Kicking off the company registration process in the UAE is your first real step into one of the world's most exciting business hubs. At its core, the process is about making a few key decisions upfront: picking the right jurisdiction (mainland, free zone, or offshore), clearly defining your business activities to secure the correct trade license, and getting all your legal documents submitted and approved.

These initial choices lay the entire foundation for how your business will operate, grow, and succeed here.

Your UAE Company Registration Roadmap

Setting up a business in the United Arab Emirates is more than just a good idea; it's a strategic move into a pro-business environment that the government has intentionally cultivated to attract global entrepreneurs. This isn't just talk. The results speak for themselves.

The UAE has consistently been ranked first globally in the Global Entrepreneurship Monitor (GEM) report, holding the top spot for four consecutive years. This reflects just how ideal the conditions are for launching a new venture.

Navigating the Core Decisions

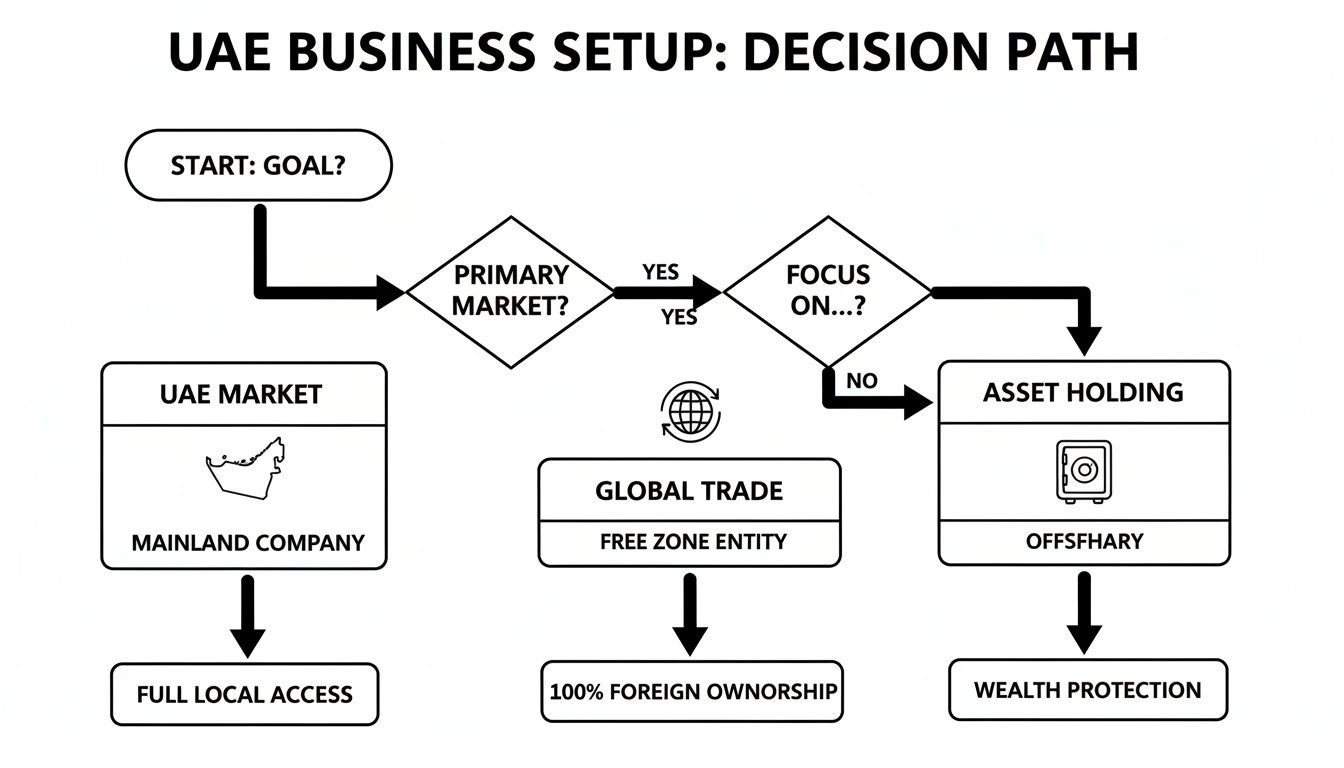

Before you get bogged down in paperwork, your first and most critical decision is choosing a business jurisdiction. This one choice will fundamentally shape your company's future, impacting everything from your market access and ownership structure to your tax obligations.

Here are your main options:

- Mainland Setup: This is for businesses that want to trade directly within the local UAE market and with government entities, without any restrictions.

- Free Zone Setup: Perfect for international trade. Free zones offer 100% foreign ownership, tax exemptions, and simplified setup processes within specific economic areas.

- Offshore Setup: This is a vehicle primarily for asset protection, international investing, and holding property. It doesn't allow for direct trade within the UAE market.

Once you've settled on a jurisdiction, the next step is to precisely define what your business will do. This is crucial because your list of activities determines which trade license you'll need—Commercial, Professional, or Industrial. Getting this right from day one saves you from major compliance headaches down the road.

The success of your UAE company registration hinges on aligning your jurisdiction and license with your long-term business goals. A mismatch here can create unnecessary operational hurdles and limit your growth potential.

Finally, it's time to gather and submit your documents to the right authority—like the Department of Economy and Tourism (DET) for mainland companies or the specific free zone's administration. This usually involves passport copies, a solid business plan, and various application forms. While the process itself is quite logical, each step comes with its own costs and timelines.

For a detailed financial breakdown, you might find our guide on the cost of starting a business in Dubai particularly helpful. Following this roadmap ensures you can approach each phase with clarity and confidence.

UAE Company Registration At a Glance

To help you visualise the journey, here’s a quick overview of the key phases and decisions you'll be making. Think of it as your cheat sheet for the entire process.

| Phase | Key Decision or Action | Primary Consideration |

|---|---|---|

| 1. Planning & Strategy | Choose Your Jurisdiction | Do you need to trade locally (Mainland) or internationally (Free Zone)? |

| 2. Foundation | Define Business Activities | What specific services or products will you offer? This dictates your license type. |

| 3. Legal Structure | Select Company Name & Structure | Is it an LLC, Sole Establishment, or another entity? Does the name meet UAE standards? |

| 4. Documentation | Gather & Submit Paperwork | Do you have all shareholder documents, the business plan, and application forms ready? |

| 5. Approvals | Obtain Initial & Final Approval | Secure permissions from the relevant economic department or free zone authority. |

| 6. Licensing | Pay Fees & Receive License | Once approved, pay the government fees to have your official trade license issued. |

| 7. Post-Setup | Open Bank Account & Process Visas | With your license in hand, you can establish corporate banking and sponsor residency visas. |

This table simplifies what can feel like a complex process, breaking it down into manageable stages. Each step builds on the last, leading you from idea to a fully operational, legally compliant company in the UAE.

Choosing Your Jurisdiction: Mainland vs. Free Zone

Right out of the gate, you'll face the single most important decision in your UAE business journey: choosing between a mainland and a free zone setup. This isn't just a matter of paperwork or different fees; it fundamentally defines who you can do business with, how your company is owned, and the very scope of your operations.

The whole thing really boils down to one simple question: Where are your customers?

If you plan to serve the local UAE market directly—think opening a café in Jumeirah, a retail shop in the Dubai Mall, or a consultancy that deals with local businesses—then a mainland company is your only real path. It gives you the freedom to trade anywhere in the UAE, from Abu Dhabi to Fujairah, without any restrictions.

On the other hand, if your business is geared towards international clients, e-commerce, or global trade, a free zone is probably a better fit. These are special economic zones built to attract foreign investment. The perks are significant: 100% foreign ownership, zero corporate tax (in most cases), and a much simpler registration process.

This quick decision tree can help you visualise the right path based on what you want to achieve.

As you can see, your target market is the starting point. It's the critical first domino that determines whether a mainland, free zone, or offshore setup will work best for your goals.

Understanding the Mainland Advantage

A mainland company, licensed by the Department of Economy and Tourism (DET) in Dubai or a similar body in another emirate, is the classic business setup. It offers ultimate flexibility to operate within the local economy, bid on lucrative government contracts, and set up your physical office or shop anywhere you like.

Now, you might have heard about the old rule requiring a UAE national to hold 51% of the shares. That was a huge consideration for years, but thankfully, things have changed. Major legal reforms now allow for 100% foreign ownership across a huge list of commercial and industrial activities, completely removing that old barrier for most entrepreneurs.

The impact was immediate and massive. After these changes, the number of registered businesses in the UAE exploded from around 400,000 to over 1.3 million in just five years.

A mainland setup is the perfect choice for:

- Retail Businesses: Cafes, boutiques, and showrooms that need a street-front presence.

- Professional Services: Law firms, accounting practices, and local consultancies.

- Construction and Real Estate: Any company directly involved in the domestic property market.

- Government Contractors: Businesses that want to bid on and win government tenders.

The main requirement? You'll need a physical office space, proven by a tenancy contract registered with Ejari (in Dubai). This is non-negotiable and proves your business has a legitimate footprint.

Exploring the Power of Free Zones

The UAE is home to more than 40 specialised free zones. Think of them as independent economic hubs, each with its own regulator and rules, designed to be magnets for foreign investment.

For example, a tech startup building software for a global audience would be right at home in a zone like Dubai Internet City. Here, they get 100% foreign ownership, the ability to send all their profits home, and an ecosystem of similar tech companies, all without needing a local partner. It's an ideal structure for any business that doesn't need a physical shop on a Dubai high street.

Free zones are a strategic launchpad for international business. They offer a cost-effective, low-bureaucracy environment that lets you focus on global growth instead of getting tangled up in local market rules.

Let's quickly break down what makes free zones so appealing:

- Complete Foreign Ownership: You keep full control of your company. No need for a local Emirati partner or service agent.

- Tax Exemptions: Most free zones offer long-term guarantees of zero corporate and personal income taxes.

- Customs Perks: You can import goods into the free zone without paying customs duties, a huge plus for import/export businesses.

- Simplified Setup: Registration is generally faster and involves less paperwork compared to a mainland company.

There is one key limitation, however. A free zone company is not allowed to trade directly with the UAE mainland market. To get around this, you’d need to appoint a local distributor or agent, which adds another layer of complexity and cost.

To help you dig deeper, we've put together a full guide comparing mainland vs free zone in Dubai. Taking the time to understand these differences is essential—your choice here will shape every other step of how you register a company in the UAE.

A side-by-side look can make the choice clearer.

Mainland vs Free Zone: A Head-to-Head Comparison

| Feature | Mainland Company | Free Zone Company | Offshore Company |

|---|---|---|---|

| Ownership | 100% foreign ownership for most activities. | 100% foreign ownership is standard. | 100% foreign ownership always. |

| Market Access | Unrestricted trade across the entire UAE and globally. | Restricted to the free zone and international markets. | Cannot trade within the UAE. For international business only. |

| Office Space | Mandatory physical office space required. | Flexible options (flexi-desk, virtual, or physical). | No physical office requirement. |

| Visa Eligibility | Directly linked to office size; generally more visas. | Limited number of visas, often 1-6 per company. | No visas are issued. |

| Business Scope | Can bid on government contracts and operate locally. | Cannot bid on government contracts directly. | Purely for holding assets or international trade. |

| Regulatory Body | Department of Economy and Tourism (DET) or equivalent. | Each free zone has its own independent authority. | Offshore authorities like JAFZA or RAK ICC. |

| Annual Audits | Mandatory for most mainland companies. | Required by some free zones, not all. | Generally not required, depends on the jurisdiction. |

Ultimately, the best structure comes down to your specific business model. Weighing these factors carefully at the start will save you from costly headaches and restructuring down the line.

Nailing Down Your Licence and Legal Structure

Once you’ve settled on your jurisdiction—whether that’s mainland or a specific free zone—the next step is to give your business its legal identity. This comes down to two crucial, linked decisions: picking the right trade licence and choosing a formal legal structure. Getting this combination right is foundational. It dictates how you operate, your liabilities, and ensures your legal setup matches what you actually do.

Your business activity is what determines the licence you need. This isn't just a piece of paper; it’s the legal authorisation to offer your specific services or sell certain goods. Think of it as the official green light for your business model. Get this wrong, and you're looking at potential fines or even having your operations frozen.

Matching Your Business to a Licence Category

In the UAE, trade licences generally fall into three main buckets. It's vital to figure out where your business fits.

- Commercial Licence: This is your go-to for any business centred around buying and selling goods. We're talking general trading, import/export, logistics, real estate, and retail shops. If you're launching a boutique, an electronics store, or a car rental agency, this is the licence for you.

- Professional Licence: This one is for service-based businesses and skilled professionals. It’s perfect for consultants, artisans, lawyers, doctors, accountants, and IT specialists. The key difference here is that you're selling your expertise, not a physical product.

- Industrial Licence: Just as it sounds, this licence covers businesses involved in manufacturing, production, or any kind of industrial activity. This could be anything from a food processing plant to textile manufacturing or a metal fabrication workshop.

It's also impossible to ignore the massive shift towards digital services. We've seen a huge surge in new business licences recently, with e-commerce and online retail absolutely exploding. One report noted that nearly 4,700 new online retail licences made up about 30% of all new registrations in its sample group—a clear sign of where the market is heading. You can see more on the increase in business registrations across the UAE.

Selecting the Right Legal Structure

Hand-in-hand with your licence, you need to choose a legal structure. This defines ownership and who is legally on the hook for the company's debts and obligations. This decision directly impacts your personal liability and your ability to bring in investors down the road.

The two most common paths for entrepreneurs are the Sole Establishment and the Limited Liability Company (LLC).

For foreign entrepreneurs, a Limited Liability Company (LLC) is almost always the most strategic move. It creates a vital protective barrier between your personal assets and the business's liabilities—a non-negotiable for smart risk management.

A Sole Establishment is the simplest setup, owned by a single person. In the eyes of the law, you are the business. This gives you total control, but it also means you're personally liable for every single business debt.

An LLC, on the other hand, creates a completely separate legal entity. This structure shields the owners' personal assets from business debts. If the company hits a rough patch financially, your personal savings, home, and other assets are safe. It can be owned by one or more shareholders, making it much more flexible for partnerships.

Let’s lay it out clearly.

| Feature | Sole Establishment | Limited Liability Company (LLC) |

|---|---|---|

| Ownership | Owned by one individual. | Can have one or multiple shareholders. |

| Liability | Unlimited personal liability. | Limited liability; personal assets are protected. |

| Best For | Freelancers, individual consultants. | SMEs, startups, foreign investors, joint ventures. |

| Flexibility | Less flexible for bringing on partners. | Easy to add or remove shareholders. |

For most entrepreneurs, especially those new to the UAE, forming an LLC is the smartest route. It offers the best blend of operational flexibility and personal asset protection, giving you a solid legal foundation to build and scale your business. It's a cornerstone of any secure company setup in the UAE.

A Practical Guide to the Registration Process

Right, you've nailed down your jurisdiction and legal structure. Now it's time to roll up your sleeves and move from planning to action. This is the hands-on part of registering your company in the UAE, where you'll be reserving your company name, pulling together documents, and submitting your application. When you get this sequence of steps right, it leads straight to your new trade licence.

The first practical hurdle is securing a trade name. This isn't just about branding; your proposed name must be unique and follow UAE naming conventions. That generally means steering clear of any offensive language or religious references. Once you submit a few options and the Department of Economy and Tourism (DET) or your chosen free zone authority gives the nod, you’re ready for the next stage: initial approval.

Getting the Initial Approval

Think of the initial approval as a no-objection certificate from the UAE authorities. It’s basically their way of saying they're happy for you to set up your business. It's the green light you need to start finalising key legal documents, like the Memorandum of Association (MOA), and to go out and secure a physical office if you're setting up on the mainland.

This is a critical checkpoint. You simply can't move forward without it—no leasing an office, no drafting final shareholder agreements, no submitting the rest of your paperwork. It’s the official confirmation that your proposed business and name are viable.

Assembling Your Document Checklist

Attention to detail here is absolutely non-negotiable. I've seen the entire process grind to a halt because of one missing or improperly attested document, leading to frustrating and expensive delays. The specific documents you'll need will vary slightly depending on whether the shareholders are individuals or a corporate entity.

Here’s a typical rundown for individual shareholders:

- Passport Copies: Clear, colour copies are needed for all shareholders and the appointed manager.

- Visa Status: If any shareholders are already in the UAE, you'll need a copy of their current visa page and entry stamp.

- Emirates ID Copy: A must-have if the shareholder or manager is a UAE resident.

- No Objection Certificate (NOC): This is sometimes required from a current sponsor if a shareholder is on an existing UAE employment visa.

For corporate shareholders, the list gets a bit longer and involves some crucial legal legwork.

Pro Tip: Get all documents from your parent company attested well in advance. Attestation from both the country of origin and the UAE embassy is a multi-step process that often becomes the biggest bottleneck in corporate setups.

If another company is coming on as a shareholder, you'll have to provide a full suite of notarised and attested corporate documents. This usually includes:

- Certificate of Incorporation: To prove the parent company legally exists.

- Memorandum of Association (MOA): The parent company's foundational document.

- Board Resolution: An official resolution from the parent company’s board authorising the new UAE entity and appointing its manager.

- Certificate of Good Standing: A document confirming the parent company is compliant in its home jurisdiction.

Finalising the Legal Paperwork

The core legal document for most new companies here is the Memorandum of Association (MOA). For an LLC, this document is critical—it outlines the shareholding structure, business activities, and the company's operational rules. It needs to be drafted in both English and Arabic, and then signed by all partners in front of a notary public.

Once the MOA is signed and you have your tenancy contract sorted (that’s the Ejari for mainland setups), you'll bundle all your documents with the initial approval and submit them to the relevant authority. After a final review, you’ll get a payment voucher. Pay the government fees, and your official trade licence will be issued. Just like that, your company is legally registered and ready for business.

Your Licence Is Issued: What Happens Next with Visas, Banking, and Compliance

Getting that trade licence in your hands is a huge milestone. It’s the moment your business officially exists in the UAE. But this isn't the finish line; it's the starting pistol. The steps you take right after are what bring your company to life, turning it from a name on a document into a real, operational business that can hire staff, open a bank account, and trade legally.

Your first move, before anything else, is to apply for your company's Establishment Card. It's a small card, but it's absolutely critical. Issued by the immigration authorities, this card formally registers your new company in their system. Without it, you can't sponsor a single visa—not for yourself, not for your partners, and certainly not for any employees. Think of it as the key that unlocks your ability to build a team in the UAE.

Once the Establishment Card is sorted, the path is clear to apply for investor or partner visas for the company owners, which can then be followed by employee visas. Each application has its own documentary requirements and involves a medical fitness test. A good Public Relations Officer (PRO) is worth their weight in gold here, as they can navigate this process for you and keep things moving smoothly.

Navigating the Corporate Bank Account Opening

With your licence and immigration file open, the next big hurdle is opening a corporate bank account. Frankly, this can be one of the trickiest parts of the entire setup process for new entrepreneurs. UAE banks are incredibly thorough with their Know Your Customer (KYC) and due diligence checks, and if you’re not fully prepared, you could face major delays.

To avoid this, you need to walk in with a complete and organised file. Banks need to see a crystal-clear picture of your business and the people behind it.

Here’s what you’ll almost certainly need:

- Company Trade Licence: Your original licence is non-negotiable.

- Shareholder and Manager Documents: Have clear copies of passports, visa pages, and Emirates IDs for everyone involved.

- Memorandum of Association (MOA): The constitutional DNA of your company.

- Office Tenancy Contract (Ejari): This proves you have a physical business address.

- Business Profile: A well-written document outlining your business model, who you'll be selling to, and your financial projections.

Insider Tip: Don't just hand over a pile of papers. Craft a professional business profile that clearly details your source of funds, anticipated transaction volumes, and mentions key suppliers or clients if possible. A well-thought-out plan gives the bank confidence in your venture and can seriously speed up approvals.

Banks are particularly focused on business "substance." A company with a real office and a resident manager is always going to look more credible than a bare-bones virtual setup. Be ready to sit down and answer detailed questions about your operations and your numbers.

Staying on Top of Your Ongoing Compliance Duties

Registering your company means you're now part of the UAE's well-regulated business ecosystem. Staying compliant isn't just a good idea—it's mandatory for avoiding hefty fines and ensuring your business can operate long-term. Your main responsibilities will centre around tax and reporting.

Value Added Tax (VAT) is the first thing to get on your radar. If you expect your company's annual turnover to hit AED 375,000, you are legally required to register for VAT with the Federal Tax Authority (FTA). Missing this can lead to penalties of up to AED 20,000. Beyond avoiding fines, being VAT-registered is often a must-have to work with larger companies, as they need to reclaim the VAT you charge them. We've written a detailed guide on this, and you can learn more about how to register for VAT in UAE here.

Next up, every company is now subject to UAE Corporate Tax. This means maintaining proper accounting records and filing an annual tax return is no longer optional. Accurate bookkeeping has shifted from just good business practice to a legal necessity.

Finally, you might also need to deal with Economic Substance Regulations (ESR) and Ultimate Beneficial Owner (UBO) declarations, depending on your activities. These rules are in place to ensure transparency and prevent tax avoidance. Getting a handle on these requirements from day one means you're building your business on a solid, sustainable, and fully compliant foundation.

Your Top Questions About UAE Company Registration, Answered

When you're setting up a company in the UAE for the first time, a lot of questions pop up. The process is pretty logical, but some of the specific rules can feel a bit confusing. Let’s clear the air and tackle some of the most common queries I hear from entrepreneurs.

Getting these details straight from the start can be the difference between a smooth launch and a frustrating delay. It’s all about knowing what to expect on your setup journey.

How Long Does UAE Company Registration Take?

"How long will this all take?" is usually the first question on everyone's mind. The honest answer? It really depends on where you set up (your jurisdiction) and what your company actually does.

In many free zones, especially the ones with slick online portals, the process can be incredibly quick. I’ve seen trade licences issued in just a couple of working days. These zones are built for speed.

For a mainland company, you're generally looking at a longer timeline, often somewhere between one and three weeks. The big variable here is whether you need external approvals from specific government ministries. For instance, if you're opening a healthcare clinic, you'll need the green light from the Dubai Health Authority (DHA), and that adds an extra step to the process.

From my experience, the single biggest cause of delays isn't the authorities—it's paperwork. Incomplete or incorrect documents can bring everything to a halt. Triple-check every form, attestation, and passport copy before you submit anything. It's the best thing you can do for a predictable timeline.

Do I Need a Physical Office Space?

This one is a hard "it depends." The rules are completely different for mainland and free zone companies.

For a mainland company, the answer is a definite yes. You absolutely must have a physical office address, which is verified by a registered tenancy contract (known as an Ejari in Dubai). There's no way around this requirement.

Free zones, on the other hand, are where you find all the flexibility. This is a huge draw for modern businesses.

- Flexi-Desks: This is essentially a shared desk facility. It gives you a legitimate business address and a place to work without the commitment and cost of a private office.

- Virtual Office Packages: These give you a registered address and mail handling services, which is perfect for satisfying the legal requirements if your team works remotely.

These options are a game-changer for consultants, tech startups, and international firms that don't need a client-facing office in the UAE right away.

Investor Visa vs. Employee Visa: What’s the Difference?

Understanding the difference between an investor visa and an employee visa is critical when you're planning your own residency and thinking about hiring. While both get you a UAE residency permit, they're designed for different people.

An investor visa is for the owners or partners of the company. It confirms your stake in the business and usually comes with a longer validity, often two to ten years. The key perk here is that you don't need a labour contract with your own company to get it.

An employee visa, as the name suggests, is sponsored by the company for its staff. This visa is tied directly to an employment contract and is typically valid for one to two years. Its validity depends on the person staying employed with your company. Plus, the number of employee visas you can issue is often linked to the size of your office.

Can I Trade Across the UAE with a Free Zone Licence?

This is a crucial question that directly impacts how you'll operate. The general rule is that a free zone company is licensed to do business within its free zone and internationally. To trade directly on the UAE mainland, there are some restrictions.

If you’re selling physical products to customers on the mainland, you’ll typically need to work with a mainland distributor or agent. They would handle the on-the-ground logistics and sales for you.

However, the rules are getting more flexible, especially for service-based businesses. Many free zone companies serve mainland clients without any issues. Some free zones have even inked special agreements to make mainland access easier. It's vital to check the specific regulations of your chosen free zone authority before you lock in your business plan.

Navigating the complexities of UAE company registration requires expert guidance to avoid costly errors and delays. Smart Classic Business Hub offers end-to-end support, from choosing the right jurisdiction to managing post-setup compliance. Our team ensures every step is handled professionally, allowing you to focus on what matters most—growing your business. Start your journey with confidence by visiting us at https://smartclassic.ae.