Opting for an offshore company in Dubai isn't just about setting up a business; it's a strategic move for entrepreneurs who think globally. It’s the perfect vehicle for protecting assets, ensuring confidentiality, and operating in a zero personal tax environment. This structure gives you 100% foreign ownership and is brilliantly suited for international trade, safeguarding intellectual property, or holding assets without the red tape of running a business on the UAE mainland.

Why Choose an Offshore Company in Dubai?

It's easy to get confused between offshore, free zone, and mainland companies. I see it all the time with clients. While they all fall under the UAE's pro-business umbrella, they serve completely different purposes. A mainland company is for trading within the UAE market, and a free zone company operates inside its designated economic zone.

An offshore company, on the other hand, is a non-resident entity. Think of it as being legally registered in the UAE but built to do business outside the country. This setup is ideal for entrepreneurs who don’t need a physical office or visas in the UAE but still want to tap into the legal and financial perks of having a Dubai-based company.

The Strategic Edge of a Dubai Offshore Company

The real appeal here goes way beyond the basics. For example, I’ve worked with e-commerce founders juggling suppliers and customers worldwide. By using a Dubai offshore company to centralise their international invoicing, they were able to dramatically simplify their finances and slash operational overheads, in some cases by as much as 20%.

Another common scenario is a real estate investor with properties scattered across different countries. Consolidating ownership under a single UAE offshore entity creates a powerful legal shield, protecting those valuable assets from potential liabilities or political instability in other regions.

The core advantages really boil down to these key points:

- Complete Foreign Ownership: You have full control. There's no requirement for a local partner or sponsor, which is a massive draw for foreign investors.

- Robust Asset Protection: Your assets are legally ring-fenced under the UAE’s stable and well-regarded legal framework. This keeps them safe from creditors or unexpected litigation.

- Enhanced Confidentiality: The names of company directors and shareholders are kept private and aren't listed on a public register, offering a high degree of privacy for your affairs.

- Simplified Compliance: Offshore companies typically have far less demanding reporting and auditing requirements compared to their mainland counterparts, which makes the admin side of things much more straightforward.

Here's the key takeaway: an offshore company isn't just a business structure; it's a strategic tool. It lets you build a secure, tax-efficient foundation for your international operations, all while benefiting from the prestige and stability of the UAE.

Leading Jurisdictions: JAFZA and RAK ICC

In the UAE, you have two main players for offshore registration: the Jebel Ali Free Zone Authority (JAFZA) and the Ras Al Khaimah International Corporate Centre (RAK ICC). Each has its own strengths.

JAFZA is often the top choice for its global reputation and, crucially, its ability to hold real estate in Dubai. RAK ICC, meanwhile, is known for being more cost-effective and having flexible regulations. Picking the right one is the first critical decision on your path to global expansion.

JAFZA vs. RAK ICC: Which Offshore Jurisdiction Is Right for You?

Choosing the right jurisdiction for your offshore company in the UAE isn't just a box-ticking exercise. It's one of the most critical decisions you'll make, with real, long-term consequences for your finances and operations.

The two heavyweights in this space are Jebel Ali Free Zone Authority (JAFZA) and Ras Al Khaimah International Corporate Centre (RAK ICC). Both offer fantastic frameworks, but they're built for very different types of businesses and budgets. Getting to grips with their unique strengths is the key to picking the right one for your goals—whether you're chasing prestige, cost-efficiency, or flexible asset protection.

JAFZA Offshore: The Gold Standard for Prestige and Property

Let's be clear: JAFZA is the premium, established choice. Its global reputation is rock-solid, earned over decades as a world-class hub for trade and logistics. If your business depends on brand perception and instant credibility, a JAFZA registration speaks volumes.

Think about it from a client's perspective. If you're running an international trading company dealing with multinational corporations, having "JAFZA" attached to your name can build trust and open doors much faster. That prestige isn't just vanity; it's a tangible business asset, and for many, it easily justifies the higher setup costs.

But the real game-changer for JAFZA is its unique ability to own freehold property in designated areas of Dubai. This is an exclusive feature you won't find elsewhere. For real estate investors, it allows for a secure, confidential structure to hold a property portfolio, protecting your assets while you tap into Dubai’s lucrative market. For a deeper dive into these benefits, you can find more on the advantages of a JAFZA offshore structure.

RAK ICC: The Smart Choice for Flexibility and Value

On the other side of the coin, we have RAK ICC. It has quickly built a stellar reputation for being incredibly cost-effective, modern, and flexible. For startups, consultants, digital businesses, or holding companies that don't need to own Dubai real estate, RAK ICC is often the more practical and economical option.

Let’s imagine you're a logistics consultant with clients across Asia and Europe. You don't need the physical port access or the "brand name" of JAFZA. What you do need is a simple, low-cost legal entity to handle international invoices and shield you from liability. RAK ICC is tailor-made for this scenario, offering a straightforward registration and much lower annual fees.

The decision often boils down to this: Go with JAFZA for its unmatched global reputation and the exclusive right to hold Dubai property. Opt for RAK ICC if you value affordability, flexibility, and a no-fuss approach to international business and asset holding.

The cost difference isn't trivial. A small logistics firm, for example, could save nearly AED 30,000 in setup and renewal fees over the first two years by choosing RAK ICC. That’s capital you can put straight back into growing your business.

A Head-to-Head Comparison of Costs

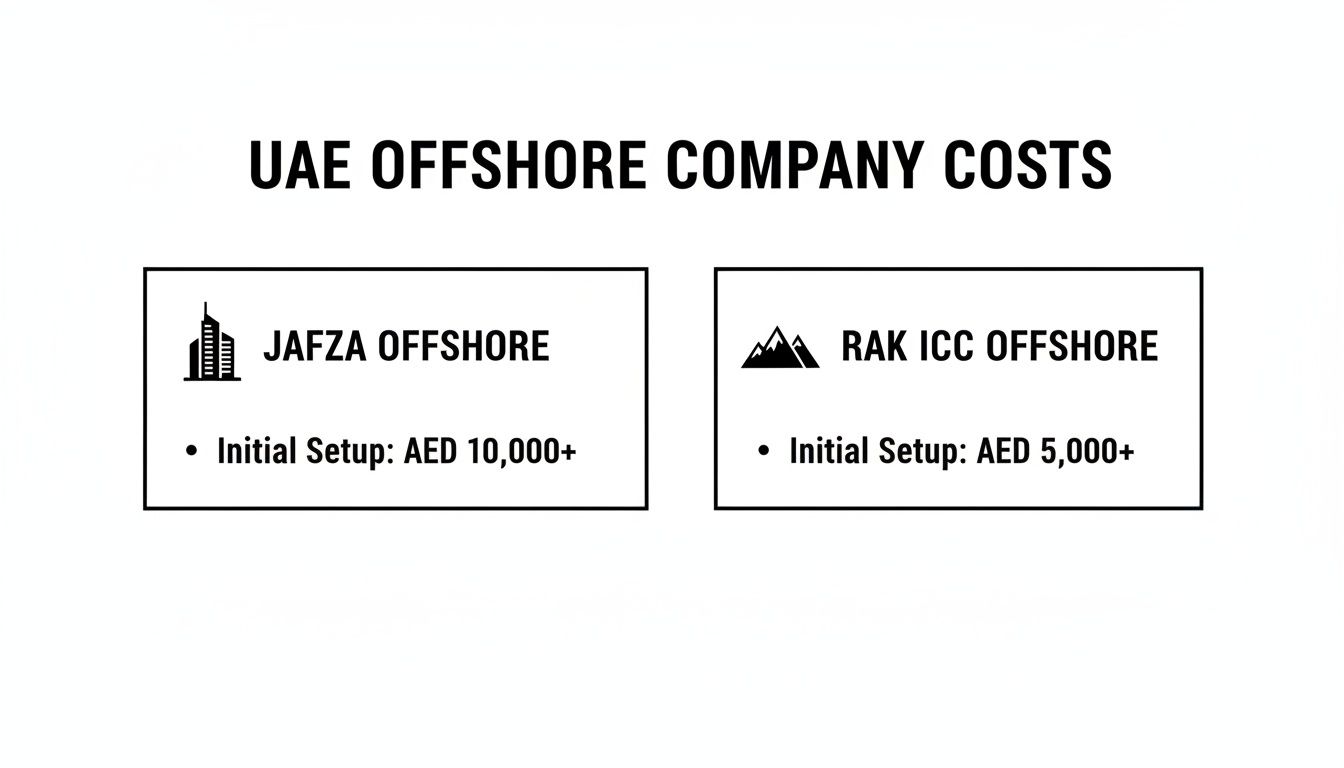

For most entrepreneurs, the financial breakdown is a make-or-break factor. The initial setup cost and ongoing fees vary significantly between the two, directly impacting your bottom line.

Generally, JAFZA offshore incorporation fees fall in the AED 10,000 to AED 15,000 range, whereas RAK ICC is more competitive, sitting between AED 5,000 and AED 8,000. The pattern continues with annual renewals: JAFZA costs AED 7,000 to AED 10,000, while RAK ICC is much lower at AED 4,000 to AED 6,000.

JAFZA vs RAK ICC: A Head-to-Head Comparison

To make the choice clearer, I've put together a simple table that breaks down the key differences between these two leading offshore jurisdictions. This should help you quickly see which one aligns better with your business model and priorities.

| Feature | JAFZA Offshore | RAK ICC Offshore |

|---|---|---|

| Primary Use Case | International trade, holding companies, and owning Dubai real estate. | Asset holding, international invoicing, consulting, and e-commerce. |

| Brand Prestige | Very high; globally recognised as a premium jurisdiction. | Strong and growing; known for efficiency and modernity. |

| Setup Cost | Higher, reflecting its premium status and benefits. | Lower, making it highly attractive for startups and SMEs. |

| Annual Renewal | Higher ongoing maintenance and renewal fees. | More affordable annual fees, reducing long-term costs. |

| Regulatory Framework | Well-established but can be perceived as more rigid. | Modern, common-law-based, and known for its flexibility. |

| Registered Agent | A JAFZA-approved registered agent is mandatory. | A RAK ICC-approved registered agent is mandatory. |

| Bank Account Opening | Excellent reputation with local and international banks. | Widely accepted by banks, with a straightforward process. |

Ultimately, there's no single "best" option. It's about finding the right fit. A trading house might find JAFZA’s reputation invaluable, while a digital nomad will love the lean efficiency of RAK ICC. Making the wrong choice can lead to wasted money or functional limitations down the road. By carefully thinking through your priorities—cost, prestige, and specific activities like property ownership—you can make a smart decision that sets you up for long-term success.

Getting Your Offshore Company Registration Right

Setting up an offshore company in Dubai isn't complicated, but it does demand precision. The process is a clear sequence of steps, but even small mistakes early on can cause surprisingly big—and expensive—delays. If you know what's coming, the whole thing shifts from a headache to a clear roadmap for building your international presence.

First up is choosing a compliant company name. This is more than a creative exercise; your name has to follow the strict rules of your chosen jurisdiction, whether that’s JAFZA or RAK ICC. You can't just throw in words like "Bank" or "Insurance" unless you have the licenses to back them up. And don't forget the legal suffix, like "Limited" or "Ltd."

A classic mistake I see entrepreneurs make is falling in love with a name before they’ve even checked if it's available. Pro tip: Use the online name search portals the jurisdictions provide, or better yet, have your registered agent check for you before you pay a single application fee. It's a simple step that saves both time and money.

Defining What Your Business Actually Does

With a name sorted, you need to spell out your company's business activities. This is far more critical than people often assume. The activities you list in your Memorandum of Association (MoA) are the legal boundaries of what your company is allowed to do. Vague terms like "general trading" will almost certainly get your application bounced.

You have to be specific. If you’re in e-commerce, a good description would be "international e-commerce trading of electronics and consumer goods." For consulting, something like "provision of international management consultancy services" works well. Getting this right ensures your application sails through and keeps the banks happy later.

Think of your business activities as the legal DNA of your company. Being precise from day one prevents future headaches with regulators and banks, making sure your operations run smoothly without any unwelcome interruptions.

Next is gathering your documents, and this requires a sharp eye for detail. The core requirements are pretty standard across the board.

- Certified Passport Copies: For every shareholder and director. This certification usually needs to come from a notary public or a lawyer.

- Proof of Residential Address: A recent utility bill or bank statement (usually less than three months old) for each shareholder and director will do the trick.

- Bank Reference Letter: Just a simple letter from your personal bank confirming you're in good standing.

- Curriculum Vitae (CV): A brief professional history for each shareholder.

Here’s an insider tip: if your home country requires it, get your documents pre-attested. Embassy backlogs are a notorious bottleneck, and having this sorted beforehand can easily shave weeks off your timeline.

Drafting the Key Corporate Paperwork

Once you have all your personal documents ready, your registered agent—that’s where a team like Smart Classic Business Hub comes in—will draft the foundational legal documents: the Memorandum of Association (MoA) and the Articles of Association (AoA). The MoA details the company’s purpose and powers, while the AoA lays down the internal rulebook for how it's managed, like director duties and shareholder rights.

You’ll review and sign these, and then they get submitted through the jurisdiction's online portal. Both JAFZA and RAK ICC have poured a lot of resources into their digital systems, which has made the whole process much, much faster.

The graphic below gives you a quick look at the typical starting costs for setting up in either JAFZA or RAK ICC.

As you can see, RAK ICC is the more budget-friendly starting point. JAFZA's higher price tag reflects its premium status and exclusive perks, like the ability to own property.

What used to be a 2-week (or much longer) process has been seriously cut down by these digital upgrades. A standard company registration now typically takes up to 5 business days, assuming all your documents are in order. Express options can get it done even faster. To dive deeper, check out the latest company formation trends in Dubai. For instance, we recently handled a full RAK ICC setup for an IT consultant in just five working days flat because he had every document prepared and certified correctly in advance. This kind of speed is the new normal, making offshore registration more accessible than it’s ever been.

Managing Compliance and Banking Requirements

Getting your offshore company registered is a huge step, but let's be clear: that’s where the real work begins. Now you have to keep the company in good standing, which means staying on top of ongoing compliance, managing your finances smartly, and figuring out the world of corporate banking.

Maintaining your company’s legal status isn't optional. There are a few key things you need to handle every year to keep your entity active and compliant with the jurisdiction’s rules. If you let these slip, you could be looking at fines, losing your good standing, or even having your company dissolved.

The core obligations are pretty straightforward, but you have to be diligent. You’ll need to handle your annual licence renewal on time, pay the registered agent fees, and make sure you have a valid registered office address in the UAE. These are the absolute basics that keep your offshore company legitimate.

The New Corporate Tax Landscape

One of the biggest recent shifts in the UAE's business world is the introduction of corporate tax. For years, offshore companies enjoyed a completely tax-free environment, but the new rules mean you have to pay much closer attention to your finances.

As of June 2023, a 9% corporate tax rate is now the standard for most businesses here. This was a major change from the UAE's traditional zero-tax model, and it brought a whole new set of compliance duties. Businesses now have to keep perfect financial records and stick to strict filing deadlines. You can find more details in the UAE Investment Climate Statement on state.gov.

The good news? Not all offshore income gets hit with this tax. Passive income streams like royalties, dividends, and interest are often exempt, which preserves some of the classic tax benefits of an offshore setup. The trick is to have crystal-clear financial records that can prove exactly where your income is coming from.

Your financial records are your first line of defence. In this new tax era, organised and transparent bookkeeping isn't just good practice—it's an absolute necessity for demonstrating compliance and protecting your company’s tax-exempt status where applicable.

Opening Your Corporate Bank Account

Think of your corporate bank account as the engine of your offshore company. It’s what allows you to handle international transactions smoothly. But honestly, getting one opened can be the toughest part of this whole process. UAE banks are incredibly strict about compliance, and their Know Your Customer (KYC) procedures are no joke.

You have to go in prepared. Banks will want to know everything about your business model, where your funds are coming from, and who every single shareholder is. If you can't give them clear, concise answers and the right documents, your application will almost certainly be rejected.

Here’s what you’ll usually need to get ready:

- A Solid Business Plan: Don't just throw something together. It needs to clearly explain your business model, target markets, and how you expect to make money.

- Proof of Funds: You need to show where your initial capital came from.

- Shareholder and Director Profiles: Professional CVs and background info for everyone in a key role.

- Reference Letters: A letter from your personal bank or existing business bank confirming you're a client in good standing.

Some entrepreneurs try to stick with global banks that have a branch in the UAE, thinking the big name will make things easier. Others find that local UAE banks are sometimes more flexible with offshore structures, especially if you can present a really clear business case.

Ultimately, the best bank for you depends on what your business does and its risk profile. For anyone running into roadblocks, it might be worth looking into a non-resident bank account in Dubai as an alternative way to get your company’s finances up and running.

Staying on top of these requirements takes a proactive and meticulous approach. From keeping up with tax laws to putting together a perfect bank application, managing your company after registration is what turns it from a legal document into a powerful global business tool. Working with a knowledgeable partner like Smart Classic Business Hub can take the guesswork out of it, ensuring your operations stay smooth and compliant right from the start.

Sidestepping Common Offshore Registration Pitfalls

Setting up an offshore company in Dubai is usually a smooth ride, but even the most seasoned entrepreneurs can hit a few common bumps in the road. We're not talking about complicated legal mazes here. More often than not, it's the simple oversights that cause frustrating delays, surprise costs, and a lot of backtracking.

Getting these details right from the very beginning is really the secret to a fast and painless setup.

Mismatching Your Jurisdiction and Your Goals

One of the most frequent mistakes we see is a basic mismatch between the jurisdiction chosen and what the company actually needs to do. For example, an entrepreneur might get drawn to RAK ICC because it’s budget-friendly, only to find out later they need to own property in Dubai. That’s a privilege only a JAFZA offshore company can have.

This kind of misalignment means you have to scrap everything and start over, which is a painful waste of both time and money.

Another classic trap is underestimating the total cost of ownership. It's easy to focus on the one-time registration fee and completely forget about the mandatory costs that keep your company running and compliant year after year.

Don’t forget to budget for these ongoing expenses:

- Annual Licence Renewals: This is a recurring fee that’s essential to keep your company in good legal standing.

- Registered Agent Fees: You are required to have an approved agent, and their services come with an annual price tag.

- Registered Office Address: Your offshore company needs a physical registered address, which also carries an annual fee.

Ignoring these costs can put a real strain on your finances and jeopardise your company's compliance. The simple fix? Work with your consultant to create a complete fee checklist before you even start.

The Devil Is in the Documentation

Submitting documents without the correct attestation is a massive roadblock. Every country has its own specific rules for legalising paperwork for use in the UAE. You can't just provide a notarised copy of your passport or proof of address and call it a day. In most cases, it will need to be attested by your home country's foreign affairs ministry and then stamped again by the UAE embassy.

This is exactly where applications get stuck for weeks, sometimes even months.

We had a client, a tech founder from South America, whose application was kicked back twice simply because his documents were missing the right consular stamps. Once we walked him through the correct attestation process, his registration sailed through in a matter of days. The lesson here is crystal clear: double-check the exact attestation requirements for your country of origin before submitting a single document.

Getting Specific About Business Activities

Defining your business activities has to be done with precision. Vague descriptions like "consulting" or "general trading" are immediate red flags for registrars and banks. Your Memorandum of Association needs to spell out the specific nature of your business—think "international IT project management consultancy" or "global trade of consumer electronics."

A real-world case involved a software developer whose application was held up because he listed his activity as just "tech services." The registrar needed more detail. Was he involved in financial technology, data analysis, or software sales? Each of those falls into a different compliance bucket.

A critical point that's often missed is the strict ban on onshore trade. An offshore company is built for international business; it cannot legally do commercial business inside the UAE mainland. Trying to send an invoice to a local Dubai client or rent an office for daily operations is a direct violation of the law.

Understanding this limitation from day one is fundamental. Your offshore company is a powerful tool for global trade, holding assets, and international invoicing—it is not a vehicle for breaking into the local UAE market. Clarifying this at the start will save you from serious legal and operational headaches later on.

By navigating around these common mistakes, your offshore company registration Dubai process will be quicker, more efficient, and free of any costly surprises.

Frequently Asked Questions

When you're getting serious about setting up an offshore company, a few key questions always come up. Here are the straight-up answers to the queries we hear most often from entrepreneurs just like you.

Can My Offshore Company Own Dubai Real Estate?

Yes, absolutely. This is one of the biggest draws for international investors, but the key is choosing the right jurisdiction.

A JAFZA offshore company, for example, is specifically permitted to own freehold properties in designated areas across Dubai. This makes it a fantastic vehicle for holding real estate assets under a secure corporate umbrella.

Companies registered with RAK ICC can also hold property. That said, it's always smart to double-check the latest regulations with the Dubai Land Department and your registered agent before you sign on the dotted line for any purchase.

Do I Need to Visit Dubai for the Registration?

Nope. One of the best things about setting up an offshore company is that you don't need to be physically present in the UAE. The entire registration process can be handled remotely through a registered agent like us.

All the essential paperwork, from passport copies to the signed Memorandum of Association, can be submitted electronically once they’ve been properly attested in your home country. This makes it incredibly convenient for global investors who can’t easily travel.

What Separates an Offshore from a Free Zone Company?

The core difference boils down to their scope of operations.

A free zone company is set up to operate within the UAE, specifically from its designated economic zone. It can trade with other businesses in free zones, engage in international trade, and—this is a big one—apply for residency visas for its staff.

An offshore company, on the other hand, is a non-resident entity. It’s built for international business, protecting assets, and optimising tax. Crucially, it cannot trade within the UAE domestic market or apply for employee visas. This reinforces its purpose as a tool for global, not local, business.

Here's the simplest way to look at it: a free zone company gives you a physical base to operate from in the UAE. An offshore company gives you a legal and financial foothold for international activities, without needing to be here at all.

Are Annual Audits Mandatory for My Offshore Company?

This is where things get a bit nuanced. By law, every offshore company must keep accurate financial records. However, the requirement to submit a formal, audited report can vary.

JAFZA, for instance, might ask to see audited financials when you renew your licence. RAK ICC has historically been more flexible on this requirement.

But here’s the real takeaway: with the UAE's new Corporate Tax regime now in place, maintaining audited financials has become a best practice for all business entities, no matter the specific rules of their jurisdiction. It ensures you're transparent and always ready for any tax compliance checks. As you manage your finances, it's also worth understanding the broader tax landscape; our guide explains how to register for VAT in the UAE, which can provide helpful context.

Getting the details right on offshore registration, compliance, and banking is what we live and breathe. The team at Smart Classic Business Hub offers expert, hands-on guidance to make sure your setup is seamless, compliant, and perfectly aligned with your international goals. Contact us today to get started.