Forming an LLC in Dubai is the most direct and powerful way for international entrepreneurs to operate within the UAE's vibrant mainland economy. It's your ticket to full market access and operational freedom, especially since the game-changing decision to allow 100% foreign ownership for most business activities. This structure isn't just a legal formality; it's the key to unlocking the full potential of the Emirates.

Why a Dubai LLC is Your Smartest Move in the UAE

Choosing to set up a business in Dubai is a big step, but picking the right legal structure is what truly sets the foundation for your success. A Limited Liability Company (LLC) on the mainland isn't just one of many options anymore—it has become the top choice for founders who want to trade directly within the local market. This is about more than just paperwork; it’s about positioning your company for maximum growth right from day one.

The biggest advantage of a Dubai LLC is the freedom it gives you. Unlike free zone companies, which are often confined to their specific jurisdiction or international trade, a mainland LLC lets you:

- Trade directly with any customer or business across all seven Emirates.

- Bid on lucrative government contracts and get involved in public sector projects.

- Set up a physical shop, office, or showroom anywhere you want in Dubai.

The Impact of 100% Foreign Ownership

Recent legal reforms have completely changed the business landscape here. Between 2019 and 2024, the UAE moved away from the old model that required a 51% Emirati partner for most mainland companies. Now, you can have 100% foreign ownership in the majority of sectors.

This single change has made the Dubai LLC incredibly attractive for everyone from solo founders to multinational corporations. It means you can keep full control over your business, its profits, and its strategy without needing a local majority shareholder.

This shift, combined with pro-business policies that saw Dubai’s GDP grow by around 4% in Q1 2025, has turned the LLC from a locally-focused entity into a flexible, globally-owned company. For a deeper look at all the advantages, check out our detailed article on the top benefits of setting up a business in Dubai.

An LLC structure provides more than just liability protection; it offers a license to fully engage with one of the world's most dynamic economies. It’s the difference between observing the market and actively shaping it.

Ultimately, choosing an LLC on the Dubai mainland is a strategic decision that aligns your business with the UAE’s long-term economic vision. It removes old barriers and gives you a clear, direct path to building a sustainable and profitable company. The choices you make now, starting with your company structure, will define your ability to seize the massive opportunities ahead.

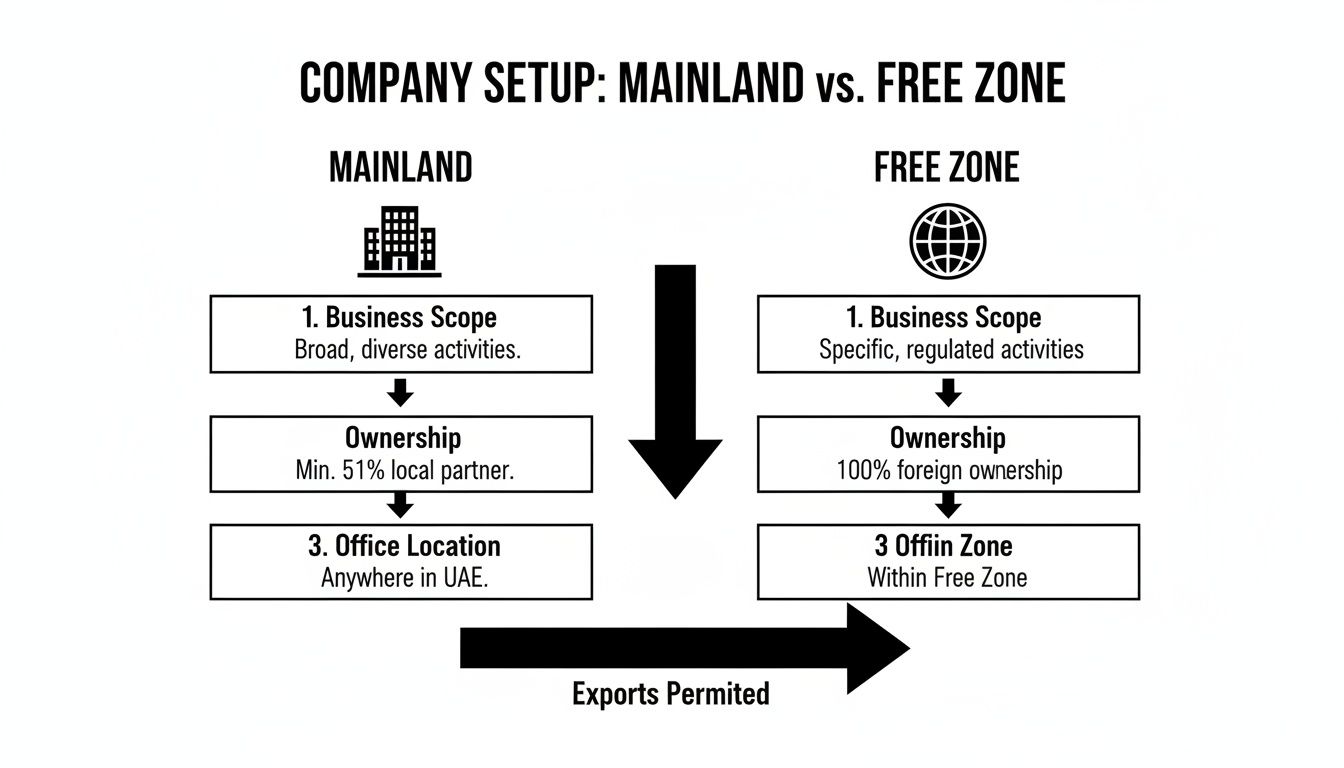

Choosing Your Path: Mainland vs. Free Zone

When you’re setting up an LLC in Dubai, this is probably the single biggest decision you'll make right out of the gate. It's not just about picking a location; it fundamentally dictates who you can do business with, how you can operate, and the ultimate growth potential of your company.

There's no simple, one-size-fits-all answer here. The right choice boils down entirely to your business model and, more importantly, where your customers are.

Think of it like this: if your dream is to open a trendy boutique in Dubai Mall or become the go-to catering service for local hotels, then a mainland LLC isn't just an option—it's a necessity. You need that unrestricted pass to the entire UAE market to trade freely, sign contracts, and have a physical presence anywhere in the Emirates.

On the other hand, let's say you're a tech consultant with clients scattered across Europe and Asia, and you're just using Dubai as your strategic base. In that case, a free zone company is likely a much better fit. These are specialized economic hubs built for international trade, packed with perks like 100% profit repatriation and often a much quicker setup process for specific industries.

The Core Trade-Off: Market Access vs. Operational Simplicity

The real difference comes down to your target audience. A mainland company hands you the keys to the entire UAE economy. You can bid on government projects and work with any client across all seven Emirates, no questions asked. This is the path for any business that needs to be deeply woven into the local commercial fabric.

A free zone company, while fantastic for international operations, generally keeps your direct business activities within its own borders or outside the UAE. If you want to tap into the mainland market from a free zone, you'll typically need to go through a local distributor or agent, which adds another layer of complexity and cost.

It’s a purely strategic decision. Just ask yourself one simple question: "Where are my customers?" If the answer is "inside the UAE," a mainland LLC is almost always the right move. If they are mostly outside the UAE, a free zone brings some very compelling advantages to the table.

Mainland LLC vs. Free Zone Company: A Head-to-Head Comparison

To really get to the heart of the matter, let's put the two options side-by-side. Each jurisdiction has its own distinct rules, benefits, and limitations that will shape your daily operations and long-term strategy.

| Feature | Mainland LLC | Free Zone Company |

|---|---|---|

| Market Access | Unrestricted trade across the entire UAE. | Limited to the specific free zone and international markets. |

| Office Requirement | Mandatory physical office with an Ejari (registered lease). | Flexible options, including flexi-desks and virtual offices. |

| Ownership | Up to 100% foreign ownership for most business activities. | 100% foreign ownership is standard. |

| Regulatory Body | Governed by the Department of Economy and Tourism (DET). | Governed by the specific free zone authority (e.g., DMCC, DAFZ). |

| Visa Quotas | Generally determined by the size of your physical office space. | Often linked to the license package or office type you choose. |

Seeing the differences laid out like this makes it clearer how your choice will impact everything from your overheads to your market reach.

Dispelling a Common Myth

There's a common misconception floating around about ownership. While it's true that 100% foreign ownership is now the standard for most mainland LLC activities, it isn't a universal rule.

For certain professional services, like a consultancy, you might still need to appoint a Local Service Agent (LSA). An LSA is an Emirati national who acts as your official representative for government paperwork but holds zero shares in your company. It’s a crucial distinction, and one that many new entrepreneurs miss.

Ultimately, this choice sets the entire foundation for your business. To dive even deeper, check out our comprehensive guide comparing mainland vs free zone company setup in Dubai to make sure your decision perfectly aligns with your vision.

Your Dubai LLC Formation Playbook

Setting up an LLC in Dubai can feel like a maze of paperwork and procedures. But when you know the path, it’s just a series of straightforward, manageable steps. Think of this as your practical roadmap, turning what seems like bureaucratic hurdles into a simple checklist. Let's walk through exactly how you bring your company to life, from picking a name to holding that final trade licence.

The entire journey is about taking one logical step after another. Each one builds on the last, and getting them right from the get-go saves a ton of time and frustration down the line.

Secure Your Trade Name and Initial Approval

First things first: your business needs a name. In Dubai, this isn't just about branding; it’s a legal requirement that needs approval and reservation from the Department of Economy and Tourism (DET). The name has to follow specific rules—it can't be offensive, go against public morals, or be a trademark someone else already owns.

Here’s a pro tip I always give clients: check the DET’s online portal for name availability before you get too attached to one. This simple search can save you the headache of a rejection. It’s always best to have at least three options ready to go, just in case.

Once your name is reserved, the next move is to get the Initial Approval. This is basically a preliminary green light from the authorities, confirming they have no objection to you setting up your business. It's a critical milestone that unlocks the rest of the process.

The visual below breaks down the key differences between the two main jurisdictions—Mainland and Free Zone—which is a decision you'd have made by this point. This choice influences every step that follows.

As you can see, the path you choose really dictates your market access and how you can operate. The mainland route offers that unrestricted access to the entire UAE economy.

Draft and Notarise Your Memorandum of Association

With your Initial Approval in hand, it's time to draft your company's most important legal document: the Memorandum of Association (MOA). Think of this as the constitution for your LLC. It spells out all the critical details about your company’s structure and how it will run.

Your MOA needs to include a few key things:

- Shareholding Structure: This clearly states the ownership percentage for each partner. Even with 100% foreign ownership now possible, this has to be formally documented.

- Management Authority: It specifies who has the power to run the company day-to-day.

- Business Activities: This is a list of the exact activities your business is licensed to do.

- Profit and Loss Distribution: It details how the financials will be shared among partners.

The MOA must be drafted in both English and Arabic, and then it needs to be notarised by a public notary here in the UAE. This step makes the document legally binding and is an absolute must before you can move on. For a closer look at these legal requirements, our guide on mainland company setup in Dubai goes into much more detail.

Secure Your Physical Office Space

One of the non-negotiables for a mainland LLC in Dubai is a physical office address. You can't use a virtual office for a mainland trade licence; it has to be a real, tangible location. You'll need to provide proof in the form of a registered tenancy contract, known as an Ejari.

Ejari is the government's official system for registering all lease contracts in Dubai. To get one, you need to sign a tenancy agreement for a commercial property. Now, this doesn't mean you have to rent a huge, expensive office right away. Many new businesses start with a cost-effective flexi-desk or a small serviced office in a business centre. These options satisfy the legal requirement while keeping your overheads down.

Don’t forget, the size of your office isn't just about workspace. It directly affects the number of employee visas your company can apply for. The general rule of thumb is you need about 100 sq. ft. of office space per visa.

Select the Right Business Licence

The final major step is picking the correct business licence for your LLC. The type of licence you need depends entirely on the activities you plan to carry out. The DET groups thousands of activities under three main licence categories.

-

Commercial Licence: You'll need this for any business involved in trading, buying, or selling goods. A classic example is a company importing electronics to sell in the local market.

-

Professional Licence: This is for service-based businesses or professionals who rely on their intellectual or artistic skills. Think management consultants, marketing agencies, or IT service providers.

-

Industrial Licence: This licence is mandatory for any business involved in manufacturing, production, or industrial processing. A company that assembles furniture or packages food products would fall under this category.

Choosing the right activities and licence is absolutely crucial. Listing the wrong activity can lead to fines or leave you unable to legally do what your business was set up for. Once you've made your choice, you'll submit all your documents—the Initial Approval, notarised MOA, and Ejari—to the DET and pay the final government fees. After that, your trade licence will be issued, and you're officially in business.

Getting Real About the Costs and Timeline for Your Dubai LLC

So, you're ready to set up your Dubai LLC. Fantastic. But let's get down to brass tacks. Two questions are probably running through your mind right now: "How much is this really going to cost?" and "How long until I'm actually in business?"

Getting clear, straight-up answers to these is the difference between a smooth launch and a series of frustrating surprises. Think of it this way: your budget and timeline are the foundation of your entire setup plan. Let's map them out so you know exactly what to expect.

The final price tag isn't just one number. It’s a mix of fixed government fees and other costs that shift depending on your specific business needs. Understanding these moving parts is key to building a financial plan that doesn't fall apart.

Breaking Down the Core Setup Costs

Your initial investment is made up of several key pieces. Some are standard, non-negotiable government fees, while others depend on the choices you make. It's crucial to separate the one-time setup charges from the recurring annual costs that will become part of your operational budget.

Here’s a look at the primary costs you'll encounter right out of the gate:

- Initial Approval & Trade Name Reservation: These are the first small hurdles. Think of them as the fees to get your foot in the door. Expect to pay somewhere between AED 1,000 and AED 2,500.

- Memorandum of Association (MOA) Notarisation: This is your company's foundational legal document. Getting it officially notarised is a mandatory step, typically costing around AED 1,500 to AED 3,000.

- Trade Licence Fees: This is the big one. It's the most significant government fee and varies wildly depending on your business activity. The range is broad, from AED 6,000 to over AED 15,000.

- Market Fees: A straightforward fee paid to the Dubai Municipality, calculated as 5% of your annual office rent.

- Chamber of Commerce Fees: A standard charge of around AED 1,200 is required for your official registration with the Dubai Chamber.

For a basic mainland LLC in Dubai, a realistic starting budget typically lands between AED 25,000 and AED 40,000. This covers the essential one-time government fees. Just remember, this figure doesn't include variable costs like your office rent, visa processing, or any professional setup support you might need.

Don't Forget the Variable and Ongoing Expenses

Once you've cleared the initial government payments, a few other significant costs come into play. These are the expenses where you have more control, and they are absolutely critical for your long-term financial planning.

Office Rent: A physical office space with a registered Ejari (tenancy contract) is non-negotiable for a mainland LLC. You could go for a cost-effective flexi-desk in a business centre, which might start around AED 15,000 a year. Or, you could lease a dedicated office, which will obviously cost more. Your choice here directly impacts your Market Fees and how many visas your company is eligible for.

Visa Processing: Every residency visa has its price tag, whether it's for you as the investor or for your future employees. The costs cover the entry permit, medical test, Emirates ID application, and the final visa stamping. It's wise to budget approximately AED 5,000 to AED 7,000 for each visa.

Consultancy Fees: Working with a business setup consultant like Smart Classic Business Hub comes with a professional fee. But honestly, this is often where you save money in the long run. A good consultant helps you sidestep expensive mistakes and frustrating delays. Fees will vary based on how complex your setup is.

How Long Does It All Take? A Realistic Timeline

Just as crucial as your financial budget is your time budget. The good news? Setting up an LLC in Dubai is often much faster than people think—if you have all your paperwork in order. Nearly every delay I've ever seen comes down to incomplete or incorrect documents.

Here’s a realistic timeline for the whole process, from start to finish:

- Company Licensing (1–2 weeks): This phase is all about the paperwork—name reservation, initial approval, and finally, getting that trade licence in your hands. If everything is correct and submitted properly, this stage can move very quickly.

- Establishment Card (1 week): As soon as your licence is issued, your company needs an Establishment Card from the immigration authorities. You can't apply for any visas without it, so it's the critical next step.

- Investor Visa Process (2–3 weeks): This is the final leg. It involves applying for your entry permit, getting your in-country medical fitness test and Emirates ID biometrics done, and finally, the residency visa stamp in your passport.

All in all, you should plan for a total timeline of 4 to 6 weeks from the day you start your application to the day you’re holding your stamped investor visa. Knowing this sequence helps you manage your own expectations and plan your move to Dubai with a lot more confidence.

Staying Compliant After You Launch

Getting your trade licence is a massive milestone, but it’s the starting line, not the finish. The real work of running a successful LLC in Dubai is about what comes next: staying on top of your ongoing legal and financial duties. If you treat compliance like a core business function from day one, you’ll avoid fines and stay focused on growth.

It's easy to get caught up in the excitement of launching and let these crucial recurring tasks slide. But in the UAE's highly regulated environment, ignorance is never an excuse. Let's break down the essential duties that will keep your business in good standing.

Understanding Your Tax Obligations

The introduction of UAE Corporate Tax was a major shift. Your LLC must register with the Federal Tax Authority (FTA) and get ready to file an annual tax return. The current rate is 9% on any taxable income that exceeds AED 375,000.

Then there's Value Added Tax (VAT). You need to assess if your company's annual turnover is likely to go over AED 375,000. If it is, VAT registration becomes mandatory. This means you'll be charging a 5% tax on your goods and services and submitting regular VAT returns to the FTA.

Proper bookkeeping isn't just good practice anymore; it's a legal requirement. You have to maintain accurate financial records that comply with International Financial Reporting Standards (IFRS). These records are the foundation for both your tax filings and your annual audits.

The Annual Licence Renewal Process

Your Dubai trade licence isn't a one-time purchase. You have to renew it every single year. Miss the deadline, and you could be looking at hefty fines and even having your company’s bank account frozen.

The renewal process involves a few key steps:

- Renewing Your Tenancy Contract (Ejari): Before anything else, your physical office lease must be valid for the upcoming year.

- Submitting the Renewal Application: This is usually done through the Department of Economy and Tourism (DET) portal.

- Paying Renewal Fees: You'll get a payment voucher that covers the licence and other government fees.

Failing to renew on time can also block you from sponsoring new employee visas or renewing existing ones, which can grind your operations to a halt.

Think of your annual licence renewal as a health check-up for your company. It’s an opportunity to ensure all your foundational documents, from your lease to your corporate approvals, are up to date and in perfect order.

Essential Corporate Governance Rules

Beyond taxes and renewals, your LLC in Dubai has to stick to specific governance standards for transparency and accountability. One of the most critical is maintaining a register of your Ultimate Beneficial Owners (UBO).

The UBO register clearly identifies the individuals who ultimately own or control the company. You must keep this information accurate and submit it to the relevant authorities to comply with anti-money laundering regulations.

This whole ecosystem of compliance is what underpins such a thriving market. It's no surprise that the LLC is the dominant business structure in Dubai's mainland economy. This dense corporate landscape—with thousands of new companies forming every year, from family firms to foreign startups—is what drives the demand for professional accounting, PRO services, and tax compliance. It’s an environment where expert support becomes invaluable for navigating the complex web of regulations. You can explore more about these market dynamics and trends in the UAE.

Managing these ongoing tasks might seem daunting at first, but it's just part of doing business here. By setting up systems and calendars for renewals, tax filings, and corporate record-keeping, you can turn compliance into a simple routine. That leaves you free to focus on what really matters—growing your business in this incredible city.

Answering Your Top Questions About Dubai LLCs

Stepping into a market as exciting as Dubai always sparks a lot of questions. It's only natural. We've been in this business for a long time, and we've heard them all. So, we’ve put together some straightforward answers to the most common queries we get from entrepreneurs who are exactly where you are right now. Let's clear things up so you can move forward.

Can I Really Own 100% of My Mainland LLC in Dubai?

Yes, you absolutely can. For the vast majority of business activities, 100% foreign ownership of a mainland LLC in Dubai is the new norm. Thanks to major legal changes, the old rule requiring a 51% Emirati partner has been scrapped for over a thousand commercial and industrial activities. This has completely opened the doors for foreign investors to have full control.

But—and this is an important "but"—it's not a blanket rule for every single profession. A handful of strategic sectors and certain professional service licences still have their own specific ownership rules. Some might require you to appoint a Local Service Agent (LSA). An LSA is an Emirati national who acts as your official liaison for government paperwork but holds zero shares and has no say in your business operations.

The key takeaway? Always verify your specific business activity with the Department of Economy and Tourism (DET) to get a final confirmation that you qualify for full ownership.

What’s a Realistic Minimum Cost to Start an LLC in Dubai?

Let's talk numbers. While every setup is different, a realistic starting budget for a basic mainland LLC usually lands somewhere between AED 25,000 and AED 40,000. This figure covers your essential, one-time government setup fees, which make up the bulk of your initial investment.

This initial budget typically includes the big-ticket items like:

- The trade licence fee itself

- Initial government approval fees

- Notarisation of your Memorandum of Association (MOA)

It's really important to see this as your starting point. This estimate doesn’t include recurring costs like your mandatory annual office rent, the fees for your investor visa (and any employee visas), or any professional setup fees if you hire a firm to help. The final bill depends on your specific activity, how many visas you need, and your office choice. That’s why getting a detailed, itemised quote is the smartest first step.

How Long Does the Whole LLC and Visa Process Take?

It’s probably faster than you think, as long as your paperwork is in order. We often see the LLC trade licence issued in just 1 to 2 weeks. Honestly, any delays at this stage are almost always down to missing or incorrect documents.

Once your licence is in hand, the investor visa process kicks off. This next phase, which includes your medical test and Emirates ID biometrics, usually takes another 2 to 3 weeks. So, a safe and realistic timeline for the whole journey—from submitting your application to getting the residency visa stamped in your passport—is about 4 to 6 weeks. Organisation is your best friend here.

Do I Absolutely Need a Physical Office for a Mainland LLC?

Yes, a physical office address is a non-negotiable for a mainland LLC in Dubai. The government requires you to provide a registered tenancy contract, known as an Ejari, to finalise your licence application. You can't use a virtual office for this.

However, "physical office" doesn't have to mean a big, empty room with a hefty price tag. Many new businesses cleverly satisfy this requirement by starting with much more flexible and affordable solutions that still provide a valid Ejari.

Think about options like:

- Flexi-desks: Your own dedicated desk in a buzzing co-working space.

- Serviced offices: A small, private office in a business centre where everything is managed for you.

These solutions give you a legitimate, professional address and tick all the legal boxes without the financial strain of a traditional lease. It’s the perfect way to start lean and scale up your space as your business and team grow.

Getting these answers is the first step, but having an expert partner makes the whole process feel effortless. The team at Smart Classic Business Hub specialises in taking these complex requirements and building a clear, simple plan to get your Dubai LLC off the ground and set up for success. https://smartclassic.ae