for Annual Renewal Costs

Your financial commitment doesn't stop once the company is registered. To keep your offshore entity active and in good standing, you absolutely must budget for annual renewal fees. Think of them as the yearly upkeep required to maintain your company's legal status.

These recurring costs typically include:

- Annual Licence Renewal: A yearly fee paid to the registrar that keeps your company’s trade licence active.

- Registered Agent and Office Fees: This covers the annual retainer for your agent's services and the cost of maintaining your official registered office address.

- Compliance Charges: Depending on your specific business activities, you might run into other small, compliance-related costs.

While these ongoing fees are much lower than the initial setup investment, they are a vital part of your long-term financial planning.

Here's a common mistake I see: entrepreneurs get hyper-focused on the initial setup price and completely overlook the recurring annual costs. A savvy business owner plans for the total cost of ownership over the first three to five years, not just the first three months.

The appetite for these setups is growing fast. As a testament to Dubai’s magnetic pull for global business, the Dubai Chamber of Commerce recently announced that a staggering 35,500 new companies were registered in just the first half of the year. This boom is a direct result of Dubai's D33 Economic Agenda, a bold plan to solidify its position as a top-tier global business hub.

To see how these offshore costs compare to other business structures, it's worth checking out our comprehensive guide on the cost of starting a business in Dubai. By looking at the bigger picture, you can make a truly informed decision that aligns with your international goals. Careful budget planning now is the best way to avoid nasty surprises later.

Life After Registration: Banking and Compliance

You have the certificate of incorporation in hand—congratulations! This is a major milestone, but the work isn't quite done. In fact, what comes next is just as crucial for the long-term health of your offshore company. Now, your focus shifts to two key pillars: getting a corporate bank account and setting up a solid compliance routine.

Without a bank account, your new international business is essentially stuck on the launchpad. Think of your company as a high-performance vehicle; the bank account is the fuel that allows it to trade, invest, and operate globally. Getting this stage right sets the foundation for everything else.

Securing Your Corporate Bank Account

Opening a corporate bank account in the UAE for an offshore entity is a meticulous process that requires serious preparation. UAE banks are governed by strict international anti-money laundering (AML) and Know Your Customer (KYC) regulations. They need absolute certainty about who you are and the nature of your business before they’ll bring you on as a client.

This isn't just about ticking boxes. The bank's compliance team will scrutinise every document you provide. The single most common hurdle we see clients face is an incomplete or poorly presented business profile. Vague descriptions of your activities or a lack of proof are immediate red flags for any bank.

To give yourself the best shot at a smooth approval, you need to present a compelling and transparent case. This should include:

- A Detailed Business Profile: Clearly lay out your business model, how you generate revenue, and who your target clients are.

- Shareholder and Director Profiles: Provide professional CVs and a clear source of funds declaration for everyone involved.

- Supporting Documentation: This is key. Gather contracts, invoices, or even letters of intent from potential clients or suppliers to back up your claims.

A common mistake is thinking a bank account is guaranteed just because your company is registered. Banks have their own internal risk policies. A strong, transparent application that clearly shows a legitimate business purpose is your most powerful tool.

If this is your first time, navigating the nuances can be a real challenge. For a closer look, our guide on opening a non-resident bank account in Dubai offers more detailed insights and practical tips.

Staying Compliant: The Ongoing Responsibilities

Once your banking is operational, your attention needs to turn to ongoing compliance. Keeping your company in good standing with the registrar isn't just good practice—it's a legal requirement. Ignoring these duties can result in fines, the suspension of your licence, or even having your company struck off the register entirely.

Your main compliance tasks will revolve around good record-keeping and timely renewals. While offshore jurisdictions like JAFZA and RAK ICC have fewer public filing requirements compared to mainland companies, maintaining proper financial records is non-negotiable. You must keep accurate books that clearly reflect the company's financial transactions and position.

The key ongoing tasks are straightforward but essential:

- Annual Licence Renewal: This is the big one. Missing your renewal deadline will lead to penalties and can put your company's legal status at risk.

- Maintaining Records: Keep all financial statements, invoices, and contracts organised and readily available.

- Filing Updates: You are legally obligated to inform the registrar of any changes to your company, like a new director, shareholder, or a change of registered address.

Navigating Corporate Tax Considerations

The introduction of UAE Corporate Tax has added a new dimension to compliance. While offshore companies are structured for tax efficiency, they aren't automatically exempt from every rule. The critical factor is whether your company earns any income from the UAE mainland.

In most cases, an offshore company that earns its income purely from qualifying international activities—with no UAE-sourced income—is unlikely to have a corporate tax liability. However, this isn't a blanket exemption. The Federal Tax Authority (FTA) will look at the specifics, including the nature of your transactions and where your clients and management are located.

It is absolutely vital to get professional tax advice tailored to your unique situation. This will ensure you stay fully compliant with FTA regulations and can run your international business with confidence, free from the worry of unexpected tax problems down the line. Proper structuring from day one is always the best strategy.

Your Questions About Dubai Offshore Companies, Answered

Even with a clear plan, diving into offshore company registration can bring up a few last-minute questions. That's perfectly normal. This is a unique business structure, and getting the small details right is what separates a good strategy from a great one.

We've rounded up the most common queries we get from entrepreneurs just like you. Here are the straight, practical answers to clear up any confusion.

Can I Get a UAE Residence Visa with an Offshore Company?

This is probably the most frequent question we hear, and the answer is simple: no, you can't. Neither a JAFZA nor a RAK ICC offshore company is eligible to sponsor UAE residence visas for its owners or staff.

Think of these companies as having a UAE address for international business, but not a physical presence. They're specifically designed for activities conducted outside the UAE, like global trade, managing investments, or holding assets. Since they can't trade locally and don't have a physical office, they don't meet the requirements for visa sponsorship.

If a UAE residence visa is a non-negotiable part of your plan, you'll need to look at a different setup entirely. A mainland LLC or a free zone company is the way to go, as they are built for onshore operations and come with visa allocations.

Is My Offshore Company Subject to the 9% UAE Corporate Tax?

In most cases, the income your offshore company earns from its international activities won't be touched by the 9% UAE Corporate Tax. The tax framework was primarily created for businesses operating and generating revenue inside the UAE.

But—and this is a big "but"—it's not a total free pass. The deciding factor is where your money is coming from. If your offshore company somehow generates income from a source on the UAE mainland (which, by its nature, it shouldn't be doing), that specific income could fall under the tax net.

Here's the takeaway:

- International Income: Revenue from global trade, investments, and services performed outside the UAE is typically not subject to corporate tax.

- Compliance is Everything: The Federal Tax Authority (FTA) has clear rules. You need to be certain your business activities fit the definition of non-taxable income.

Don't leave this to chance. Getting professional tax advice is critical. A qualified advisor can look at your specific business model and give you a definitive answer, making sure you stay on the right side of the FTA.

Do I Need to Physically Visit Dubai to Register?

Good news here—for the most part, you can get the entire registration done remotely. Both JAFZA and RAK ICC have modernised their processes, allowing entrepreneurs to incorporate from anywhere in the world through a registered agent like us.

Your agent is your boots on the ground. We handle all the document submissions, liaise with the registrar, and manage the entire process while you focus on your business.

There is, however, one crucial step that requires your presence: opening the corporate bank account. While the company formation can be done from afar, virtually every bank in the UAE will require you to meet them in person. It’s a mandatory part of their "Know Your Customer" (KYC) checks.

So, while you can skip the trip for registration, plan on visiting Dubai to finalise your banking. It's a standard security measure that underscores the strength of the UAE's financial system.

Getting the details right on an offshore registration is what makes it a powerful tool for your business. At Smart Classic Business Hub, we manage every single step, from picking the right jurisdiction to helping you navigate the bank account opening. Let us handle the admin, so you can get back to your global ambitions. Contact us today for a personalised consultation.