On the face of it, UAE Corporate Tax is a federal tax charged on the net profits your business makes. But it’s been cleverly designed to support small businesses and startups. In simple terms, any profit up to AED 375,000 is taxed at 0%. Anything you earn above that mark is taxed at a flat rate of just 9%.

Understanding the New UAE Corporate Tax System

The roll-out of corporate tax represents a huge shift in the UAE's financial landscape. For decades, the country was famous for its virtually tax-free environment, so this new system is a fundamental change for every company operating here.

But don't think of it as a complicated burden. It’s better seen as a straightforward 'membership fee' for doing business in one of the world's most stable and energetic economies. This was a strategic move to bring the UAE in line with global financial standards, improve transparency, and create a sustainable, non-oil-based income stream for the government.

The Core Components

The whole system is refreshingly simple and clearly built to protect new and growing businesses. Officially kicking off on 1 June 2023 under Federal Decree-Law No 47 of 2022, the tax structure has two main tiers.

First, there’s a 0% tax rate on taxable income up to AED 375,000 a year. This is a huge relief for startups and SMEs, giving them room to grow without a tax burden. For any profit that goes above that amount, a flat 9% rate applies—which is still one of the most competitive corporate tax rates in the world. This blend of a generous tax-free threshold and a low standard rate ensures the UAE remains a top destination for ambitious companies. You can read more about the latest corporate tax trends on Chambers.com.

At its heart, the UAE's corporate tax system is about balancing international compliance with pro-business policies. It's a calculated step to modernise the economy while preserving its competitive edge as a global business hub.

To break it down even further, here’s a quick overview of the key facts every business owner should know.

UAE Corporate Tax At A Glance

This table gives you a simple summary of the essential components of the UAE's new corporate tax system.

| Component | Details |

|---|---|

| Standard Tax Rate | A flat rate of 9% on taxable income exceeding AED 375,000. |

| Exemption Threshold | 0% tax on taxable income up to AED 375,000 per year. |

| Applicability | Applies to most businesses operating in the UAE, including free zones. |

| Primary Goal | To align with global standards and diversify national revenue sources. |

These fundamentals form the basis of the new tax regime, ensuring it remains both fair and business-friendly.

Figuring Out if Your Business Needs to Pay Tax

So, with this new corporate tax system, the big question on every business owner’s mind is: “Do I need to pay?”

It’s a fair question, and thankfully, the UAE government has been very clear about who falls into the tax net. This isn’t just for the big players; the rules are designed to cover almost everyone doing business here, from a bustling mainland LLC in Dubai to a freelancer with a trade licence.

The official term you’ll hear is ‘Taxable Person’. Think of this as the government’s label for any individual or entity that needs to register for corporate tax. It’s a broad definition, and that’s intentional. The goal is to create a fair and consistent system for all.

Who Exactly is a ‘Taxable Person’?

Let’s break down who gets pulled into the corporate tax framework. The law is designed to be comprehensive, covering both local businesses and international companies earning money in the UAE.

Here are the main groups considered Taxable Persons:

- UAE Companies and Other Legal Entities: This is the biggest category. It includes any business incorporated, established, or managed within the UAE. We’re talking about LLCs, public and private joint-stock companies, partnerships—the whole lot.

- Individuals with a Business Licence: If you’re a freelancer, a consultant, or a sole proprietor with a commercial or business licence, you’re in this group too. Your business income is now on the tax radar.

- Foreign Companies with a ‘Permanent Establishment’: This is a key concept. If a foreign company has a fixed base of operations in the UAE, like an office, factory, or branch, it's considered a ‘permanent establishment’. The profits generated from that UAE base are subject to corporate tax.

- Foreign Companies Earning UAE-Sourced Income: A company doesn’t even need a physical office here to be taxed. If a foreign entity earns income from assets or activities within the UAE, that income might be taxable.

This structure creates a level playing field, ensuring that everyone contributing to the UAE economy is treated fairly under the law. For international investors, it’s also a good idea to understand how obtaining a tax residency certificate in the UAE can affect their obligations.

And Who Is Exempt from Corporate Tax?

Just as crucial as knowing who pays is knowing who doesn’t. The UAE has carved out specific exemptions for entities that serve a public purpose or operate in strategic sectors of the economy. This ensures the tax doesn’t interfere with essential services or key investment activities.

The exemption rules are designed to protect public welfare organisations and strategic investment vehicles, ensuring that the corporate tax system supports, rather than hinders, the nation's broader economic and social goals.

Here’s a quick rundown of the main exempt groups:

- Government Bodies: All federal and Emirate-level government departments, agencies, and public institutions are exempt.

- Government-Controlled Companies: Certain companies wholly owned and controlled by the government are also exempt, but they must be specifically named in a Cabinet Decision.

- Public Benefit Organisations: Think charities and non-profits. If they are officially listed in a Cabinet Decision, they are exempt from corporate tax.

- Qualifying Investment Funds: Certain investment funds and Real Estate Investment Trusts (REITs) can apply for an exemption, but they have to meet a strict set of criteria to qualify.

It’s important to remember that these exemptions aren’t always automatic. In many cases, an organisation has to apply and prove it meets all the conditions. This distinction is vital for understanding what corporate tax in UAE means for your specific business.

How to Calculate Your Taxable Income

Alright, let's get down to the practical side of things. Understanding how to calculate your taxable income is where the theory of UAE corporate tax meets your actual business operations. It’s not simply your final profit figure; it's a specific calculation that starts with your accounting books and then requires a few important adjustments.

Think of it this way: your business's financial statements are the starting point on a map. The tax law provides the specific route you need to follow to arrive at the final destination – your taxable income.

The journey begins with your accounting net profit or loss. This is the bottom-line number you see on your income statement, which should be prepared according to internationally recognised accounting standards. For nearly all businesses in the UAE, this means following the International Financial Reporting Standards (IFRS). This initial figure shows your total revenue minus all the business expenses your accountant has recorded.

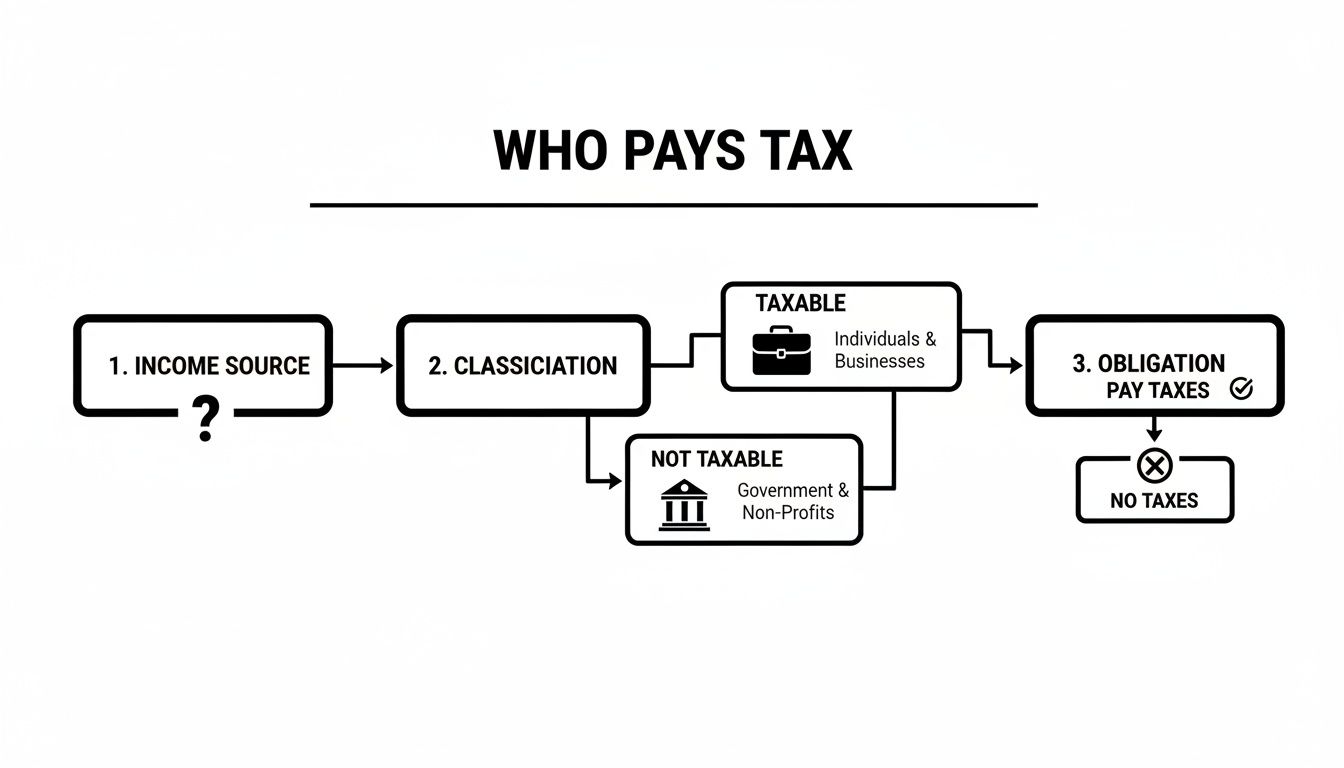

This infographic gives a simple breakdown of who is considered taxable under the new law.

As the visual shows, there's a clear line between business entities subject to tax and other organisations, like government bodies or public benefit groups, that are exempt.

From your accounting profit, you'll need to make several adjustments to align it with the rules in the UAE Corporate Tax Law. This involves adding back certain expenses that aren't tax-deductible and subtracting any income that isn't subject to tax. The final, adjusted number is your ‘Taxable Income’.

Identifying Deductible Expenses

A massive part of getting your taxable income right is knowing exactly which expenses you can legally deduct. The golden rule here is that an expense is deductible if it was incurred wholly and exclusively for the purpose of generating your business’s taxable income. It's a broad principle, but a crucial one.

Some of the most common, fully deductible expenses include:

- Employee Salaries and Benefits: This covers everything from wages and bonuses to health insurance and other costs related to your staff.

- Office Rent and Utilities: The costs associated with keeping your physical workspace up and running are classic business expenses.

- General and Administrative Costs: This is a catch-all for your day-to-day operational spending, like marketing campaigns, office supplies, and professional fees.

These deductions are usually straightforward because they have a clear and direct link to your business operations. Keeping meticulous records of these costs isn't just good accounting practice—it's essential for minimising your tax liability.

Understanding Non-Deductible Expenses

Just as critical is knowing what you can't deduct. The tax law singles out certain costs that, even if they are genuine business outgoings, are not allowed to be subtracted when calculating your taxable income. You have to add these back to your accounting profit.

Think of non-deductible expenses as costs the government has decided are not directly related to generating taxable profit. Forgetting to add these back is one of the easiest ways to make a mistake on your tax return.

Here are a few examples of non-deductible expenses:

- Donations made to organisations that are not approved charities or public benefit institutions.

- Penalties and fines, such as government-imposed sanctions for breaking regulations.

- Dividends, profit distributions, and similar payments made to the business owners.

- 50% of the cost of entertainment provided to customers, shareholders, or suppliers.

Recognising these non-deductible items is key to ensuring your calculation is both compliant and accurate.

Advanced Concepts Simplified

Beyond the basic ins and outs, the law has more complex rules, like tax loss relief and limits on interest deductions.

Tax loss relief is a particularly powerful tool. If your business makes a loss one year, you can carry that loss forward to offset taxable profits in future years. In simple terms, a tough year can actually help lower your tax bill when business picks up again.

Similarly, there are limits on how much interest expense you can deduct. This rule is designed to stop companies from using excessive debt to artificially shrink their profits. These more advanced topics are precisely why many businesses decide to get professional advice. It ensures they get the calculation right and truly understand what corporate tax in UAE means for their bottom line.

Navigating Tax Rules for Free Zone Companies

The introduction of corporate tax has definitely stirred the pot, especially for one of the UAE's most prized business assets: the free zones. For years, these economic hubs have been the undisputed champions for international entrepreneurs, and the good news is, the new tax law aims to keep it that way. However, it does introduce a few new terms you absolutely need to get familiar with.

At the very top of that list is the ‘Qualifying Free Zone Person’ (QFZP). This isn't just a label for any company operating in a free zone. It's a specific legal status that you have to earn by meeting a pretty strict set of conditions. Getting this status is your golden ticket to the highly attractive 0% corporate tax rate.

Becoming a Qualifying Free Zone Person

So, how do you get this coveted QFZP status? The government has laid out several criteria to ensure the 0% tax benefit goes to businesses that are genuinely contributing to the economy from within the free zones.

Here’s what you’ll need to do:

- Maintain Adequate Substance: This is a big one. You need a real, physical presence and must be conducting your main income-generating activities right from your free zone base. This is to prevent "shell companies" being set up just to dodge taxes.

- Derive ‘Qualifying Income’: The bulk of your revenue has to come from specific, approved activities. We'll break this down in a moment.

- Audited Financial Statements: Your books must be prepared according to internationally recognised standards and, importantly, be audited.

- Comply with Transfer Pricing Rules: Any deal you do with a related company (like a parent or subsidiary) has to be at 'arm's length'—meaning, you have to price it as if you were dealing with a complete stranger.

Slip up on any of these, and you could lose your QFZP status. If that happens, you're looking at the standard 9% tax rate on all your profits.

Understanding Qualifying Income

The most critical piece of the puzzle for any QFZP is ‘Qualifying Income’. This is the specific type of profit that gets the 0% tax rate. Any income that doesn't fit this definition gets taxed at the standard 9%, even if you are a QFZP.

Think of it this way: your business has two buckets for its income. One is the tax-free bucket (Qualifying Income), and the other is the taxable one.

Qualifying Income is generally profit you make from transactions with other companies based in any UAE free zone, or with international customers outside the UAE. On the flip side, income you make from selling goods to customers on the UAE mainland is usually not Qualifying Income and gets taxed at 9%.

Grasping this difference is fundamental to understanding what corporate tax in the UAE means for your free zone business. It directly shapes how you need to structure your sales and day-to-day operations. For a closer look at setting up your business in these prime locations, our guide on free zone company setup in the UAE is a great place to start.

Mainland vs Qualifying Free Zone Tax Treatment: A Comparison

The choice between a mainland and a free zone setup has always been a major fork in the road for entrepreneurs in the UAE. With the new tax law, the financial implications of that decision are more pronounced than ever.

Here’s a simple table to show you the key differences in how corporate tax works for each.

| Aspect | Mainland Company | Qualifying Free Zone Person |

|---|---|---|

| Tax Rate | 0% on profits up to AED 375,000, then 9% on profits above that. | 0% on Qualifying Income, and 9% on any non-Qualifying Income. |

| Main Market | Can trade freely across the entire UAE mainland without any restrictions. | Primarily serves other free zone companies and international clients. |

| Mainland Sales | All income from mainland sales is subject to the standard tax rules. | Income from most mainland sales will be taxed at the 9% rate. |

| Compliance | Must register for tax, file a return, and keep proper accounting records. | Must meet all QFZP conditions, register, file returns, and maintain audited financials. |

At the end of the day, this comparison should help you make a smarter, more strategic decision. The right structure for you comes down to your business model, who your customers are, and where you see your company heading in the future.

Your Essential Corporate Tax Compliance Checklist

Making the leap into a new tax era is about more than just knowing the rules; it's about having a clear, actionable game plan. Think of corporate tax compliance less like a one-off task and more like a continuous cycle. Falling behind can bring on penalties you really don't need, so a solid checklist is your best friend for staying on track.

This is your straightforward, step-by-step roadmap. By breaking the process down into manageable chunks, you can steer your company through its tax duties with confidence, without letting any of the critical details slip through the cracks.

Step 1: Register with the Federal Tax Authority

First things first: you absolutely must register for corporate tax with the Federal Tax Authority (FTA). This is non-negotiable for almost every business in the UAE, including those in free zones. And here's a crucial point many miss—you have to register even if your annual profits fall below the AED 375,000 threshold and you expect your tax bill to be 0%.

The FTA has set specific registration deadlines based on when your business was founded and when your financial year ends. Missing this deadline is the first potential pitfall and can lead to penalties right out of the gate. So, your number one priority should be to find out your specific timeline and get registered on the EmaraTax portal.

Step 2: Maintain Meticulous Financial Records

Clean, organised financial records are the foundation of your entire corporate tax compliance. Your books are no longer just for you; they are the official source for calculating your taxable income and putting together your annual tax return. The law is clear: businesses must keep detailed records and all supporting documents for a minimum of seven years after the end of the tax period.

What does this mean in practice? You need a solid system for:

- Tracking every dirham: All your income and expenses must be recorded without fail.

- Keeping the proof: Hold onto all your invoices, receipts, and contracts. These are the evidence that back up your financial statements.

- Following the standard: Your accounts must be prepared according to International Financial Reporting Standards (IFRS), the recognised benchmark in the UAE.

Good bookkeeping isn't just a suggestion anymore—it's a legal duty that directly affects the accuracy of your tax filings. If you're already handling other compliance tasks, you can often adapt your existing processes. For instance, many businesses find their procedures for VAT filing in the UAE can be a great starting point for corporate tax record-keeping.

Step 3: File and Pay on Time

Once your financial year wraps up, two important dates go on the calendar. First, you have to prepare and send your corporate tax return to the FTA. Second, you need to pay whatever tax you owe. You have to get both of these done within nine months after your financial year ends.

For example, if your company's financial year closes on 31 December, your tax return and payment are due by 30 September of the next year. That nine-month window seems like a lot of time, but it's smart to avoid leaving it to the last minute.

Missing these deadlines can result in some hefty penalties for both late filing and late payment. A simple but effective trick is to map out your tax calendar and set reminders well in advance. It’s the easiest way to make sure you hit your deadlines without any last-minute panic.

Step 4: Partner with a Tax Professional

While the basics of UAE corporate tax are designed to be straightforward, things can get complicated fast. Calculating taxable income, figuring out what you can deduct, and navigating the specific rules for free zones can be tricky. This is where bringing in a tax professional really pays off.

A good tax advisor will help ensure everything is accurate, spot tax-saving opportunities you might have overlooked, and can even handle the entire filing process for you. It's about more than just compliance; it’s about peace of mind, letting you get back to what you do best—running your business—while knowing your tax affairs are in expert hands.

Partnering With Experts for Tax Success

Getting to grips with the UAE's new corporate tax system is a tall order, especially when you're also managing the day-to-day pressures of running your business. While this guide gives you a solid footing, applying the rules to your specific situation is where things get tricky. Precision and foresight are key.

This is exactly where bringing in seasoned professionals can make all the difference. What feels like a compliance headache can be transformed into a streamlined, strategic part of your business.

At Smart Classic Business Hub, we’re experts at bridging that gap between knowing the law and applying it perfectly. Our team specialises in translating the complexities of what is corporate tax in UAE into simple, actionable steps for your business. We provide the hands-on expertise you need to not just meet every legal requirement, but to actually strengthen your financial position within the new framework.

Your Pathway to Full Tax Readiness

Getting tax-ready is about more than just filing a form on time. It means taking a proactive look at your entire financial management system and corporate structure. We offer a dedicated suite of services designed to walk you through every single stage, ensuring no detail is missed and no opportunity is overlooked. Our goal is to empower your business, whether you're a brand-new startup or an established international player.

Our core services tackle the main challenges we've covered in this guide:

- Seamless Corporate Tax Registration: We’ll manage the entire registration process with the Federal Tax Authority (FTA), making sure your application is spot-on and submitted well ahead of any deadlines to avoid penalties.

- Strategic Structural Advice: The choice between a mainland and free zone company is more critical now than ever. We give you clear, practical advice on the best structure for your business model to make the most of potential tax advantages.

- Meticulous Bookkeeping and Accounting: Our experts will set up and maintain precise, audit-ready financial records. These records are the foundation of your tax compliance, giving you total confidence in your numbers.

When you proactively manage your tax obligations with expert support, you free yourself up to focus on what you do best: driving business growth. We aim to give you the peace of mind that comes from knowing your tax affairs are not just compliant, but strategically sound.

Let's Achieve Compliance Together

Your business journey in the UAE deserves a partner who brings clarity and expert guidance to this new financial landscape. We're here to help you navigate the corporate tax system with confidence and ease.

Take the next step toward securing your company's financial health. Schedule a consultation with our tax experts today, and let’s build a robust strategy that fits your unique business needs and ensures you are fully tax-ready.

Frequently Asked Questions

Getting your head around a new tax system always throws up a few questions. While the main ideas are straightforward, the real confusion comes when you try to apply them to your own business. Here are some quick, clear answers to the most common queries we hear from business owners about UAE corporate tax.

When Is My First Corporate Tax Return Due?

This all comes down to your company's financial year. The law kicked in for financial years starting on or after 1 June 2023, so you need to know your official financial year to work out your deadline.

Let's use a simple example. If your financial year is the same as the calendar year (1 January to 31 December), your first tax period will be for the 2024 calendar year. The rule is you have nine months from the end of your financial year to file your corporate tax return with the Federal Tax Authority (FTA).

For a business whose financial year ends on 31 December 2024, your tax return and payment are due by 30 September 2025. Getting this nine-month window locked in your calendar is crucial to avoid any late filing penalties.

Do I Need to Register If My Profit Is Below AED 375,000?

Yes, absolutely. This is probably the biggest point of confusion for business owners. Almost every business in the UAE must register for corporate tax, no matter how much profit you make.

The AED 375,000 threshold is about tax liability—that is, whether you actually owe any tax. It has nothing to do with your duty to register. Even if you make zero profit, you are still legally required to register with the FTA and file an annual tax return. The only ones off the hook are specific exempt groups like government bodies. Skipping this step can lead to penalties, so make it a priority.

Can I Deduct My Salary As a Business Owner?

For the most part, yes. A reasonable salary you pay yourself is a legitimate business expense that can be deducted when calculating your company's profit. The key word here is reasonable.

The amount needs to be justifiable for the work you do. You can't just award yourself an enormous salary to wipe out your taxable profit, as the tax authorities could easily challenge this. It's good practice to document why your salary is set at a certain level—maybe by benchmarking it against similar roles in your industry—and make sure it's all properly recorded in your accounts.

How Does Corporate Tax Affect My Company Structure Choice?

The arrival of corporate tax has made the choice between a mainland and a free zone company more strategic than ever before. The tax hit for each is very different and really depends on how and where you do business.

Here’s a quick look at the main things to consider:

- Mainland Company: You’ll fall under the standard tax rules: 0% on profits up to AED 375,000 and 9% on anything above that. This is the obvious choice if your customers are mainly on the UAE mainland.

- Free Zone Company: You might be able to get a 0% tax rate on your 'Qualifying Income' if you meet the strict criteria for a 'Qualifying Free Zone Person' (QFZP). This income typically comes from trading with other free zone companies or international clients.

This distinction is massive. If your free zone business earns a lot of money from the UAE mainland, that portion of your profit will likely be taxed at the standard 9%. Your decision should be all about who your customers are and where they’re located.

Getting this right from the start demands precision and a bit of expert knowledge. Smart Classic Business Hub is here to make sure your business is not just compliant, but set up to thrive under the new tax rules. From registration to filing, our team can give you the clarity you need. Schedule a consultation with our tax experts today and get your business fully prepared.