A freelance license in Dubai is essentially your golden ticket to operate as an independent professional in the UAE. Think of it as a legal permit that lets you live and work here on your own terms, without needing a traditional company setup or an employer to sponsor you. It's designed specifically for individuals offering skilled services—like tech gurus, media creatives, and consultants—allowing you to legally issue invoices, open a business bank account, and secure your own residence visa.

Why Dubai Is a Hub for Freelancers

Dubai's rise as a global hotspot for independent talent is anything but accidental. It's the direct result of smart, strategic government initiatives aimed at attracting the world's best and brightest. The city has cultivated a dynamic, pro-business environment where innovation isn't just a buzzword; it's actively encouraged and supported.

For many freelancers I've worked with, the appeal goes far beyond the iconic skyline and tax-free living. It’s really about having a solid legal foundation to build a career on your own terms. A freelance license gives you exactly that. It's a simple, affordable entry point into one of the most exciting markets in the world, letting you test the waters with your services without the heavy risks of a full-blown company formation.

The Rise of the Independent Professional

The UAE government has been a major force in building this ecosystem, recognising the massive value that freelancers add to the economy. This isn't some niche market anymore—it's become a central part of the country's talent strategy.

The numbers speak for themselves. Between 2022 and 2025, freelance licensing was transformed into a primary pathway for skilled professionals to enter the UAE. In the 12 months leading up to September 2025 alone, official data shows over 50,000 freelance permits were issued. This boom reflects a massive regional trend, with freelance registrations skyrocketing by 142% between 2022 and 2023. You can dive deeper into this growth by checking out the full report on the UAE's freelance economy.

This official backing translates into real-world advantages for you:

- Legal Recognition: You can officially issue invoices and operate a corporate bank account.

- Visa Sponsorship: The permit allows you to secure a residence visa for yourself and even sponsor your family.

- Access to a Thriving Market: It opens doors to a network of local and international clients in a business-friendly setting.

- Simplified Setup: The process is far more direct and cost-effective compared to setting up a full company.

Who Is This License For?

A freelance license in Dubai is perfect for a certain kind of professional. It’s not a catch-all solution, but for those with proven expertise in their field, it's an incredibly powerful tool.

A freelance permit is essentially a trade license for one. It grants you the legal status of a sole practitioner, allowing you to work under your personal name rather than a company brand. This is perfect for consultants, creatives, and specialists who are the face of their own service.

This setup is particularly well-suited for professionals like:

- Creatives: Writers, designers, photographers, and marketing specialists.

- Tech Experts: Developers, IT consultants, and cybersecurity professionals.

- Consultants: Business, management, and education advisors.

Ultimately, the permit gives you the freedom to build your client portfolio without the overhead of a physical office or staff. It empowers you to do one thing: focus on delivering exceptional work.

Choosing Between Mainland and Free Zone Licenses

Your first big decision on the path to becoming a freelancer in Dubai is picking your jurisdiction: mainland or a free zone. This isn't just paperwork; it fundamentally shapes who you can work for, your visa eligibility, and the entire structure of your freelance business.

Think of it like this: a mainland license, often called an e-Trader license from the Department of Economy and Tourism (DED), plants you right in the middle of the local UAE economy. It’s a great option if your clients are primarily other businesses and residents across Dubai.

On the other hand, a free zone permit positions you within a specialised economic hub. These zones are built for international trade and services, making them the go-to—and often the only viable—option for expatriate freelancers needing to sponsor their own residence visa.

Mainland: The Local Specialist

So, when does a mainland license make sense? Imagine you're a UAE or GCC national starting an online shop for handcrafted goods, selling directly to customers in Dubai. In that case, the mainland e-Trader license is a perfect fit. It gives you unrestricted access to the local market without the extra layers of a free zone.

But for most expats, the mainland e-Trader license comes with a major catch. It generally doesn't allow you to apply for a residence visa. This makes it a non-starter if your plan is to live in Dubai based on your freelance work.

Free Zones: The Global Professional

For the vast majority of expatriate freelancers—whether you're an IT consultant, a graphic designer, or a marketing strategist—a free zone is the clear winner. If you're an expat who needs a freelance license in Dubai that also includes a residence visa, this is your primary route.

Free zones come with some powerful advantages:

- Visa Sponsorship: This is the big one. The free zone authority acts as your sponsor, enabling you to get a residence visa for yourself and, in many cases, your family.

- 100% Ownership: You keep full ownership of your freelance business. No need for a local partner.

- Tax Benefits: You get to take advantage of 0% corporate and personal income tax, a huge draw for professionals from all over the world.

To get a clearer picture of how these two paths differ in cost, setup, and legal structure, take a look at our detailed comparison of mainland vs free zone Dubai setups. It will help you make a fully informed choice.

The table below offers a quick snapshot to help you see the key differences at a glance.

Mainland e-Trader vs Free Zone Freelance Permit: A Quick Comparison

| Feature | Mainland DED e-Trader | Free Zone Permit |

|---|---|---|

| Primary Market | Local UAE market only | Local and international markets |

| Visa Sponsorship | No residence visa sponsorship | Yes, includes residence visa |

| Ownership | 100% for UAE/GCC nationals | 100% foreign ownership |

| Office Space | Not required | Often requires a flexi-desk or similar |

| Best For | UAE/GCC nationals, online sellers with no visa needs | Expatriate freelancers needing a visa |

| Client Restrictions | Can deal directly with any mainland company | May need an agent for mainland business |

Ultimately, this isn't about which option is "better." It's about finding the perfect fit for your specific situation.

Choosing the right jurisdiction is less about which one is "better" and more about which one aligns with your specific client base and residency needs. An expat web developer serving international clients has very different requirements than a local event photographer working exclusively within the UAE.

Your choice really boils down to two things: who are your clients, and do you need a visa? For most expat freelancers, the visa sponsorship and international framework offered by a free zone license make it the obvious and most practical solution. A mainland license, in contrast, is tailored for those already rooted in the local market.

Finding the Right Free Zone for Your Niche

Picking a free zone for your freelance gig in Dubai is a lot like choosing a neighbourhood to live in. It's not just about finding the cheapest rent; you want the right community, the right resources, and the right vibe to help you thrive. With over 40 free zones, it’s crucial to look past the price tag and find one that genuinely aligns with your profession.

A common pitfall I see is freelancers treating all free zones as if they're just interchangeable government offices. They're not. They are specialised economic hubs. A graphic designer will get so much more out of being in Dubai Media City—surrounded by agencies and potential clients—than in a generic, all-purpose zone. Likewise, a fintech developer is far better off setting up in Dubai Internet City, where they can rub shoulders with tech giants and startups.

Specialised Hubs for Creatives and Tech Pros

For a lot of creative and tech freelancers, the TECOM Group's GoFreelance package is a fantastic starting point. It’s popular for a good reason: it covers several key industries and gives you access to some of the most well-known, industry-specific zones.

- Dubai Media City (DMC): This is the undisputed heart of the media world in Dubai. If you're a writer, journalist, marketer, or social media guru, this is your place. It's packed with international news agencies and top-tier ad firms, making it a goldmine for networking.

- Dubai Internet City (DIC): The epicentre for all things tech. For freelancers in software development, cybersecurity, or IT consulting, DIC is where the action is. Your next client or collaborator could be in the same building.

- Dubai Design District (d3): A seriously cool and vibrant community tailor-made for fashion designers, artists, architects, and other creative minds. The focus here is less on corporate stuff and more on artistic collaboration and innovation.

Choosing one of these isn’t just about getting a freelance license in Dubai; it’s about plugging yourself directly into an established professional community from day one.

The real value of a specialised free zone isn't the license itself, but the ecosystem it unlocks. Attending an industry-specific workshop or bumping into a potential client at a café within your zone can be more valuable than any cost saving.

Flexible Options for General Consultants

What if your work doesn't neatly fit into a creative or tech box? If you're a management consultant, business advisor, or offer a broader range of professional services, there are some great versatile free zones that offer flexibility and competitive pricing.

Two solid contenders here are:

- Ras Al Khaimah Economic Zone (RAKEZ): Okay, so it’s not physically in Dubai, but RAKEZ is highly respected for its budget-friendly freelance packages and incredibly straightforward setup process. It's a very practical choice if you're keeping a close eye on your budget and want minimal fuss.

- International Free Zone Authority (IFZA): Located in Dubai, IFZA has become a popular choice fast. They're known for efficient service, great pricing, and a huge list of approved activities, making it a fantastic all-rounder for generalist freelancers.

When you’re weighing these options, don't just look at the initial setup fee. Think about the annual renewal costs, the quality of the admin support you'll receive, and how easy they make it to process your visa and other essential paperwork. To get a better feel for how these different jurisdictions work, our guide on Dubai free zone company setup offers some really valuable insights. Making the right choice now sets your freelance career on solid ground for the future.

Getting Your Application and Documents in Order

Once you've zeroed in on the right free zone, it’s time to get your paperwork sorted. Think of this part as building your professional case for getting a freelance license in Dubai. Honestly, success here comes down to being organised and paying close attention to the small stuff. It's all about presenting yourself as a credible, serious professional.

I've seen it happen time and time again: a single missing document or a passport photo that doesn't meet the exact standards can send an application right back to the start. That costs you time and money. Being meticulous here really does pay off.

Your Core Document Checklist

While every free zone has its own unique requirements, there's a core set of documents you'll need pretty much everywhere. It’s best to get these ready before you even think about hitting 'submit' on that application form.

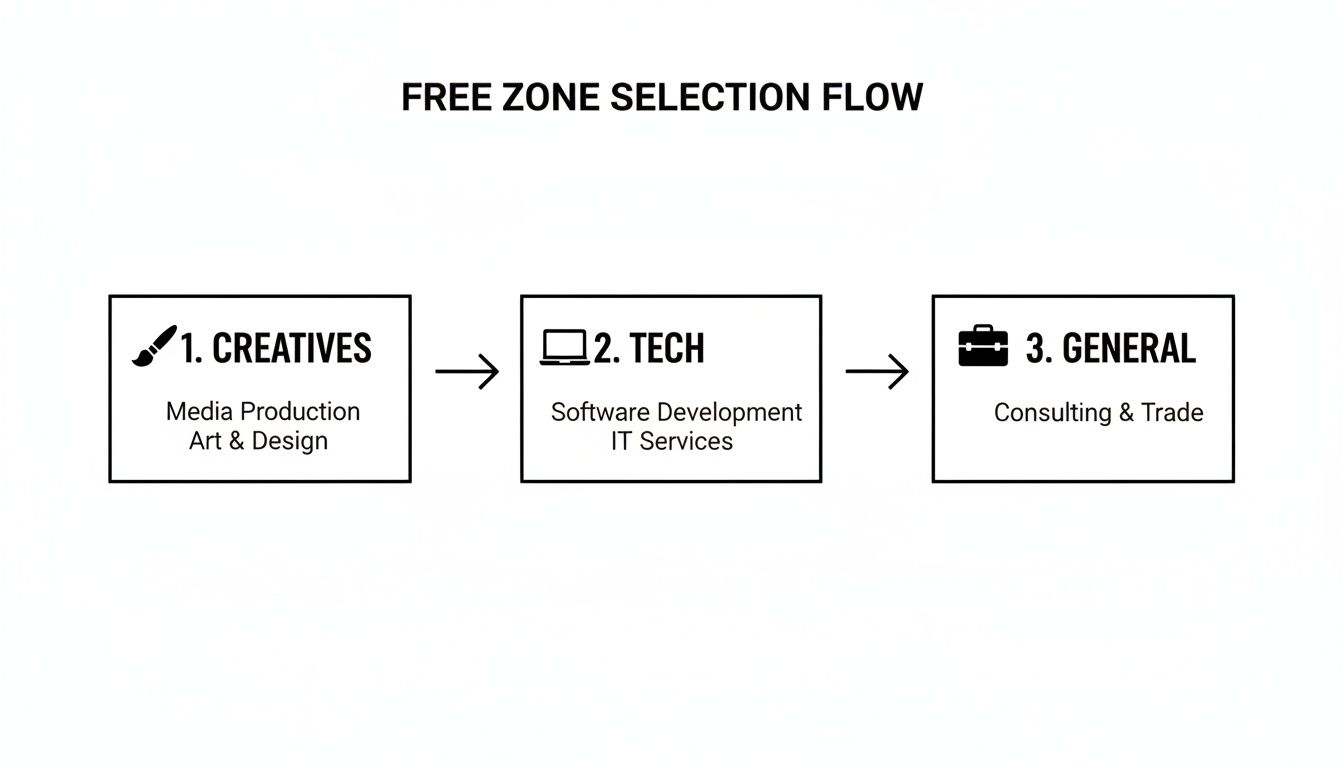

This flowchart gives a simple breakdown of the main freelance categories and which free zones cater to them, whether you're a creative, a tech guru, or a general business consultant.

As you can see, the very first step is making sure your professional activity aligns with the right specialised zone. This is non-negotiable.

Here’s a typical checklist to get you on your way:

- Completed Application Form: This is your official starting point. You'll usually find it on your chosen free zone's online portal.

- Clear Passport Copy: Make sure it has at least six months of validity left. A high-resolution colour scan is a must.

- Passport-Sized Photograph: This is more specific than you might think. It absolutely must have a white background and meet strict government dimensions—don't just crop a selfie.

- Updated CV or Portfolio: This is where you shine. Your CV should clearly show your professional background and how it relates to the freelance activity you're applying for.

- Academic Qualifications: You may need a copy of your university degree or relevant professional certificates. Sometimes, these need to be officially attested, which is a separate process in itself.

Putting Together a Winning Application

Beyond the basic list, a few other elements need a bit more thought. Some free zones, for instance, might ask for a brief business plan. Don't panic—this isn't a 50-page thesis. It’s a concise, one-page summary of the services you'll offer, who you'll be working for (your target market), and a rough income projection. Keep it simple and focused.

You'll also likely need a bank reference letter or recent bank statements to show you're financially stable. This is just to reassure the authorities that you can support yourself while you get your freelance business off the ground in Dubai.

Insider Tip: Treat your entire application package like a professional proposal you'd send to a high-value client. Make sure every file is clear, correctly named, and formatted properly. This small effort speaks volumes about your professionalism and can make the review process much smoother for the authorities.

The All-Important Establishment Card

Once your initial freelance permit application gets the green light, you'll move on to securing your Establishment Card. This document is absolutely critical; you can't proceed without it.

It's an electronic card issued by the immigration authorities that officially registers your new freelance entity with their system. Think of it as the bridge connecting your permit to your personal visa.

You cannot even start your own residence visa application until this card is issued. It's the key that unlocks the next steps, like your medical test and Emirates ID biometrics. Once you have this card in hand, you're officially in the home stretch.

Understanding the Costs of Your Freelance Setup

Alright, let's get straight to the numbers. Budgeting for your freelance license in Dubai means looking beyond just the advertised permit fee. The total investment is actually a sum of several mandatory costs that, when you add them all up, give you the true price tag for launching your independent career in the UAE.

A common pitfall I see is freelancers focusing only on the licence price, then getting blindsided by the fees for their visa and other essential documents. Having a clear financial picture from the very beginning makes for a smooth, stress-free process, with no last-minute financial scrambles.

Breaking Down the Full Investment

To budget accurately, you have to account for a sequence of interconnected fees. Each step has its own cost, and they all contribute to your total initial outlay. Think of it like building the foundation for your freelance business—each brick comes with its own price.

Here’s a realistic look at what your initial budget needs to cover:

- Freelance Permit Fee: This is the main cost, and it can vary quite a bit depending on the free zone you choose.

- Establishment Card: A critical document that officially registers your freelance entity with immigration, paving the way for your visa application.

- Residence Visa Application: This covers everything from the entry permit and status change (if you're already in the UAE) to the final visa stamp in your passport.

- Mandatory Medical Test: A required health screening that has to be completed before your visa can be finalised.

- Emirates ID Processing: The fee for your national identity card, which is directly linked to your residence visa.

When you factor in all these components, the total cost for a complete freelance setup—including the licence and a one-year visa—typically lands somewhere between AED 7,500 and AED 20,000. Where you fall in that range really depends on your choice of free zone and the specific visa package.

Planning your budget is more than just a financial exercise; it's about setting realistic expectations. Knowing the all-in cost upfront empowers you to choose a package that aligns with your financial reality, preventing any unwelcome surprises down the line.

Planning for the Long Term

It’s also smart to think beyond the first year. Your ongoing costs are just as important for long-term financial planning. The good news? Annual renewal fees for your freelance licence are usually much lower than the initial setup cost.

Most cost analyses for the UAE market show that a core freelance permit typically ranges from AED 7,500 to AED 15,000 annually for renewal. This figure generally bundles the licence fee, administrative charges, and the visa package (including medicals and Emirates ID). If you need a workspace, co-working solutions often add another AED 8,000 to AED 12,000 per year. For a more detailed breakdown, you can explore this complete guide on freelance permit costs.

This structure makes your first year the biggest investment, with subsequent years becoming much more manageable. By understanding both the initial and recurring costs, you can build a sustainable financial model for your freelance career in Dubai from day one.

Managing Your Legal and Tax Obligations

Getting your freelance license in Dubai is a huge win, but it’s really just the starting line. The real key to a long and successful freelance career here is staying on top of your ongoing responsibilities. It's not the most exciting part of the job, but knowing your obligations—especially around tax and renewals—will save you a world of headaches later on.

Think of your licence as a professional passport. You have to keep it stamped and valid to operate legally. This isn't just about paying a fee once a year; it's about being aware of the rules that shape your financial reporting and business activities.

Navigating VAT and Corporate Tax

The big one you need to keep on your radar is Value Added Tax (VAT). For most freelancers just starting out, this won't be an issue right away, but you absolutely must keep a close eye on your revenue.

The rule is simple: once your turnover hits AED 375,000 within any 12-month period, you are legally required to register for VAT. This isn’t optional. The moment you cross that threshold, you need to start charging 5% VAT on your invoices and filing regular tax returns with the Federal Tax Authority (FTA). Good financial tracking from day one is your best friend here—it will help you avoid the sting of late registration penalties. If you're approaching that number and need a hand, our guide on how to register for VAT in the UAE walks you through the entire process.

It’s also worth knowing about Corporate Tax. While most freelancers won't meet the threshold, it applies to net profits that exceed AED 375,000 in a year. As your business scales, this could become a factor, which is another great reason to keep clean, organised accounts right from the beginning.

Understanding Your Licence Limitations

Your freelance permit gives you a ton of freedom, but it comes with a few clear boundaries you need to respect. Knowing these rules is crucial for staying compliant and avoiding any trouble.

Here are the main limitations to remember:

- No Hiring Staff: Your licence is for you, the individual professional. You cannot hire employees on your permit. If you get to a point where you need to build a team, you'll need to look at upgrading to a full company structure.

- Specific Activities Only: You're only authorised to work within the specific business activities listed on your licence. Taking on projects outside that scope is a compliance violation.

- Personal Name Operation: You must operate and invoice under your own personal name, not a fancy brand name.

The UAE’s VAT framework mandates registration and reporting for freelancers once their annual turnover surpasses AED 375,000. It's important to remember that while some free zones offer cost-effective licences, they come with clear rules, such as prohibiting the hiring of employees. Learn more about the evolving landscape for self-employed professionals, including long-term residence options like the Green Visa introduced in 2022.

Finally, don't forget the annual basics. Your licence and visa both need to be renewed every year. Put a reminder in your calendar and aim to start the process at least a month early. This simple bit of planning avoids any last-minute stress and ensures you can keep your focus where it belongs: on your clients and your work.

Navigating the complexities of business setup and ongoing compliance in Dubai can be challenging. Smart Classic Business Hub offers expert guidance to ensure your freelance journey is smooth, legal, and successful from day one. Let us handle the details so you can focus on growth. Contact us today for a consultation.