Starting your Dubai free zone company setup is more than just a smart decision; it’s a strategic play for any global entrepreneur. Think 100% foreign ownership, zero corporate and personal income taxes, and refreshingly simple import/export rules. It’s a structure built from the ground up to give ambitious businesses a powerful launchpad in a dynamic, pro-business hub.

Why a Dubai Free Zone Is Your Smartest Business Move

Choosing where to plant your business flag is one of the biggest calls you'll make as an entrepreneur. For a growing number of international businesses, the answer is, without a doubt, a Dubai free zone. This isn't just about getting a fancy address; it’s a calculated move based on real-world financial and operational perks that genuinely fuel growth.

The biggest draw? Complete control. Unlike the old mainland rules that often required a local partner, a free zone company gives you 100% foreign ownership. That means your vision, your profits, and your decisions are all yours. No compromises.

The Financial Edge You Gain

Ownership is just the start. The tax advantages are where things get really interesting. When you operate in a free zone, you're exempt from corporate taxes on qualifying income, and there are absolutely no personal income taxes. This isn't just a small saving; it's capital you can pour right back into the business.

We’ve seen clients use these savings to:

- Innovate faster: Funneling cash directly into R&D to create better products.

- Scale up marketing: Funding aggressive campaigns to grab more market share.

- Hire top talent: Offering competitive packages to attract the best in the field.

Plus, the system allows for the full repatriation of both capital and profits. There are no restrictions on moving your money back home. It's a setup built on trust and designed to attract serious foreign investment. The economic proof is in the pudding. This model kicked off with the Jebel Ali Free Zone (JAFZA) back in 1985 and completely changed the game. Today, with around 30 active free zones, these hubs are the lifeblood of the economy, accounting for roughly 60% of Dubai's total goods exports.

Operational Simplicity and Global Access

Anyone who has started a business knows how tangled the red tape can get. Free zones are specifically designed to cut through that. They often act as "one-stop shops" where you can sort out your registration, licensing, visas, and other legal bits and pieces all under one roof. This integrated approach is a massive time-saver.

The real power of a Dubai free zone isn't just one benefit. It's the combination of 100% ownership, tax exemptions, and streamlined operations working together. It creates an ecosystem where businesses can just get on with growth and innovation.

Then there’s the geography. Dubai sits at the crossroads of Europe, Asia, and Africa, offering unmatched access to global markets. The infrastructure here is world-class, from the seaports to the airports, making import and export a smooth, seamless process without the usual customs headaches inside the zone. Find out more about the key advantages of setting up a business in Dubai in our detailed article.

It’s this powerful mix of financial perks, operational ease, and strategic location that keeps a Dubai free zone company setup at the top of the list for entrepreneurs worldwide.

Choosing the Right Free Zone and Business License

With over 30 free zones in Dubai, picking the right one can feel overwhelming. But this decision is the single most important one you'll make when setting up your company. Getting it right gives you a powerful head start. Your choice isn't just about a physical location; it's about plugging your business into an ecosystem built specifically for your industry.

The core principle is simple: alignment. Each free zone is a specialised hub. A fintech startup, for example, will naturally gravitate towards Dubai International Financial Centre (DIFC), where it can tap into a network of VCs and operate under financial regulations designed for the industry. On the other hand, a global logistics firm would be right at home in Jebel Ali Free Zone (JAFZA), with its world-class port and infrastructure at its doorstep.

Think of it like this: you wouldn't open a high-end fashion boutique in the middle of an industrial park. The same logic applies here. The goal is to find a zone that doesn't just allow your business activities but actively supports and nurtures them.

Aligning Your Business with the Right Industry Hub

The very first thing to do is nail down your core business activities. Are you trading physical goods, offering consultancy, developing software, or producing media content? With a clear answer, you can start shortlisting the most relevant free zones.

Here’s how this plays out in the real world:

- For Tech and E-commerce: Entrepreneurs in this space often look to zones like Dubai Internet City (DIC) or Dubai Silicon Oasis (DSO). These aren't just locations; they're communities offering tech-focused infrastructure and access to a deep pool of talent.

- For Trading and Logistics: It's hard to look past JAFZA and Dubai Airport Freezone (DAFZA). Their direct links to major sea and air cargo routes are a game-changer, dramatically simplifying import and export operations.

- For Media and Creative Services: Dubai Media City (DMC) and Sharjah Media City (Shams) are the go-to hubs. They provide tailored licences and facilities for everything from film production houses to marketing and advertising agencies.

- For General Trading and Multiple Services: If your business model is more diverse, versatile zones like DMCC (Dubai Multi Commodities Centre) or IFZA (International Free Zone Authority) are excellent choices. They offer a much broader range of approved activities.

This decision has a ripple effect on your entire business. For a more detailed comparison of how these zones stack up against a mainland setup, our guide on the differences between mainland and free zone setups in Dubai is a must-read.

Selecting the Correct Business License

Once you have a couple of promising free zones in mind, the next step is to pick the right licence. This document is what legally defines what your company can and cannot do. Getting this wrong can lead to serious operational headaches and even fines down the line, so you need to be precise.

You’ll typically come across three main licence categories:

- Commercial Licence: This is for any business involved in buying and selling goods, simply known as trading. It can cover everything from general trading to specific product lines like electronics or textiles.

- Professional/Service Licence: If you’re offering services instead of physical products, this is the one for you. It's the standard choice for consultants, marketing agencies, IT specialists, and other professionals.

- Industrial Licence: This is required for any business that engages in manufacturing, processing, packaging, or assembling goods. These licences usually come with specific requirements for facilities, like needing a warehouse or production unit.

The name on your licence is less important than the activities listed on it. You must ensure every single service you intend to provide or product you plan to trade is explicitly mentioned. This is key to staying compliant.

For example, a digital marketing agency would need a Professional Licence with activities like "Social Media Marketing" and "SEO Consultancy" clearly listed. A company importing and selling furniture would need a Commercial Licence specifying "Furniture Trading."

Comparing Top Dubai Free Zones for Your Business

Choosing a free zone is a strategic decision that impacts everything from your costs to your growth potential. To help you navigate the options, we've put together a comparison of some of the most popular choices, highlighting what makes each one unique.

| Free Zone Name | Best For (Industry) | Key Advantages | Estimated Starting Cost (AED) |

|---|---|---|---|

| IFZA Dubai | Consulting, Services, General Trading | Fast and easy setup, cost-effective packages, wide range of activities. | 12,900 |

| DMCC | Commodities, Crypto, General Trading | Prestigious address, strong community, specific crypto and tech hubs. | 35,000 |

| JAFZA | Logistics, Manufacturing, Trading | Direct access to Jebel Ali Port, excellent for import/export, vast warehousing options. | 25,000 |

| DAFZA | Aviation, Logistics, E-commerce | Prime location next to Dubai International Airport, ideal for air freight and fast-moving goods. | 30,000 |

| Dubai Silicon Oasis (DSO) | Technology, R&D, Startups | Integrated tech ecosystem with residential and commercial spaces, strong startup support. | 15,000 |

| Dubai Media City (DMC) | Media, Advertising, Production | Hub for the region's creative industry, excellent networking opportunities. | 20,000 |

This table gives you a starting point, but the best choice always depends on your specific business plan and long-term goals. It's crucial to weigh the costs against the benefits of being in an ecosystem designed for your success.

Office Space and Its Impact on Your Visas

Your choice of workspace is about more than just having a desk; it's directly linked to your budget and, critically, the number of residence visas you can obtain for your team. Free zones offer everything from affordable shared desks to large private offices.

The two main options you'll encounter are:

- Flexi-desk: This is a shared desk in a co-working facility. It’s the most cost-effective solution and perfect for solo entrepreneurs or small startups. A flexi-desk package usually comes with a small visa allocation, typically one to three visas, depending on the free zone.

- Physical Office: Renting your own dedicated office provides privacy and a more established presence. More importantly, it gives you a much higher visa quota. The rule of thumb is roughly one visa for every 80-100 square feet of office space, though this can vary.

A common mistake we see is new business owners choosing a flexi-desk to keep initial costs low, only to find they need to hire more people than their visa limit allows. This forces them into a costly and time-consuming upgrade process later.

Before you decide, map out your hiring plans for the next one to two years. Choosing an office solution that accommodates your future growth from day one will ensure your Dubai free zone company setup is built on a solid foundation.

Your Company Formation Blueprint From Start to Finish

Setting up a company in a Dubai free zone is a journey with several key milestones. While the exact path can differ slightly from one free zone to another, the core sequence is pretty much the same across the board. Getting your head around this flow is the best way to prepare properly, pull together the right documents, and sidestep the common hiccups that can stall your launch.

Think of the entire process as building the legal foundation for your business, piece by piece. Every decision, from your company name to the fine print on your licence activities, has to be made with clarity and precision. Let's walk through the essential stages so you know exactly what to expect at each turn.

The First Hurdle: Naming and Activities

Before you even think about filling out an application, you need to lock down two things: your business activities and your company's trade name. Getting these right from the get-go is non-negotiable. It’s the difference between a smooth start and frustrating rejections down the line.

Your business activities must be crystal clear and match one of the pre-approved categories in your chosen free zone. A classic mistake we see is being too vague. For example, simply putting "consulting" won't cut it; you need to be specific, like "Management Consultancy" or "IT Consultancy." This precision ensures your licence truly reflects what your business does.

At the same time, you'll need to reserve your trade name. The UAE has strict naming rules you have to play by:

- The name can't be offensive or go against public morals.

- It must not include names of religions or government bodies.

- It has to be unique and not already registered.

- Fancy adding "Global" or "International"? You might need to prove you have a larger operational footprint to justify it.

Once your name gets the green light and is reserved, it's officially yours. Now you can move forward with confidence.

Gathering Your Essential Documents

With your name and activities sorted, it’s time to tackle the paperwork. Every free zone has its own checklist, but the core requirements are all about proving who you are and what your business is about. This is where you build your application file.

Here’s what you’ll typically need to get ready:

- Passport Copies: Clear, colour copies for every shareholder and the person appointed as manager.

- Passport-sized Photographs: Standard specs apply – white background, looking straight ahead.

- Proof of Address: A recent utility bill or bank statement for each shareholder usually does the trick.

- Business Plan: Many free zones, especially for certain activities, will ask for a concise business plan. It should cover your objectives, a quick market analysis, and your financial projections.

Heads up: depending on your company structure or business activity, some documents might need attestation. This is a formal legalisation process that starts in your home country and ends at the UAE embassy. It can take a while, so it’s smart to get a head start on this.

So why do so many businesses flock to Dubai's free zones? It's the powerful trio of statutory benefits: 100% foreign ownership, corporate tax exemptions for qualifying companies, and customs advantages. With over 40 multidisciplinary free zones across the UAE (and about 30 in Dubai alone), these hubs offer a one-stop-shop that can get you up and running in just a few weeks. You can learn more about the UAE's dynamic free zone network and what it offers international investors.

Application Submission and Approval

Got your documents in order? Great. The next step is submitting your application to the free zone authority. This is where the official review process kicks off. The authority will go through your application with a fine-tooth comb, verifying your documents and running the necessary background checks on all shareholders.

This is where your meticulous preparation pays off. A complete, accurate application sails through. Missing info or incorrect documents? You’ll get bogged down with requests for clarification, and that means delays.

Once the authority is happy with everything, they’ll issue an Initial Approval Certificate (IAC). This is a huge milestone. It’s the official green light from the government, confirming they have no objection to your business and giving you the go-ahead for the final steps.

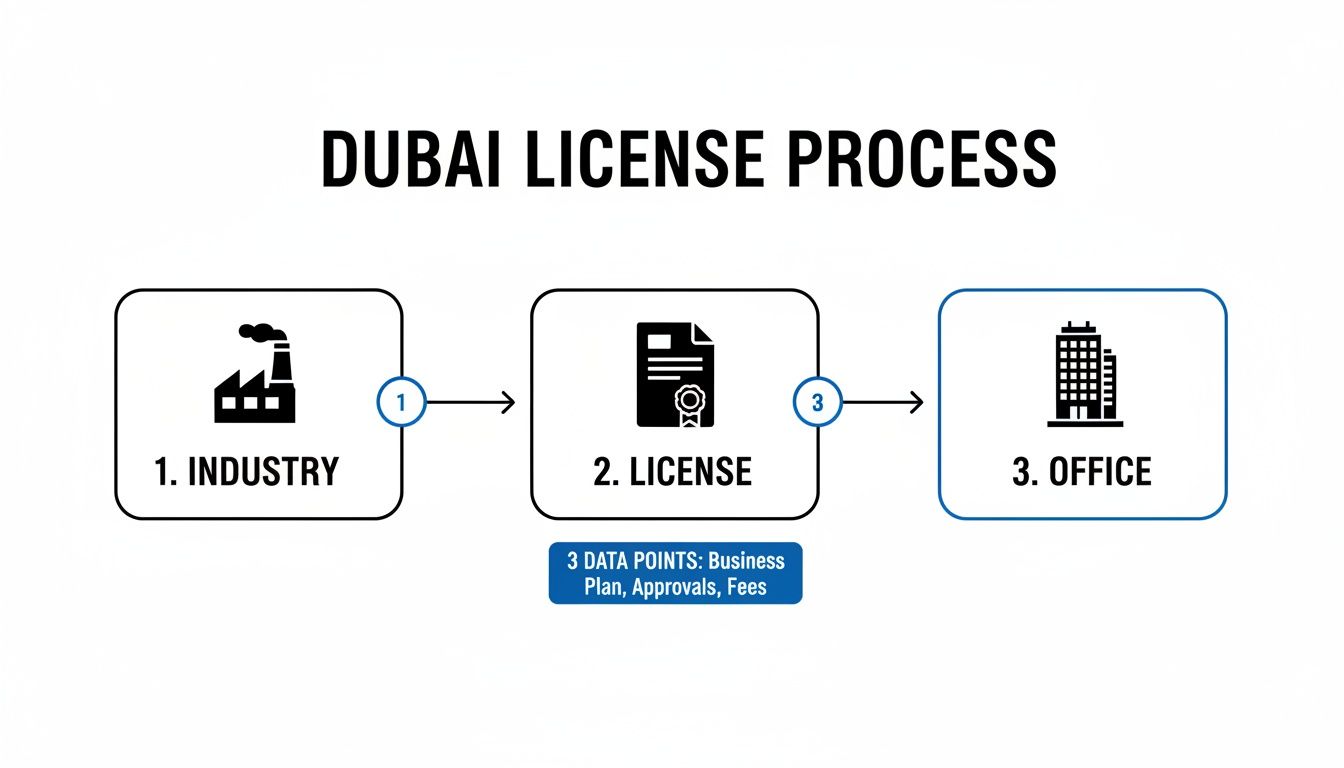

This flowchart shows how the big pieces of the puzzle—your industry, licence, and office space—all fit together.

As you can see, these aren't separate decisions but interconnected stages that build on each other for a successful launch.

Finalising Your Legal Status and Getting Your Licence

With your initial approval secured, you’re on the home stretch. This final phase involves signing the legal paperwork that officially creates your company, like the Memorandum of Association (MOA), and paying all the government fees. These fees usually cover your registration, the licence itself, and your office or flexi-desk rental.

After the ink is dry and the payments are settled, the free zone authority issues your business licence. This is the moment your company officially exists. You'll receive a package of corporate documents, which typically includes:

- Your Trade Licence

- Certificate of Formation

- Share Certificates

- Memorandum and Articles of Association

- Lease Agreement for your office space

Post-Licensing Essentials: Immigration and Visas

Receiving your licence is a massive win, but you're not quite at the finish line. To legally operate and live in the UAE, you need to get your company's immigration file opened. The very first step is applying for the Establishment Card, sometimes called the Company Immigration Card.

This card is non-negotiable. It registers your new company with the immigration authorities, which then allows you to start applying for residence visas for yourself, your staff, and even your family. Once that card is in hand, the visa process can begin, which involves getting an entry permit, completing a medical fitness test, and applying for your Emirates ID.

Here at Smart Classic Business Hub, we live and breathe this stuff. We guide clients through every single stage of the Dubai free zone setup. From getting documents attested to handling visa processing, our PRO services manage these crucial steps efficiently, so you can focus on what really matters—building your new business.

Budgeting for Costs, Visas, and Ongoing Compliance

Getting a clear picture of the real financial commitment for your Dubai free zone company setup is absolutely essential for long-term success. The initial licence fee you see advertised? That's just the tip of the iceberg. A proper budget needs to factor in everything from one-off registration costs to recurring visa fees and annual compliance obligations.

Sorting these numbers out upfront saves you from nasty surprises later and makes sure your new venture is built on solid financial ground.

Let's move beyond the flashy package prices and break down what it really costs to get up and running. This kind of transparency is key to planning effectively, ensuring you have enough capital not just to launch, but to actually grow and thrive.

A Realistic Breakdown of Your Initial Investment

The total outlay to get your company operational is made up of several distinct parts. Each one plays a critical role in establishing your legal presence and your ability to do business in the UAE. Getting these calculations wrong can seriously strain your cash flow right from the start.

Your main costs will fall into a few key buckets:

- Licence and Registration Fees: This is the main fee you'll pay to the free zone authority. It usually covers your business licence, registration certificate, and foundational documents like your Memorandum of Association. Prices vary wildly between free zones, but you'll find some packages starting from around AED 12,000.

- Office Space Rental: Every free zone company must have a registered address. Your choices range from a budget-friendly flexi-desk, perfect for solo entrepreneurs, to a full-blown private office for a growing team. You can find annual flexi-desk rentals starting from AED 5,000, while a private office will obviously cost a lot more.

- Establishment Card Fee: This is a mandatory, one-time fee to register your company with the immigration authorities. You absolutely cannot apply for any residence visas until this card is issued.

For a more comprehensive look at how these figures come together, check out our detailed guide on the cost of starting a business in Dubai, which breaks it down with more examples.

Navigating the Visa Process for You and Your Team

Getting residence visas is a major milestone. It's what allows you and your employees to legally live and work in the UAE. The process itself is pretty systematic, but it demands close attention to every detail. One crucial thing to remember is that your visa eligibility is directly linked to your office space.

A standard flexi-desk package, for instance, typically allows for one to three visas. If you need more staff, you’ll have to upgrade to a physical office. The general rule of thumb here is you get one extra visa for every 80-100 square feet of office space you rent.

The visa application journey has several steps, each with its own cost:

- Entry Permit: This is the initial document that lets the person enter the UAE for employment purposes.

- Medical Fitness Test: Every applicant has to go through a mandatory medical screening for communicable diseases.

- Emirates ID Application: This is for the official, government-issued identification card for all residents.

- Visa Stamping: This is the final stage where the residence visa is physically stamped into the passport.

Each of these stages has a government fee. Per person, you should budget somewhere between AED 4,000 to AED 7,000 for the whole process. This applies to your own investor visa, employee visas, and any dependent visas for your family.

Ongoing Responsibilities and Annual Compliance

Your financial and admin duties don’t stop once that trade licence is in your hands. To run a compliant free zone company, you have ongoing responsibilities that are vital for staying in good standing with the authorities.

"Many entrepreneurs focus so much on the setup that they overlook the annual recurring costs. Budgeting for renewals and compliance from day one is the hallmark of a well-planned business."

By far, your biggest ongoing expense will be the annual licence renewal. This fee, paid to the free zone, is usually about the same as your initial licence and registration cost. It is non-negotiable if you want to keep your company legally active.

But beyond the renewal, you also need to think about:

- Accounting and Bookkeeping: Keeping accurate financial records isn't just good practice; it's a legal requirement. Proper bookkeeping is mandatory for demonstrating substance and being prepared for any potential audits.

- Audit Requirements: Not all free zone companies need to submit an annual audit, but many do. It's vital to check the specific rules for your chosen free zone. If an audit is required, you'll need to hire a registered auditor, which comes with a professional fee you need to budget for.

- Corporate Bank Account: While opening the account might be free, most banks in the UAE have minimum balance requirements. If you dip below this, you'll be hit with monthly penalties.

At Smart Classic Business Hub, our support extends well beyond the initial setup. We offer ongoing help with VAT-compliant accounting, audit coordination, and PRO services to manage your annual renewals, ensuring your business stays compliant so you can focus on growth.

Common Setup Pitfalls and How to Sidestep Them

Setting up a company in a Dubai free zone looks straightforward on paper, but after helping countless entrepreneurs, we’ve seen where the hidden hurdles lie. These aren't just small admin headaches; they're mistakes that can genuinely cost you time, money, and that crucial early momentum. Knowing what to watch for is your best line of defence.

A lot of entrepreneurs get tripped up by picking a free zone that doesn't quite fit their long-term vision. It might have an attractive price tag, but if its list of approved activities doesn't perfectly match what you actually do, your licence is practically useless. It's a surprisingly common and very expensive error.

Another frequent oversight is underestimating the real, all-in cost. That advertised licence fee? That’s just the beginning. Smart budgeting means factoring in everything else: visa processing, office rent, the Establishment Card, document attestation, and other administrative fees that can pop up. Forgetting these can put a serious dent in your startup capital right from the get-go.

Misaligned Activities and Licence Scope

One of the most critical mistakes we see is choosing a business activity that’s too vague or doesn't cover all your services. You might pick "IT Consultancy," for example, but if you also plan to develop and sell your own software, that single activity won't cut it. Each free zone has a very specific, pre-approved list of activities, and there’s no room for deviation.

- The Pitfall: Selecting a free zone that seems perfect but lacks the exact licence activity you need. This forces a costly change or even a full relocation down the line.

- The Solution: Before you commit to anything, make a detailed list of every single service you will offer and every product you will sell. Meticulously cross-reference this list with the official activity lists of the free zones you're considering. Always go with the one that gives you the most precise match for your operations.

Document Attestation Delays

For certain company structures or depending on the shareholders' nationalities, documents like educational degrees or a power of attorney need to be legally attested. This isn’t a quick stamp; it’s a multi-step process that starts in your home country and involves various government bodies, including the UAE embassy.

Underestimating the time and complexity of document attestation is a classic rookie mistake. This single process can delay your entire company formation by weeks, if not months, if it’s not started early enough.

Don't wait until you've paid your registration fees to get this sorted. The moment you decide on your company structure, identify which documents need attestation and get the ball rolling immediately.

Visa Allocation and Office Mismatches

Here’s a classic scenario: picking a low-cost flexi-desk package without thinking about future hiring. Most of these basic packages come with a fixed, small visa allocation—often just one or two. If your plan is to hire a team of five in the first year, your initial setup will instantly become a roadblock. You'll be forced into an unplanned and often expensive office upgrade just to get more visas.

With the recent boom in new business registrations, especially in tech and e-commerce, this kind of forward-thinking is more important than ever. The environment is moving fast, and you need a solid foundation from day one. You can read more about Dubai's booming business registration trends to understand why getting this right is so crucial.

The fix is simple. Map out your hiring plan for the next 18-24 months. Then, choose an office and licence package that provides enough visa eligibility to support that growth from the outset. It’s always far more efficient to plan for growth than to have to react to it. Sidestepping these common errors will ensure your business journey in Dubai starts on the right foot.

Common Questions About Dubai Free Zone Setups

When you're looking to set up a company in a Dubai free zone, a lot of specific questions pop up. It’s completely normal. To help you out, I’ve put together answers to some of the most common queries we get from entrepreneurs who are exactly where you are right now. My goal is to give you direct, practical insights that clear up the confusion so you can move forward with confidence.

Can I Do Business on the UAE Mainland With a Free Zone Licence?

This is a really important point to get right from the start. A Dubai free zone licence gives you the green light to operate within your specific free zone’s borders and, of course, to do business internationally. What it doesn't allow is for you to trade directly with customers located on the UAE mainland.

So, how do you bridge that gap? The most common route is to partner with a local distributor or an agent who can handle mainland sales for you. Another path is to establish an official mainland branch of your free zone company. The key takeaway here is to think about your market entry strategy early on.

Is a UAE Corporate Bank Account Actually Mandatory?

Yes, it’s non-negotiable. As soon as you have your new trade licence in hand, opening a corporate bank account in the UAE is your next critical step. This isn't just a formality; it's essential for all your business transactions—from getting paid by clients to paying suppliers and staff—and it proves your company has financial substance.

Be prepared, though. The account opening process can be quite rigorous due to the banks' strict due diligence and compliance checks. My advice? Start the application process the moment your company is officially registered to avoid any hold-ups in getting your business operational.

What's the Difference Between an FZE and an FZC?

This one is simple and comes down to the number of shareholders you plan on having. It’s a straightforward but vital choice about your company's structure.

- Free Zone Establishment (FZE): This is the structure for a single shareholder. That owner can be an individual person or another company (a corporate entity).

- Free Zone Company (FZC): This structure is for businesses with two or more shareholders. You might also see it called a Free Zone Limited Liability Company (FZ-LLC).

Which one you choose depends entirely on your ownership plan. Both the FZE and FZC offer the exact same core benefits, including 100% foreign ownership and all the tax advantages you’re looking for.

The core benefits remain the same regardless of your company structure. The decision between an FZE and an FZC is purely about how many owners will be on the company's books.

How Long Does the Whole Setup Process Take?

The timeline for a Dubai free zone company setup isn't set in stone; it typically ranges from just a few business days to several weeks. What causes the variation? A few things: the specific free zone you pick, how complex your business activities are, and whether your documents are all in order.

For instance, a standard consultancy licence with perfect paperwork might be turned around in less than a week. On the other hand, an industrial licence that needs external approvals from other government bodies will naturally take longer. Working with an experienced consultancy like ours can really speed things up, as we ensure every piece of paper is correct from day one, helping you get up and running much faster.

Answering these kinds of questions is what we do all day, every day. The team at Smart Classic Business Hub is here to make the entire setup process straightforward and efficient, from picking the right structure to getting your visas finalised. Find out how our expert services can get your Dubai business off the ground smoothly by visiting us at https://smartclassic.ae.