Is a low cost business setup in Dubai actually possible?

People often assume launching a business here requires a massive war chest. But that’s a common myth. With the right strategy, you can get your venture off the ground for far less than you’d imagine. It all boils down to making smart choices about your jurisdiction, licence, and office space from day one.

Understanding Your Dubai Business Setup Options

The first—and most critical—decision you'll make is picking the right jurisdiction. This single choice will shape everything that follows: your operating scope, ownership structure, initial setup fees, and ongoing costs.

Think of it like choosing a neighbourhood for your business. Each one has its own rules, perks, and price tag. Getting this right is your biggest cost-saving move.

The Three Core Jurisdictions

In Dubai, your options essentially come down to Mainland, Free Zone, and Offshore. Each serves a very different purpose, especially when you’re keeping a close eye on the budget.

- Mainland Setup: This is your all-access pass to trade anywhere in the UAE. Historically, this was the pricier route because it required a local sponsor. However, recent reforms now allow 100% foreign ownership for thousands of business activities, making it a much more competitive and attractive option than ever before.

- Free Zone Setup: Free zones are often the go-to for affordable setups. These are special economic zones—and there are over 40 of them—that offer huge benefits like tax exemptions and simplified setup processes. They are perfect for consultants, tech startups, and anyone involved in international trade.

- Offshore Setup: This isn't for operating within the UAE. An offshore company is a non-resident entity used mainly for international business, holding assets, or managing investments. It offers incredible privacy and tax advantages at a very low entry price.

To give you an immediate understanding of your choices, here’s a quick comparison of the three main jurisdictions on key cost-related factors.

Quick Glance at Low Cost Dubai Business Setup Options

| Factor | Mainland | Free Zone | Offshore |

|---|---|---|---|

| Initial Cost | Higher, but more flexible | Lowest for specific activities | Generally very low |

| 100% Ownership | Available for most activities | Yes, standard feature | Yes, standard feature |

| Office Space | Mandatory physical office | Flexi-desk/virtual options | No physical office needed |

| Local Market Access | Direct, unrestricted access | Restricted (needs distributor) | No local access |

| Visa Eligibility | Yes, based on office size | Yes, packages often included | No residency visas |

| Best For | Local retail, clinics, restaurants | Consultants, traders, startups | Holding assets, int'l business |

This table is a starting point. Your specific business activity will ultimately determine which option is the most cost-effective. For instance, a freelance consultant targeting international clients would find a media-focused free zone incredibly economical. On the other hand, a small retail shop would benefit most from a Mainland licence to reach local customers.

The good news is you're launching into a thriving economy. In the first quarter of this year, Dubai's economy grew by 3.2%, with the non-oil sector making up a massive 75% of its GDP. This kind of stable growth is exactly what new businesses need. You can explore more on Dubai's economic strength and the opportunities it presents for entrepreneurs.

A common mistake is thinking "low cost" means settling for something second-rate. In Dubai, it's all about being strategic. By perfectly matching your business activity to the most suitable jurisdiction, you gain access to world-class infrastructure and a global market without breaking the bank.

Choosing Your Jurisdiction: Mainland vs Free Zone

One of the first, and biggest, decisions you'll make when setting up a low-cost business in Dubai is picking your jurisdiction: Mainland or Free Zone. This choice isn't just about a physical address; it fundamentally shapes who you can do business with, what kind of office you need, and most importantly, how much you'll spend to get started and keep running.

Forget the textbook definitions for a moment. This is a strategic decision that lays the entire financial groundwork for your company. Getting this right is probably the single most effective way to keep your setup costs lean.

The Mainland Advantage: Access to the Entire UAE Market

A Mainland company, registered with the Department of Economy and Tourism (DET), gives you the ultimate freedom to trade directly with anyone, anywhere in the UAE. If your business model involves local services, a retail shop, or selling directly to consumers in Dubai or other emirates, this is your only real path.

Not long ago, the requirement for a local Emirati sponsor made this a pricier option. But things have changed. Recent legal reforms now allow for 100% foreign ownership across more than a thousand commercial and industrial activities. This has been a complete game-changer for international entrepreneurs.

It means you can set up a Limited Liability Company (LLC) without giving up a single share of equity, giving you full control and a direct line to the lucrative local market. If you dream of opening a café, a boutique, or providing services directly to Dubai's residents, the Mainland isn't just an option—it's essential.

The Free Zone Path: The Go-To for Lean Startups

For most entrepreneurs chasing a low-cost business setup in Dubai, free zones are the natural starting point. And for good reason. These designated economic areas are engineered to attract foreign investment with a bunch of compelling perks. With over 40 free zones across the UAE, many are hyper-focused on specific industries like media, tech, or commodities.

The trick to free zones isn't just finding the cheapest one, but finding the cheapest one that's a perfect match for your business activity. An e-commerce licence from a tech-focused free zone will be miles cheaper than a generic trading licence from a different zone.

The core benefits that make free zones so attractive are pretty clear:

- 100% foreign ownership is standard.

- 0% corporate and personal income tax (though you need to be mindful of the new corporate tax law).

- Simplified and much faster setup processes.

- The freedom to repatriate all your capital and profits.

These zones are perfect for businesses that don't need to trade directly on the UAE mainland—think international consultants, e-commerce stores with a global customer base, or import/export traders. You can still work with mainland companies, but it usually means going through a local distributor. For a deeper dive, check out our comprehensive guide on the differences between Mainland vs Free Zone.

Comparing Costs: Real-World Scenarios

Let's make this practical. Here’s how the choice plays out for a few common business types.

| Business Type | Ideal Jurisdiction | Why It's Cost-Effective |

|---|---|---|

| Freelance Graphic Designer | Free Zone | A freelance permit from a zone like Dubai Media City or even one in a northern emirate gives you an all-in-one package with a visa and no office needed. This is the absolute cheapest, fastest way to get legal. |

| Online Clothing Store | Free Zone | An e-commerce licence from a zone like Dubai CommerCity or IFZA lets you operate globally. You start with a flexi-desk and avoid the high cost of a mainland warehouse until you’re ready to scale. |

| Small Cafe or Eatery | Mainland | Here, direct access to local customers is everything. A Mainland Professional Licence lets you set up shop anywhere in Dubai. The initial costs are a bit higher, but your market is unrestricted. |

| IT Consultancy Firm | Free Zone | A specialised tech free zone like Dubai Internet City or DTEC offers fantastic networking and affordable licence packages. You can serve clients globally and work with mainland businesses through service agreements. |

As you can see, the "cheapest" route really depends on what you're selling and to whom. A free zone almost always offers the lowest entry price for service-based and international businesses. But if your success is tied to the local UAE market, the slightly higher upfront cost of a Mainland setup is an investment that pays for itself.

Finding The Most Affordable Business Licence

Once you've got a handle on your ideal jurisdiction, the next massive piece of the puzzle is your business licence. This isn't just a bit of paperwork; it's the entire legal backbone of your company, and the type you choose directly hits your setup costs. Making a smart decision here can genuinely save you thousands of dirhams right out of the gate.

Choosing the right licence goes beyond simple legal compliance—it's a core part of your strategy for a low cost business setup in Dubai. Pick the wrong one, and you could be facing unnecessary expenses and annoying operational limits for years to come.

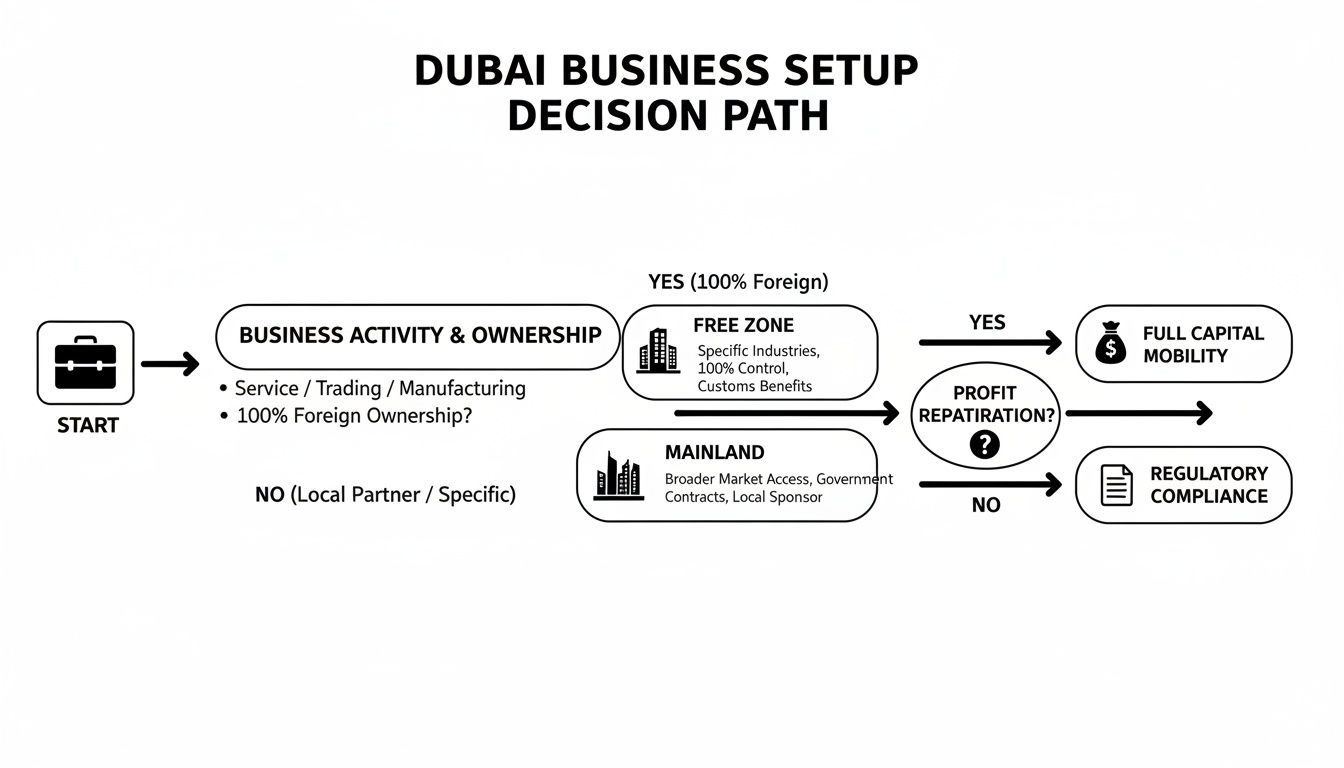

To simplify things, you can think of the decision-making process like a flowchart. This visualises the typical paths an entrepreneur takes when choosing between setting up on the Mainland or in a Free Zone.

As you can see, the path you take really depends on your business model. Do you need direct access to the local market, or are you more focused on international operations? This first choice immediately starts to narrow down your licensing and ownership options.

Professional vs Commercial Licence

For most people offering a service, the choice boils down to two main categories: a Professional Licence or a Commercial Licence. Knowing the difference is absolutely critical for keeping your budget in check.

A Commercial Licence is what you'll need for any business that involves trading—basically, buying and selling goods. This covers everything from e-commerce stores and import/export companies to your standard retail shop. These licences usually come with slightly higher government fees.

On the flip side, a Professional Licence is designed for service providers, consultants, and artisans. Think designers, marketers, accountants, and other skilled professionals. The biggest advantage here is the cost. Professional licences are often much cheaper to get, making them the go-to option for consultants and freelancers who want to operate legally without a massive upfront investment.

For a service-based entrepreneur, opting for a Professional Licence is one of the smartest cost-saving moves you can make. It allows you to operate legally with full ownership on the mainland as a Sole Establishment, often with lower government fees compared to a commercial LLC.

Nailing Your Business Activities

Here's a common and very expensive mistake I see people make: they pay for way too many business activities on their licence. When you apply, you have to specify exactly what your company will be doing. Each activity, or group of activities, has a cost tied to it. Piling on unnecessary ones just inflates your initial setup fees and your annual renewal costs.

Be specific. If you're a social media marketing consultant, don't just go for a general "Marketing Management" activity if a more precise—and potentially cheaper—option is available. List only what you need to get started. You can always amend your licence later to add more activities as your business grows. This focused approach will keep your initial outlay as low as possible.

Low-Cost Permits for Solopreneurs

The authorities in Dubai get it—the gig economy is booming. To support this, they've created some fantastic, ultra-low-cost permits specifically for individuals. These are perfect for anyone who isn't quite ready to commit to forming a full-blown company.

- Freelance Permit: You'll find these offered by many free zones (like Dubai Media City and Dubai Internet City, among others). They are a brilliant all-in-one solution, giving you a licence to operate under your own name and often including eligibility for a residence visa, all for one affordable annual fee.

- E-Trader Licence: Issued by the Department of Economy and Tourism (DET), this licence is tailor-made for individuals running e-commerce businesses from home via social media. For UAE and GCC nationals, it's an incredibly cheap way to make your online side hustle official.

These permits are designed to be the most accessible entry points into the market. For a more granular look, you can learn more about the complete trade license Dubai cost in our in-depth guide. Making the right choice from the very beginning ensures your business is built on a financially sound and sustainable foundation.

Smart Strategies To Minimise Your Setup Costs

Once you’ve settled on the right jurisdiction and licence, it's time to get tactical. This is where you can actively hunt down every possible cost-saving opportunity, turning a potentially expensive process into a lean and efficient one. It's about being clever with every dirham you spend on essentials like office space, visas, and paperwork.

Making smart choices here is what ensures your low cost business setup in Dubai isn’t just affordable on day one, but sustainable for the long haul. Let's break down the most effective ways to trim your expenses without cutting corners.

Ditch The Traditional Office Lease

For any new business, one of the biggest line items on the budget is rent for a physical office. In Dubai, this can easily run into tens of thousands of dirhams annually—a massive burden for a startup. Thankfully, there are brilliant modern solutions to slash this cost.

Forget the traditional lease. Consider these much more affordable alternatives:

- Virtual Offices: This is often the most economical choice. A virtual office provides a legal business address, a phone number, and mail handling services, all without the physical space. It ticks the legal box for company registration in many free zones and is perfect for consultants, freelancers, and digital businesses. You can learn more about how a virtual office in Dubai can fit into your setup strategy.

- Flexi-desks or Co-working Spaces: If you need a physical spot to work from time to time, a flexi-desk is the answer. You get access to a shared workspace for a certain number of hours each month, giving you a professional environment when you need it without the high cost and commitment of a dedicated office.

By opting for a flexi-desk in a cost-effective free zone, an entrepreneur can often save over 70% on their annual workspace costs compared to leasing a small, private office. That's a game-changing saving for any new venture.

Be Strategic With Your Visa Package

Another significant upfront expense is your visa allocation. It’s tempting to go for a package with multiple visas, thinking about future hires. This is a common mistake that inflates your initial budget for no good reason. Every visa in your package adds to the total cost, whether you use it immediately or not.

Start lean. Only pay for the visas you absolutely need right now—which is usually just one for yourself as the owner. Most free zones and mainland authorities make it easy to apply for additional employee visas later, once your business is up, running, and generating revenue. This "pay-as-you-grow" approach keeps your initial outlay to a bare minimum.

Manage Your PRO Services Wisely

Public Relations Officer (PRO) services cover all the essential government legwork, from visa processing and document clearing to licence renewals. While hiring a professional PRO service is almost always the smoothest path, it does come with a fee.

For the truly budget-conscious entrepreneur, a hybrid approach can work. You could handle some of the simpler online applications and document submissions yourself to save some money. But be careful. The time you spend navigating government portals and standing in queues is time taken away from building your business. For anything complex, a professional's expertise can prevent costly mistakes and delays, making it an investment that pays for itself.

Watch Out For Hidden Fees

A common trap for new entrepreneurs is getting blindsided by unexpected costs. The initial quote for your licence and office is just one part of the story. To build a realistic budget, you absolutely have to account for these often-overlooked expenses:

- Document Attestation: Any personal or corporate documents from outside the UAE (like university degrees or incorporation papers) need to be legally attested. This involves stamps from the UAE Embassy in your home country and the Ministry of Foreign Affairs here, a process that can cost hundreds of dirhams per document.

- Legal Translation: All official documents submitted to government bodies must be in Arabic. If yours are in another language, you’ll have to pay for a certified legal translator.

- Emirates ID and Medical Test: These are mandatory steps for your residence visa, and they come with their own set fees.

- Establishment Card: This is a crucial card for your company that allows you to hire staff and apply for their visas.

At Smart Classic Business Hub, we help clients navigate these complexities by streamlining mainland, free zone, and offshore formations with transparent, affordable packages. With the right guidance, the setup costs for a tech firm using a flexi-desk in a zone like DTEC can be in the AED 15,000–25,000 range, compared to a much higher AED 25,000–40,000 for a business requiring a physical location. Find out more about how profitable business ideas are being launched in Dubai with these smart, cost-effective strategies.

Managing Your Ongoing Costs And Compliance

Getting your low-cost business setup in Dubai across the finish line is a great feeling, but the real journey begins now. The true test of a sustainable business isn't just a cheap launch; it's how you manage your finances year after year. That initial setup fee? Think of it as the starting pistol. Now, you need to focus on the recurring annual costs that keep your business lean, legal, and profitable.

It’s a classic mistake I see all the time: entrepreneurs get so laser-focused on the setup that they completely overlook the annual renewals and compliance duties. These aren't sneaky hidden fees. They're standard, predictable costs that every single business in the UAE has to plan for. Nail this from day one, and you'll avoid nasty financial surprises down the road.

Your Annual Financial Checklist

To keep your business financially healthy, you have to know what expenses are coming around the bend every 12 months. These are the non-negotiables for keeping your doors legally open.

Here are the main recurring costs you absolutely must factor into your annual budget:

- Trade Licence Renewal: This will be your biggest annual expense. The cost is usually pretty close to what you paid initially and is mandatory to keep operating.

- Establishment Card Renewal: You need this card to handle your company's visas and immigration files. It’s an annual renewal, no exceptions.

- Office/Flexi-Desk Renewal: Whether you have a virtual office, a hot desk, or a physical space, that rental cost is coming due.

- Visa Renewals: Every residence visa tied to your company, including your own, will need renewing every one to two years. This involves fees for medicals and your Emirates ID.

A word of advice: forgetting to renew your trade licence on time can lead to some eye-watering fines and could even get your company blacklisted. Set a reminder in your calendar at least two months before it expires. That gives you plenty of time to get your documents together and make the payment without any last-minute panic.

Navigating The UAE Tax Landscape

Let's be honest, a big part of Dubai's appeal has always been its tax-friendly environment. While that's still true, the landscape has shifted, and you need to be aware of the current rules to stay compliant. The introduction of corporate tax was a big change, but it was designed to support startups and SMEs, not crush them.

The UAE’s corporate tax rate is a very manageable 9%. But here's the key part: it only applies to taxable profits exceeding AED 375,000. This generous threshold means most small businesses and startups will pay 0% corporate tax in their early years. Some free zones even sweeten the deal with complete tax exemptions for certain activities, making them a goldmine for a low cost business setup in Dubai. You also need to stay on top of VAT rules and the upcoming e-invoicing mandate in July 2026. If you want a deeper dive, you can find more great insights about the UAE's tax rules on YouTube.

The Importance of Bookkeeping and VAT

Even if your business is comfortably under the corporate tax threshold, keeping clean financial records is not optional. Proper bookkeeping isn't just a legal requirement; it's the only way to get a clear picture of your company's financial health and make smart decisions.

On top of that, you have to register for Value Added Tax (VAT) if your taxable supplies and imports go over the mandatory registration threshold of AED 375,000 a year. You can also choose to register voluntarily if your turnover is above AED 187,500. Staying on top of your VAT obligations and filing your returns on time is critical to avoid penalties from the Federal Tax Authority (FTA). Thankfully, simple accounting software can make this whole process surprisingly straightforward, even if you're not an accountant.

Answering Your Top Dubai Business Setup Questions

Starting a new business always throws up a ton of questions. To give you some clarity, I’ve put together answers to the most common queries we get from entrepreneurs aiming for a low cost business setup in Dubai.

Let's cut through the noise and get straight to what you need to know.

What Is The Absolute Cheapest Way To Start A Business In Dubai?

Hands down, the most budget-friendly option is a freelance permit from one of the more affordable free zones. Think of places like Ajman or Ras Al Khaimah. These permits are tailor-made for solo professionals—consultants, designers, marketers, you name it.

For a single yearly fee, you're usually covered for:

- A legal licence to operate your business.

- The ability to apply for a residence visa.

- Access to open a corporate bank account.

This route sidesteps the need for a physical office, making it the leanest way to get your business up and running in the UAE. It’s the perfect launchpad for solopreneurs.

Can I Get A Residence Visa With A Low Cost Setup?

Yes, absolutely. It's a huge misconception that a cheap setup means you can't get residency. Almost every low-cost package, from freelance permits to basic free zone companies, includes one visa or offers it as a straightforward add-on.

Securing a residence visa is a fundamental part of even the most affordable business setups here. The authorities know it's a major reason people choose the UAE, so they've built it into their packages.

Whether you go for a simple flexi-desk package in a Dubai free zone or a freelance permit, you'll have a clear path to getting your UAE residence visa. This lets you live and work here legally while you build your business from scratch.

What Are The Most Common Hidden Fees To Watch Out For?

While good consultants are upfront about costs, a few expenses can still pop up and surprise you if you aren't ready for them. They aren't "hidden" so much as easily forgotten when you're doing your initial maths.

Make sure you budget for these:

- Document Attestation: Any official papers from back home, like your degree or marriage certificate, need to be attested by several government departments. Each stamp comes with a fee, and it can easily add up to several hundred dirhams per document.

- Legal Translation: All your official documents have to be in Arabic. If they're in English or another language, you’ll have to pay for a certified legal translation.

- Visa-Related Costs: Don't just budget for the visa sticker itself. You also have the mandatory medical fitness test and the fee for your Emirates ID card.

- Establishment Card: This is a vital company document that lets you apply for visas for yourself and your staff. It has its own registration fee and needs to be renewed annually.

Factoring these in from day one will give you a much more realistic budget for your low cost business setup in Dubai. It’s all about planning ahead to avoid those nasty financial surprises down the line.

Getting through the setup maze takes know-how and a solid grasp of local rules. Smart Classic Business Hub offers complete support to make sure your launch is not just affordable but also fully compliant and set up for success. Let our experts manage the details so you can focus on building your business. Find out more about how we can help at https://smartclassic.ae.