Figuring out the total cost to set up a company in Dubai can feel like trying to hit a moving target. You might hear numbers ranging from AED 15,000 for a simple free zone package all the way up to AED 70,000 or more for a mainland LLC with a physical office and multiple visas. The truth is, the final number depends entirely on your choices: the jurisdiction, your specific business activity, and how you plan to operate.

A High-Level Map of Dubai Business Setup Costs

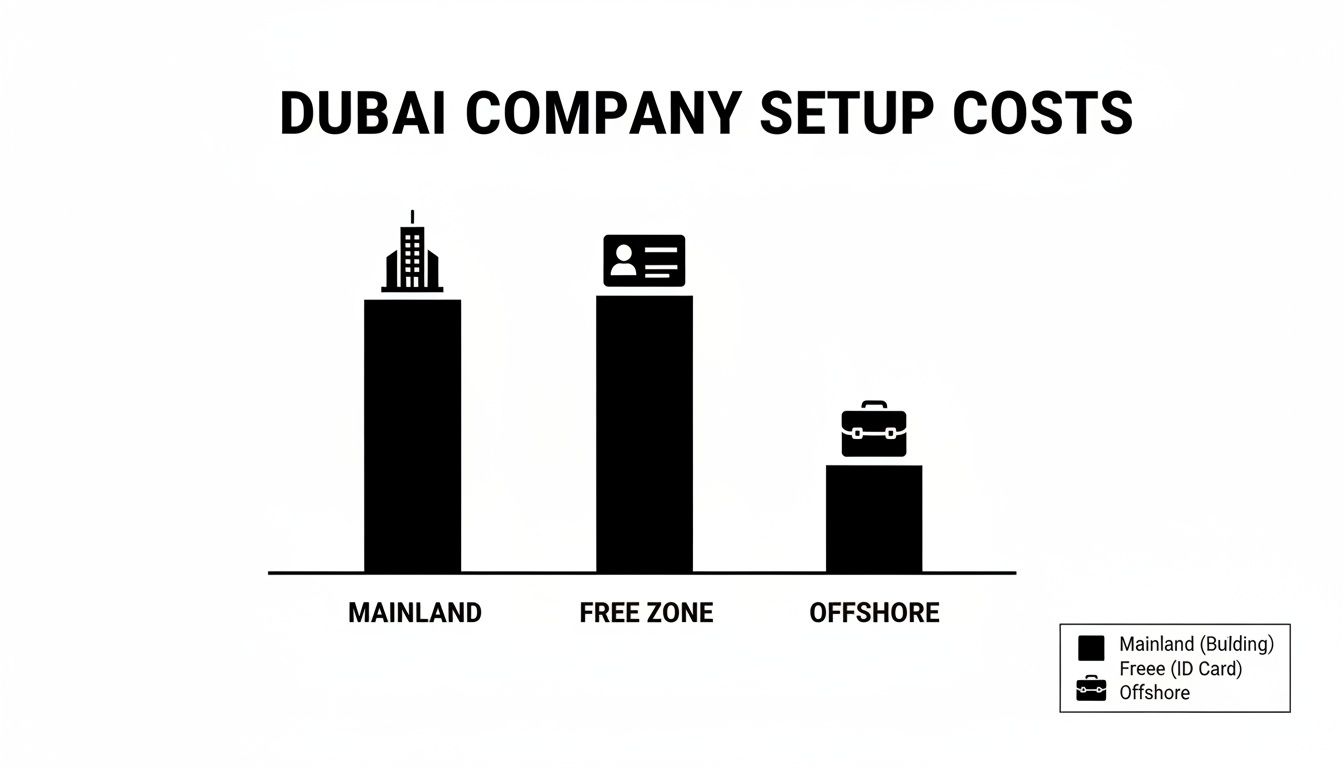

"So, what does it really cost to start a business in Dubai?" It’s the first question on every founder's mind, and the answer isn’t a single figure. It's a spectrum of possibilities defined by three main pathways: mainland, free zone, and offshore. Each route is built for a different strategic goal and comes with its own unique price tag.

A good way to think about it is like choosing a vehicle for a journey. An offshore company is like a nimble scooter—highly cost-effective and perfect for a very specific, limited task. A free zone company is the versatile sedan, offering a fantastic balance of features, freedom, and affordability that suits most entrepreneurs. Then you have the mainland company, which is like a robust SUV; it gives you unrestricted access to every road in the UAE but requires a bigger upfront investment.

Comparing the Three Jurisdictions

To build a budget that makes sense for your venture, you first need to grasp the fundamental differences between these options.

- Mainland Setup: This is your ticket to the entire UAE market, with no restrictions. It's the go-to choice for businesses that need to trade directly with local customers or other mainland companies. This freedom, however, usually comes with higher initial costs, often due to mandatory office space and more involved licensing procedures.

- Free Zone Setup: This is the most popular route for foreign investors, and for good reason. It offers 100% ownership and attractive tax exemptions. With over 40 free zones to choose from, costs can vary wildly, from budget-friendly packages for freelancers to premium setups for large enterprises.

- Offshore Setup: Think of this as a non-operational entity. It’s a powerful tool for international trade, protecting assets, or holding investments. It’s by far the most affordable option, but it won’t get you a visa or allow you to do any business inside the UAE.

The chart below gives you a clear visual breakdown of the typical starting costs for each path.

As you can see, mainland setups typically require the highest initial investment, while offshore entities offer the most economical entry point for very specific corporate structuring needs. In this guide, we'll pull back the curtain on these numbers, breaking down every cost component so you can make a smart financial decision and set your Dubai venture up for success from day one.

Breaking Down Mainland Company Setup Costs

Opting for a Dubai mainland setup is a strategic move if you want direct, unrestricted access to the bustling local UAE market. This is the path you take to trade freely with anyone in the country, bid on government projects, and set up your shop or office anywhere you like. But this level of freedom comes with a more layered and structured cost breakdown than you’ll find in other jurisdictions.

Think of it like building a custom house instead of renting a pre-furnished apartment. You get more control and long-term potential, but you’re on the hook for every single detail, from the building permits to the final inspections. Setting up on the mainland follows a similar logic; it involves several distinct government fees and mandatory steps that all contribute to your total investment.

Core Government and Licensing Fees

Your journey to getting a mainland trade license starts with a series of non-negotiable government fees. These are the absolute essentials required by the Dubai Department of Economy & Tourism (DET) to legally recognize your business.

The process usually happens in stages, and each one has a price tag attached:

- Trade Name Reservation: This is your first official step. You'll pay a fee to secure your unique business name, making sure it follows all the UAE's naming rules.

- Initial Approval Certificate: Once your name is locked in, you need initial approval for your business activities. This certificate is basically the government giving a nod of approval to your proposed venture.

- Memorandum of Association (MOA) Attestation: Your MOA is the legal blueprint for your company. It has to be drafted and notarized, which means paying for both the legal drafting and the official court attestation.

- Trade Licence Issuance Fee: This is typically the biggest chunk of the government fees. The exact amount depends on your specific business activity and legal structure, like whether you’re setting up a Limited Liability Company (LLC).

While the costs for mainland company formation in Dubai have become more predictable, the main drivers of your budget will always be the government fees and mandatory office rent. The DET has made its fee structures simpler over the years, but a realistic first-year outlay for a lean startup often lands somewhere between AED 40,000–70,000, and that includes a small office and a couple of visas. You can learn more about the factors influencing Dubai mainland license costs on bizinvestfirm.com.

Ancillary Costs You Cannot Ignore

Beyond the core DET fees, several other expenses are mandatory for a mainland LLC. These are often the "hidden" costs that can catch new entrepreneurs by surprise if they haven't budgeted for them.

The most significant of these is the requirement for a physical office. Unlike some free zones that are fine with flexi-desks, a mainland company must have a registered physical address, proven with an Ejari—the official tenancy contract registration in Dubai.

Other crucial ancillary costs include:

- Establishment Card: This card is essential for opening your company’s immigration file, which you’ll need to apply for any employee visas.

- Labour File Opening: You'll also need to register your company with the Ministry of Human Resources and Emiratisation (MOHRE).

- Local Service Agent/Corporate Sponsor Fees: The 100% foreign ownership law has been a game-changer, but certain professional activities still require a UAE national as a Local Service Agent. This service comes with an annual fee.

A Practical Cost Example for a Mainland LLC

Let's ground this in a real-world example. Imagine you're launching a small consultancy—a Professional Services LLC—with two partners, and both of you will need investor visas.

Here’s a rough estimate of what your first-year company formation dubai costs could look like:

| Cost Component | Estimated Cost (AED) |

|---|---|

| Trade Name & Initial Approval | 1,000 – 1,500 |

| MOA Notarisation & Typing | 1,500 – 2,500 |

| Trade Licence Issuance Fee | 12,000 – 18,000 |

| Mandatory Office Rent (Smallest Space) & Ejari | 15,000 – 25,000 (Annually) |

| Establishment Card & Immigration File | 2,000 – 3,000 |

| Subtotal (Core Setup) | ~31,500 – 50,000 |

| 2 x Investor Visa Applications (incl. medicals) | 8,000 – 12,000 |

| Estimated Total Year 1 Outlay | ~AED 39,500 – 62,000 |

This breakdown really shows how the costs add up beyond just the license itself. The mandatory office rent and visa processing are substantial expenses that have to be part of any realistic mainland budget from day one.

Understanding Free Zone Company Formation Costs

Dubai's free zones are a huge draw for entrepreneurs from all over the world, and for good reason. They offer the golden ticket: 100% foreign ownership and some very attractive tax perks. With more than 40 different free zones, each with its own focus and price list, figuring out the costs can feel a bit overwhelming at first. But this variety is actually a massive advantage, as it means there's a perfect fit for just about any business model or budget.

Think of it like choosing a car. You could go for a simple, budget-friendly model that gets you from A to B with minimal fuss and cost. Or, you could invest in a high-end, premium vehicle loaded with features. The key is knowing what's under the hood—what drives the price—so you can pick a free zone that matches what you want to achieve without breaking the bank.

The Core Components of Free Zone Costs

Unlike setting up on the mainland where you juggle separate government fees, free zones usually bundle everything into neat packages. This definitely makes life easier, but you still need to know exactly what you’re paying for.

Your total package price will almost always boil down to three main things:

- The Licence Type: A general trading licence, which lets you deal in a wide range of goods, will naturally cost more than a licence for a specific service like consulting. Specialised activities, say in media or healthcare, often come with higher fees, too.

- The Office Solution: This is one of the biggest factors influencing your cost. Your options can range from a basic flexi-desk (essentially a shared hot-desking space) all the way up to your own dedicated private office. The flexi-desk is the go-to for keeping costs down, while a private office will push the annual price up significantly.

- The Visa Quota: How many residency visas do you need? This is tied directly to your office choice. A zero-visa package will be the cheapest option. If you or your team need visas, the price goes up. A small office space might get you two or three visas, while renting a larger office unlocks a bigger quota.

It’s pretty simple, really. The more you need—whether that's a bigger office footprint or the ability to bring more people on board—the higher your company formation dubai costs will be. Our detailed guide on free zone company setup in the UAE dives deeper into choosing the right package for your needs.

Budget-Friendly vs. Premium Free Zone Costs

The price gap between an entry-level free zone and a premium one is pretty wide. For example, zones like IFZA (International Free Zone Authority) or Meydan have built a reputation for their competitive, all-in-one packages. This makes them a magnet for startups, freelancers, and solo consultants looking for an affordable launchpad.

On the other end of the spectrum, you have prestigious hubs like the DMCC (Dubai Multi Commodities Centre) or DIFC (Dubai International Financial Centre). These places charge a premium because they offer more than just a licence; they provide a high-end business address, world-class infrastructure, and a curated community for specific industries like commodities trading or finance. That kind of positioning comes with a higher price tag.

Free zone setup costs in Dubai can start from under AED 20,000 for a basic package and climb to over AED 60,000 in the top-tier hubs, all depending on your licence, office, and visa requirements. To give you a concrete example, a standard package in a major zone like DMCC, which includes the licence, registration, and a workspace, often starts around AED 35,484 for the first year.

For most small and medium-sized businesses, a realistic first-year budget, including a desk space and one visa, usually lands somewhere in the AED 30,000–60,000 range.

Cost Comparison of Popular Dubai Free Zones (Year 1 Estimates)

To give you a clearer picture, let's break down the typical first-year costs across different free zone tiers. This table really shows how your choice of location can impact your startup budget.

| Free Zone Category | Example Free Zone | Estimated Licence & Registration Cost | Typical Office Solution Cost | Estimated Total Year 1 Cost (with 1 visa) |

|---|---|---|---|---|

| Budget-Friendly | IFZA or Meydan | AED 12,000 – 15,000 | Flexi-Desk (included in package) | AED 18,000 – 25,000 |

| Mid-Range | Dubai South | AED 15,000 – 20,000 | Shared Office or Flexi-Desk | AED 25,000 – 40,000 |

| Premium Hub | DMCC | AED 30,000 – 40,000+ | Flexi-Desk or Small Private Office | AED 45,000 – 65,000+ |

As you can see, the total cost can easily double—or more—when you move from a budget-friendly option to a premium hub. This really drives home how important it is to match your free zone not just to your business activity, but also to your financial runway. By taking a hard look at what you truly need right now for office space and visas, you can find a smart, cost-effective solution to get your Dubai business off the ground without overspending.

The Costs of Premium and Offshore Setups

While mainland and free zone setups work for most businesses, some ventures need a more strategic—and often more specialised—structure. If you’re in finance or focused on international asset management, a premium financial hub or a lean offshore entity might be on your radar. Naturally, these elite options come with their own unique cost structures.

Think of it this way: a standard free zone is like a high-quality business park, perfect for a wide range of companies. A premium financial free zone, on the other hand, is like setting up shop in the heart of London’s financial district—you get unmatched prestige and a world-class regulatory environment, but with a price tag to match. An offshore company? That’s like a secure digital vault. It’s not a place you work from, but an incredibly efficient tool for holding and protecting assets around the globe.

The Investment for a Premium Financial Hub

For businesses in finance, fintech, or wealth management, a premium jurisdiction like the Dubai International Financial Centre (DIFC) is the gold standard. Operating in the DIFC immediately signals trust and credibility, largely because it’s governed by an independent legal system based on English common law. This robust framework means the company formation dubai costs are in a completely different league.

The investment here is substantial, and it's driven by a few key things:

- High-Tier Licensing Fees: Getting a licence from the Dubai Financial Services Authority (DFSA) is a rigorous process, and the fees reflect that.

- Mandatory Class-A Office Space: Forget a simple flexi-desk. The DIFC requires companies to lease premium office space within its district, which is a major annual expense.

- Strict Regulatory Compliance: Ongoing compliance, hefty capital requirements, and professional indemnity insurance all add to the operational overhead.

For firms operating within elite financial free zones like the DIFC, the first-year setup costs can escalate dramatically. A standard non-financial professional services firm should budget for AED 257,000–279,000 in its first year, while fully regulated financial services companies can see costs rise to between AED 660,000–740,000. Discover more insights about DIFC business setup costs and requirements on kayrouzandassociates.com.

The Lean Efficiency of an Offshore Company

Shifting gears from the high-investment world of financial hubs, we land on the offshore company—a model built for pure efficiency and global reach. Jurisdictions like the Jebel Ali Free Zone (JAFZA) and the Ras Al Khaimah International Corporate Centre (RAK ICC) offer offshore setups that are perfect for specific, non-operational roles.

An offshore entity isn’t designed for doing business inside the UAE. Instead, it acts as a powerful international tool. It’s the ideal structure for:

- Holding Company: Owning shares in other companies around the world.

- Asset Protection: Shielding real estate, intellectual property, or other valuable assets under a secure corporate veil.

- International Trading: Handling global trade and invoicing without needing a physical presence in Dubai.

The key thing to grasp is that an offshore company is a legal entity, not a physical one. This means no office space is required, and just as importantly, it does not grant you or your employees UAE residency visas. This lack of physical infrastructure is exactly what makes it such a cost-effective solution. The setup and annual renewal fees are minimal compared to any other structure, making it a smart, strategic choice for investors focused purely on corporate structuring and asset management.

Uncovering Hidden Fees and Annual Renewals

Your initial setup fee is just the first chapter of your financial story. To build a sustainable business in Dubai, you need to look beyond that first payment and understand the full picture, which absolutely includes the recurring costs that pop up after your first year. A successful venture is built on foresight, not just a healthy starting budget.

It’s a common pitfall: many entrepreneurs get caught by surprise in year two when a new wave of invoices arrives. These aren't "hidden" fees in a sneaky sense; they are standard, recurring costs for operations and compliance. Thinking of your company formation as a one-time payment is like buying a car and forgetting about insurance, registration, and fuel—the ongoing costs are what truly keep you on the road.

Annual Government and Licensing Renewals

The biggest and most predictable recurring expense you'll face is your annual licence renewal. This is completely non-negotiable for keeping your company in good legal standing. If you fail to renew on time, you can expect hefty fines and even risk having your company blacklisted.

Beyond your main licence, a few other government registrations also need to be renewed each year. They are all essential for your company to remain operational and compliant.

- Trade Licence Renewal: This is the core annual fee you'll pay to your licensing authority, whether it's the DET for a mainland business or your specific free zone authority. You can get a deeper look in our complete breakdown of the trade license Dubai cost and what it covers.

- Establishment Card Renewal: This card is linked to your company's immigration file. It must be renewed every year if you want to process or maintain any employee visas.

- Office Lease/Ejari Renewal: For mainland companies, your tenancy contract (Ejari) needs annual renewal. In a free zone, your flexi-desk or office lease agreement also comes with a yearly fee.

Operational and Visa-Related Recurring Costs

Once your business is up and running, operational costs become a regular line item in your budget. The most significant of these are tied to the legal right for you and your employees to live and work in the UAE.

Every residency visa typically has a two-year validity. This means you need to budget for the full renewal process for each employee—including yourself—every other year.

It's a classic budgeting mistake to only account for the initial visa stamping fee. Don't forget that every renewal involves government fees, medical tests, and Emirates ID processing, creating a recurring expense for every single visa holder in your company.

Here are the key visa-related renewals to plan for:

- Residency Visa Renewal: This process, required every one to three years depending on the visa, includes renewal fees, medical fitness tests, and visa restamping.

- Medical Insurance: Health insurance is mandatory for all residents. Policies must be renewed annually for every visa holder sponsored by your company.

- Emirates ID Renewal: Your Emirates ID is tied directly to your visa and has to be renewed at the same time, which comes with its own separate fee.

Compliance and Financial Obligations

Finally, staying compliant with the UAE's evolving financial regulations is another critical, ongoing cost. With the introduction of VAT and Corporate Tax, businesses now have to factor in professional fees for accounting, reporting, and potential audits.

These aren't one-off tasks; they demand continuous management.

- Corporate Tax and VAT Filings: You'll need ongoing services from an accountant or tax agent to make sure your filings with the Federal Tax Authority (FTA) are accurate and on time.

- Annual Audit Reports: Many free zones and all mainland companies (depending on their structure and turnover) require an audited financial statement each year. This means hiring an approved audit firm.

- Ultimate Beneficial Owner (UBO) Register: Maintaining and updating your UBO register is a mandatory compliance task that might require professional help to get right.

Smart Strategies to Lower Your Setup Costs

Starting a business in Dubai always requires capital, but you have more control over the final bill than you might think. The total cost isn't a fixed number; it's the direct result of the choices you make during the setup process. By being strategic from the very beginning, you can free up more of your budget for what actually matters—growing your new company.

Think of this as your playbook for making every dirham count. From the licence you pick to the office solution you choose, small tweaks can lead to some seriously big savings on your overall company formation costs in Dubai.

Choose Your Business Activities Wisely

One of the most direct ways to manage your expenses is by being laser-focused on your business activities. For example, a "General Trading" licence is fantastic because it gives you broad permissions, but it definitely comes with a premium price tag. On the flip side, a licence for a specific professional service, like "Marketing Management," is often much more affordable.

Take a moment to map out exactly what you need to do to operate legally. The temptation to add extra activities "just in case" is real, but each one can bump up government fees and add complexity. A focused approach means you only pay for what you absolutely need right now.

Embrace Lean Office Solutions

Your choice of office space is a huge factor in your first-year expenses, particularly if you're setting up on the mainland. A private office is great, but a flexi-desk or co-working space can be a complete game-changer for your cash flow. Many free zones even include flexi-desk options in their packages, satisfying the physical presence requirement without the hefty price of a dedicated lease.

Opting for a flexi-desk instead of a private office can easily save you AED 15,000 to AED 30,000 or more in your first year alone. This one decision is one of the most powerful moves you can make to protect your startup budget.

Look for Multi-Year and Bundled Packages

It pays to think long-term. Many free zones want to keep you around, so they offer attractive discounts on multi-year licence packages. Paying for a two or three-year licence upfront can often slash your annual renewal fee by 15-25%, which adds up to significant savings over time. For more ideas, you can dive into our guide on finding a low cost business setup in Dubai that fits your budget.

Also, think about bundling your services. When you work with a single expert partner who handles your company formation, visa processing, and accounting, you can often unlock valuable package deals. This doesn't just cut costs; it simplifies your life, letting you get back to the work of building your business.

Common Questions About Dubai Business Setup Costs

When you're navigating the financial side of setting up a business in Dubai, a lot of practical questions pop up. Getting straight answers is the only way to build a realistic budget and move forward with confidence. Let's tackle the most common queries we hear from entrepreneurs just like you.

What Is the Absolute Cheapest Way to Set Up a Business in Dubai?

If you're on a tight budget, your best bet is almost always a free zone package with zero visas and a flexi-desk. Free zones like IFZA and Meydan are well-known for their competitive, all-in-one deals that can start as low as AED 12,000 to AED 15,000.

This route gets you a legitimate trade licence and a legal business entity without the heavy overhead of a private office or visa fees. It’s the perfect launchpad for freelancers, consultants, or digital entrepreneurs who don't need a physical presence or UAE residency right away.

How Much Does a UAE Residency Visa Actually Cost?

Visas are often bundled into setup packages, but it’s smart to know the standalone cost. On its own, a two-year investor or employee visa will typically run you between AED 5,000 and AED 8,000. This amount usually covers every step of the process.

Here’s what goes into that total cost:

- Establishment Card Fee: This is the initial cost to register your new company with the immigration authorities.

- Entry Permit: The document that allows you to officially begin the residency process inside the UAE.

- Medical Fitness Test: A mandatory health screening for all residents.

- Emirates ID Application: For your official resident identity card, which you'll use everywhere.

- Visa Stamping: The final step where the visa is physically placed in your passport.

Remember, this is a recurring cost, so be sure to factor it into your long-term budget for yourself and any staff you plan to hire.

Can I Get a Business Licence Without Renting an Office?

Yes, you absolutely can. This is one of the biggest perks of setting up in a free zone. Most of them offer flexi-desk or co-working space options right in their licence packages. This satisfies the legal requirement for a registered business address without the huge expense of leasing your own private office.

While mainland companies almost always require a physical office with a registered Ejari (tenancy contract), a free zone flexi-desk is a clever, budget-friendly strategy. It keeps your initial company formation Dubai costs down while still making you eligible for residency visas if you decide you need them later on.

Ready to turn your business idea into reality with a budget that's clear and predictable? The experts at Smart Classic Business Hub provide transparent, end-to-end guidance on every aspect of company formation in Dubai. We handle it all—from licence registration to visa processing—so there are no surprises. Start your journey with a free consultation today.