When you're ready to start your company formation in UAE, the entire journey hinges on two critical decisions you make right at the beginning: what your business will actually do (your business activity) and how you'll structure it legally.

Getting these two things right from the get-go is everything. Honestly, it's the foundation of your whole venture, and it dictates your scope, ownership rights, and all the compliance you'll deal with later. A mistake here can be a real headache to fix down the line.

Starting Your UAE Business Journey

The first question I always ask clients isn't "Where do you want to set up?" It's "What exactly is your business?" Pinpointing your business activity is the absolute cornerstone of the setup process. Why? Because that single decision determines the kind of licence you need and which jurisdictions—mainland or free zone—are even on the table for you.

For example, a tech founder building new software is on a completely different path than a consultant offering management advice. The tech business needs a commercial or technology licence, while the consultant is heading for a professional licence. This isn't just paperwork; it has massive real-world implications for ownership, liability, and even who you can do business with.

Aligning Activity with Legal Structure

Once you’ve nailed down your activity, the next piece of the puzzle is picking a legal structure that fits. This is where a lot of entrepreneurs get bogged down in jargon, but it's simpler than it looks. The most common choices are a Limited Liability Company (LLC) on the mainland or a Free Zone Company (FZCO/FZE) in one of the many free zones.

Let's go back to our tech founder to see how this plays out in the real world.

- The Mainland LLC Route: If their goal is to sell their software directly to local UAE businesses or bid on government tenders, a mainland LLC is the only way to go. It gives them complete freedom to operate anywhere in the UAE economy.

- The Free Zone FZCO Route: But what if their clients are all international? In that case, 100% ownership and zero need for a local service agent might be more appealing. A free zone like Dubai Internet City would be a perfect fit, and an FZCO structure is ideal for a startup with multiple shareholders.

I can't stress this enough: choosing the right combination of activity and legal structure is the single most impactful decision you'll make. It directly affects your setup costs, your operational freedom, and how easily you can scale your business later on.

The Foundation for Success

Nailing these initial decisions creates a solid launchpad for your company. A mismatch, like setting up in a free zone when your main goal is to open a retail shop in a local neighbourhood, will create massive operational roadblocks.

You have to think about your long-term goals from day one. Are you planning to hire a big local team? Will you be importing goods? Are your main clients mainland companies? The answers to these questions will point you in the right direction. It's also worth taking a moment to understand the key benefits of setting up a business in Dubai, as this can help you see which structure truly aligns with your vision.

Choosing Your Jurisdiction Mainland vs Free Zone

When it comes to setting up your business in the UAE, the very first—and most critical—decision you'll make is choosing your jurisdiction. This isn't just about picking an address; it’s a strategic choice that dictates who you can do business with, your ownership structure, and your overall market access. You've got three main routes: Mainland, Free Zone, and Offshore, and each one is built for a different kind of business.

Let your long-term goals guide you. Do you dream of opening a shop in a Dubai mall? Do you need to trade directly with other local businesses or bid on government contracts? If that sounds like you, then a Mainland company is your only real option. It gives you a pass to operate anywhere and everywhere within the UAE.

But what if your business is all about international trade? Or perhaps you're a consultant with clients scattered across the globe, or you run an e-commerce store shipping worldwide. In that case, a Free Zone setup is probably the smarter move. These are specialized economic hubs designed to attract foreign entrepreneurs just like you with some seriously compelling perks.

Understanding the Mainland Advantage

A Mainland company is registered directly with the Department of Economic Development (DED) in the emirate you choose, like Dubai or Abu Dhabi. The biggest plus? Total freedom. You can set up your office or store anywhere, trade without restriction across the country, and tap directly into the bustling local market.

The game really changed recently with new legal reforms. Today, you can get 100% foreign ownership for most business activities on the mainland. This was a huge hurdle for international investors in the past, but now, it makes a mainland setup more appealing than ever before.

Exploring the World of Free Zones

The UAE has more than 45 Free Zones, and it's best to think of them as independent, industry-specific business parks. You have zones dedicated to media (like Dubai Media City), tech (Dubai Internet City), and even commodities trading (DMCC). Each one has its own set of rules and its own regulator.

The main draw for Free Zones is crystal clear: 100% foreign ownership, zero corporate and personal taxes, and the ability to send 100% of your profits back home. This combination makes them incredibly popular for international traders, service providers, and consultants who don't necessarily need to operate within the local UAE market. For a deeper look at how they stack up against a mainland company, check out our detailed guide on Mainland vs Freezone in Dubai.

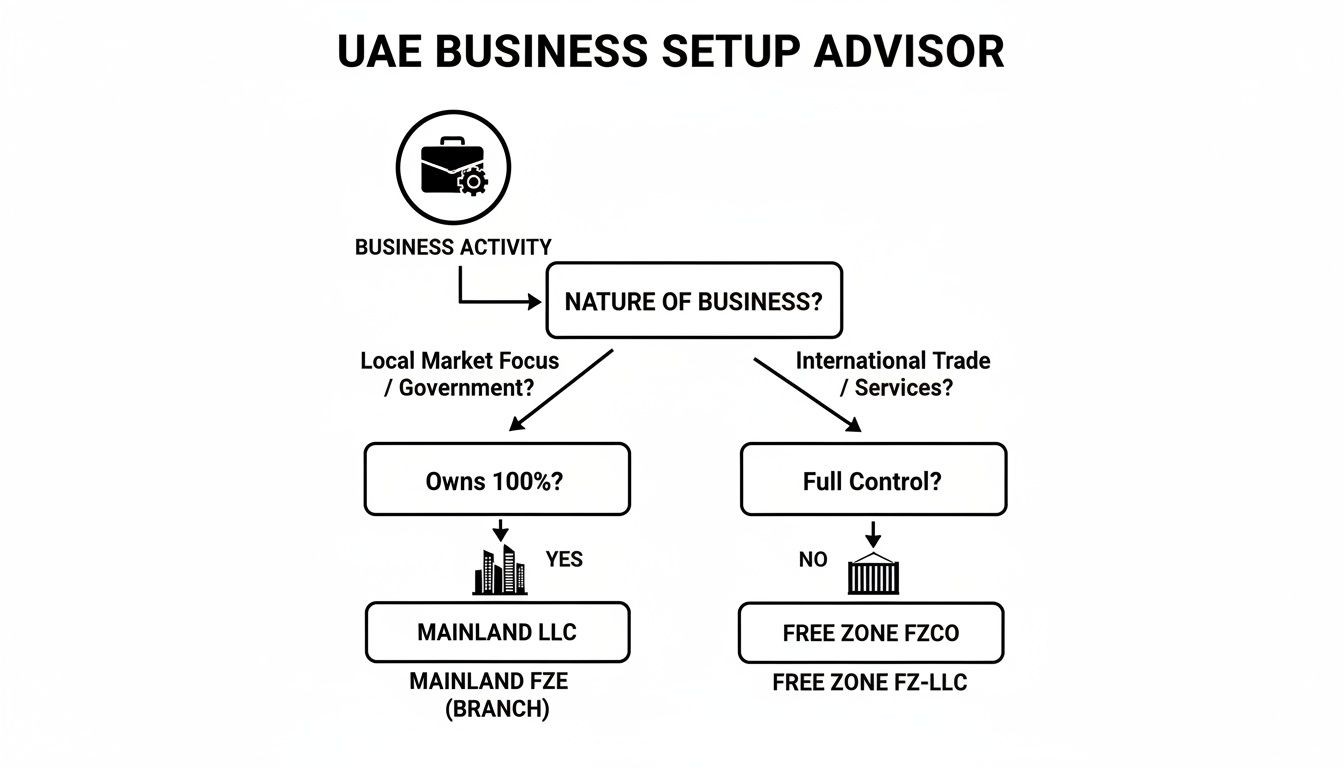

This decision tree gives you a quick visual on how to choose between mainland and free zone based on what your business actually does.

As you can see, if your focus is local, the path points straight to a mainland LLC. If you're looking outward to the global market, a free zone is likely your best bet.

A Quick Look at Offshore Companies

There's a third, more niche option: an Offshore company, sometimes called an International Business Company (IBC). These aren't for doing business inside the UAE at all. Instead, they act as legal vehicles for things like international trade, protecting your assets, or holding investments.

An offshore company, for example one registered with Ras Al Khaimah International Corporate Centre (RAK ICC), offers a private and tax-free way to manage global assets. The key thing to remember is that it doesn't come with residency visas and you can't trade locally.

The difference is simple when you boil it down: Mainland companies are for operating within the UAE market. Free Zone companies operate from the UAE to serve the rest of the world. Offshore companies are purely for international financial and legal structuring.

Comparing Your Options Directly

To make the right call, you need to put these jurisdictions side-by-side and see how they measure up against your business plan. The best choice for a tech startup won't be the same for a logistics firm or an investment holding company.

Here’s a straightforward table to help you compare the pros and cons.

UAE Jurisdiction Comparison Mainland vs Free Zone vs Offshore

| Feature | Mainland Company | Free Zone Company | Offshore Company |

|---|---|---|---|

| Business Scope | Can trade anywhere in the UAE and internationally. | Primarily trades internationally or within its specific free zone. | Only for business activities conducted outside the UAE. |

| Ownership | 100% foreign ownership for most activities. | 100% foreign ownership is standard. | 100% foreign ownership. |

| Office Space | Mandatory physical office space required (Ejari). | Offers flexible options from flexi-desks to large offices. | No physical office is required; a registered agent address is used. |

| Visa Eligibility | High eligibility for visas, dependent on office size. | Visa eligibility is often linked to the office package chosen. | Not eligible for UAE residency visas. |

| Corporate Tax | Subject to the standard 9% UAE Corporate Tax. | Qualifies for 0% Corporate Tax for specific income sources. | Exempt from UAE Corporate Tax. |

| Government Approvals | Requires approvals from DED and other ministries. | All approvals are managed by the specific free zone authority. | Regulated by the specific offshore authority (e.g., RAK ICC). |

Getting your jurisdiction right from the start is without a doubt the most important step in your UAE business journey. It sets the foundation for your company's growth, compliance needs, and day-to-day operations. Taking the time to get this right will save you a world of headaches, time, and money down the road.

Navigating The Company Registration Process

Once you’ve locked in your jurisdiction and legal structure, it’s time to get into the nitty-gritty: the registration itself. This part can feel like a maze of paperwork and approvals, but it’s actually a very logical sequence of events. Think of it less as a bureaucratic hurdle and more as a clear roadmap to getting your business legally recognised and up and running.

This whole process is becoming more efficient every year. The UAE's business scene is absolutely booming, with 250,000 new companies added in just one year, bringing the total to over 1.4 million. This incredible growth shows just how accessible registration has become. You can dive into the details of this expansion in this insightful economic report.

Securing Your Trade Name and Initial Approval

Your first real step is choosing and reserving a trade name for your company. This is more than just a creative decision; your name has to comply with strict government naming rules. For instance, names that are already taken, violate public morals, or contain religious references will be flat-out rejected.

Here are a few insider tips to avoid common mistakes:

- Be Unique: Don't pick a name that's too generic or sounds too similar to a major brand. It's a recipe for rejection.

- Check for Clarity: The name should give a clear idea of your business activity without being misleading.

- Follow the Rules: Be aware that certain words like "International" or "Global" often come with a higher fee or require extra justification.

Once your name is approved, you’ll apply for an Initial Approval. This is a preliminary green light from the relevant authority—either the Department of Economic Development (DED) for mainland or the specific free zone authority—stating they have no objection to you starting your business. It’s a vital document that unlocks all the next steps.

Drafting Your Legal Foundation: The MOA

With your initial approval in hand, the next job is to draft your company’s foundational legal document: the Memorandum of Association (MOA). If you're setting up a mainland LLC, this is an especially critical document. It lays out the company’s rules, shareholding structure, and the exact responsibilities of each partner.

The MOA has to be drafted in both English and Arabic and then notarised by a public notary. This is a step where professional guidance is worth its weight in gold. A simple error in your MOA, like a vague definition of partner responsibilities, can lead to serious disputes down the road.

Think of your MOA as the constitution for your company. It’s not just a piece of paper for registration; it's the legal framework that will govern your business operations and shareholder relationships for years to come.

The Importance of a Physical Address

A non-negotiable requirement for company formation in the UAE, especially on the mainland, is securing a physical office space. You can't just use a P.O. box; you need a registered physical address documented by an Ejari. An Ejari is the official online registration system for all tenancy contracts in Dubai, managed by the Real Estate Regulatory Agency (RERA).

This rule ensures every business has a legitimate physical presence. Your signed tenancy contract gets uploaded to the Ejari system, and the certificate it generates is a mandatory document for your final trade licence application. Free zones are often more flexible, offering everything from dedicated offices to cost-effective flexi-desks that still provide a valid registered address.

Submitting Your Documents and Final Approval

Now, it's time to pull all your documents together for the final submission. This typically includes:

- The approved trade name certificate and initial approval.

- The notarised Memorandum of Association (MOA).

- Passport copies of all shareholders and the appointed manager.

- The Ejari certificate for your office lease.

- Any extra approvals needed for special business activities (e.g., from the Health Authority or Municipality).

These documents are submitted to the relevant authority, either through government service centres like Tasheel or Amer for mainland setups, or directly to the free zone’s administration. Any missing document or incorrect information will cause delays, which is why meticulous preparation is key.

This is where professional PRO (Public Relations Officer) services become incredibly useful. They handle these submissions daily and know exactly what authorities are looking for, ensuring a smooth and fast process.

After a final review, the authority will issue a payment voucher for your trade licence fees. Once that's paid, your official trade licence is issued, and your company is legally ready to do business in the UAE.

Managing Visas and Post-Setup Compliance

Getting your trade licence is a huge milestone, but it's really just the beginning of the journey. Once the paperwork is done and the company is officially formed, your focus has to shift to the practical side of things: getting residency visas for yourself and your team, and setting up the routines for ongoing compliance that will keep your business on the right side of the law.

This is the phase where your company goes from an idea on paper to a living, breathing, operational business. Honestly, handling the visas and compliance properly is every bit as important as the initial registration.

Securing Your Investor and Employee Visas

Before you can even think about applying for visas, your new company needs an Establishment Card. It’s a small card, but it's the key that unlocks everything else. It officially registers your business with the immigration and labour departments, turning it into an entity that can legally sponsor people.

With the Establishment Card in hand, you can start the process of getting your own residency visa as the company's investor. It’s a multi-stage process, but it’s very structured.

- First, you'll apply for an entry permit, which lets you stay in the UAE legally while the rest of the process unfolds.

- If you’re already in the country on a tourist visa, you’ll do a "change of status" once the permit is issued.

- Next up is the mandatory medical fitness test, which is standard for all residents and screens for specific diseases.

- Finally, you’ll visit a designated centre to give your biometrics (fingerprints and photo) for your Emirates ID.

Once all these steps are cleared, your passport gets the residency visa stamp, and your Emirates ID arrives soon after. Sorting out your own visa is the top priority because only then can you start sponsoring your family or your employees. To get a better handle on that first crucial step, you can learn more about the UAE Establishment Card in our detailed guide.

Maintaining Ongoing Business Compliance

With your visa sorted, your attention needs to turn to the non-negotiable world of compliance. The UAE fosters a fantastic business environment by making sure every company plays by the same clear rules. Keeping up with these duties isn't just a good idea—it's essential for your company’s survival and growth.

The government's supportive framework has paid off, helping national small and medium enterprises (SMEs) grow by an incredible 63 percent in the last five years. That kind of growth is built on a stable regulatory system that everyone, local or foreign, has to follow.

Key Compliance Obligations

There are a few key areas you'll need to keep on your radar. Dropping the ball on these can lead to hefty fines and can even halt your operations.

- Corporate Tax Registration: Every single business must register for Corporate Tax with the Federal Tax Authority (FTA). This is mandatory even if your profits are below the AED 375,000 taxable threshold.

- VAT Registration and Filing: If your annual turnover is expected to hit AED 375,000, you are legally required to register for Value Added Tax (VAT). This means filing regular returns and keeping very organised financial records.

- Annual Licence Renewal: Your trade licence isn’t a one-and-done deal; it needs to be renewed every year. This usually involves making sure your office lease (Ejari) is current and paying the renewal fees on time.

Staying compliant isn't just about dodging penalties. It’s about building a solid, reputable business. When you keep accurate records and handle renewals on time, you're showing that you're serious about operating professionally in the UAE.

By getting a handle on your visa processes and staying ahead of compliance deadlines, you're building a stable foundation for your business to really take off. It frees you up to focus on what you came here to do: grow your company in one of the most exciting markets on the planet.

Common Mistakes to Sidestep When Forming Your UAE Company

Setting up a business in the UAE is a well-trodden path, but it’s definitely not without its potential stumbles. While the country is incredibly business-friendly, a few common oversights can quickly lead to frustrating delays, unexpected costs, and even legal headaches. Knowing what these hurdles are before you start can make your company formation in UAE a much smoother ride.

It’s easy to get swept up in the excitement of a new venture. But trust me, avoiding these frequent mistakes is what separates a seamless setup from a stressful one. Think of this as your friendly cautionary guide, built from years of seeing what works and what doesn't, to keep your business journey on the right track from day one.

Choosing the Wrong Business Activity

This is, without a doubt, the most critical error an entrepreneur can make. Your entire trade licence is built around the specific business activities you declare. Picking one that doesn't quite fit what you actually do—maybe to shave a little off the fees or because it just seemed "close enough"—is a recipe for trouble.

If an inspector finds you operating outside the scope of your licence, you could be looking at significant fines. More importantly, it can stop you from legally invoicing for certain services or trading specific goods. This can cripple your business before you've even had a chance to get going.

Take your time and really dig into the official list of over 2,000 business activities. If you offer a range of services, make sure every single one is listed on your licence. It’s the only way to stay compliant and avoid problems down the line.

Here’s a real-world example: a marketing consultant who also builds websites for clients must have both activities on their licence. If they only list "Marketing Consultancy," all their web development revenue could be at risk during an audit.

Underestimating the True Setup Costs

So many entrepreneurs create a budget based only on the trade licence fee, and this is a major miscalculation. That initial quote for your licence? It's just one piece of a much larger financial puzzle. Forgetting to factor in all the other associated costs can put a serious, and often fatal, strain on your startup capital.

A realistic budget has to include a whole host of other essential expenses. These are the costs that people often forget, and they can add up fast, sometimes even doubling what you thought you'd pay.

- Visa and Emirates ID Fees: Every residency visa, whether for owners or employees, comes with its own set of costs for medical tests, biometrics, and the final stamping in your passport.

- Establishment Card: This is a mandatory card that registers your company with the immigration department, and it has its own separate fee.

- Government Approvals: Some business activities need a sign-off from external ministries or regulatory bodies, and each of those applications has a fee.

- Office Lease (Ejari): For a mainland company, the cost of renting and officially registering a physical office (Ejari) is a significant upfront expense you can't ignore.

- PRO Service Fees: While using a professional PRO service saves a massive amount of time and prevents costly errors, their fees need to be built into your initial budget.

Failing to account for these will leave you scrambling for funds right when you should be focused on launching and growing your business.

Trying to Navigate the Paperwork Alone

The UAE's registration process is logical, but that doesn't mean it's simple. For a newcomer, the sheer volume of documentation, the requirement for official Arabic translations, and the very specific submission protocols can be completely overwhelming. We've seen countless people try to manage this themselves, only to have their applications rejected for tiny errors.

A single missing signature, a document formatted the wrong way, or a missed deadline can send you right back to square one. These delays aren't just frustrating; they cost you real time and money, pushing back the date you can actually start operating. A professional setup consultant just knows the nuances of every step, ensuring every document is perfect the first time.

Picking the Wrong Mainland Partner

For mainland companies that need a Local Service Agent (LSA) for a professional licence, your choice of partner is absolutely crucial. An LSA isn’t a shareholder, but they are a legal requirement for certain company structures. A huge mistake is choosing an LSA based only on who offers the lowest annual fee, without thinking about their reliability or professionalism.

An LSA who is unresponsive or uncooperative can become a massive roadblock. You need them to sign off on essential admin tasks like visa applications, licence amendments, and other government paperwork. If they're unavailable or just plain difficult to work with, your business operations can grind to a complete halt. It's vital to partner with a reputable and dependable agent who actually understands and fulfils their responsibilities.

Your UAE Business Setup Questions Answered

When you’re looking to set up a company in the UAE, a lot of questions pop up. It’s natural. Even with a solid plan, entrepreneurs I talk to always have specific worries about the real costs, how visas work, and the legal nitty-gritty. This section is all about tackling those common questions head-on with straight, practical answers.

Think of it as your quick-reference guide. Getting these points clear in your head now will save you a ton of time and help you lock in your business setup strategy with confidence.

How Much Does It Cost to Set Up a Company in The UAE?

This is the big one, isn't it? It’s almost always the first question I get asked, but the truth is, there's no single price tag. The cost to get your company off the ground in the UAE depends heavily on a few key choices: where you set up (mainland or a free zone), your specific business activities, and how many visas you'll need.

Let’s talk real numbers. A simple, no-frills free zone package with one visa might start around AED 15,000. But if you're looking at a more involved mainland setup, say for a trading business that needs a physical office and a few external government approvals, you could easily be looking at AED 35,000 or more for the first year.

My best piece of advice? Always, always ask for a fully itemised quote. It should break down every single fee, from one-off registration costs to annual renewals like your licence and office space. That level of detail is crucial for budgeting properly and making sure there are no nasty surprises down the line.

Can I Get a UAE Residence Visa by Opening a Company?

Yes, absolutely. For many people, starting a company is the most direct way to get a UAE residence visa. As the owner of your new business, you're eligible to apply for what’s known as an investor or partner visa.

This visa is usually valid for two years and can be renewed as long as your company stays active and in good standing. The moment your visa is stamped and you have your Emirates ID, you can then sponsor your immediate family, like your spouse and children, to join you here.

Your company can also sponsor visas for your employees. How many visas you're allowed (your "quota") typically depends on the size of your office if you're on the mainland, or the specific package you've chosen in a free zone.

Do I Still Need a Local Emirati Partner?

For most businesses today, the answer is a firm no. This is one of the biggest and best changes we’ve seen in UAE business law recently. Thanks to updates in the Commercial Companies Law, the vast majority of mainland businesses can now be set up with 100% foreign ownership.

This reform got rid of the old rule that required a local Emirati partner to own a 51% majority share, and honestly, it's been a game-changer for entrepreneurs wanting to set up on the mainland.

In the free zones, 100% foreign ownership has always been a key benefit, and that hasn't changed. Just keep in mind that a handful of strategic or highly regulated industries on the mainland might still have specific ownership requirements, so it's always smart to double-check for your exact business activity before you start.

What Is The Difference Between a Trade Licence and a Business Licence?

Here in the UAE, these terms are basically two sides of the same coin—they mean the same thing. Whether someone calls it a "trade licence" or a "business licence," they're talking about the official government permit that makes your company legal and allows you to operate.

This document is your company's ID card. It clearly lists your registered company name, legal structure (like an LLC or FZCO), your official address, and—most importantly—the exact business activities you're approved to carry out.

The type of licence you get, whether it's Commercial, Professional, or Industrial, is decided by the nature of those activities. A company that buys and sells goods will get a Commercial Licence, while a consulting firm will be issued a Professional Licence. Simple as that.

Getting clear answers to these questions is your first step to a successful launch. At Smart Classic Business Hub, we cut through the confusion and give you the expert guidance you need for every part of your company formation. We're here to make sure you build your business on a solid, well-informed foundation. Contact us today to get started.