So, you're thinking about launching a business in the United Arab Emirates? Fantastic decision. The UAE isn't just a business hub by chance; it's a carefully crafted ecosystem built on strategic location, government foresight, and a buzzing, diversified economy that genuinely rolls out the red carpet for foreign investment and new ideas.

Navigating Your UAE Business Launch

This guide is designed to cut through the jargon and give you a clear, practical roadmap for setting up your company. We'll walk you through everything from the big initial decisions to getting your doors open for business.

One of the first—and most important—things you'll discover is the choice between setting up on the Mainland or in a Free Zone. Getting this right from the start can save you a world of headaches, time, and money down the road.

A Thriving Entrepreneurial Ecosystem

The UAE’s pro-business attitude is more than just talk. It’s embedded in its national identity and vision for the future. The government is actively championing startups and small-to-medium enterprises (SMEs), knowing they're the engine of economic growth.

The numbers speak for themselves. By mid-2022, SMEs were contributing a massive 63.5% to the nation’s non-oil GDP. It’s a dynamic environment. The government's 'The Emirates: The Startup Capital of the World' campaign proudly noted that the country is home to over 1.2 million registered companies, with entrepreneurs owning about 94% of them.

And they’re not stopping there. The goal is to push that number past 2 million by 2031, a clear signal of the long-term commitment to enterprise. You can read more about the UAE's startup growth and economic goals.

When you're starting a company in the UAE, the single most critical decision you'll make is choosing your jurisdiction. It dictates your ownership structure, where you can legally operate, and how easily you can scale in the future.

Core Business Jurisdictions

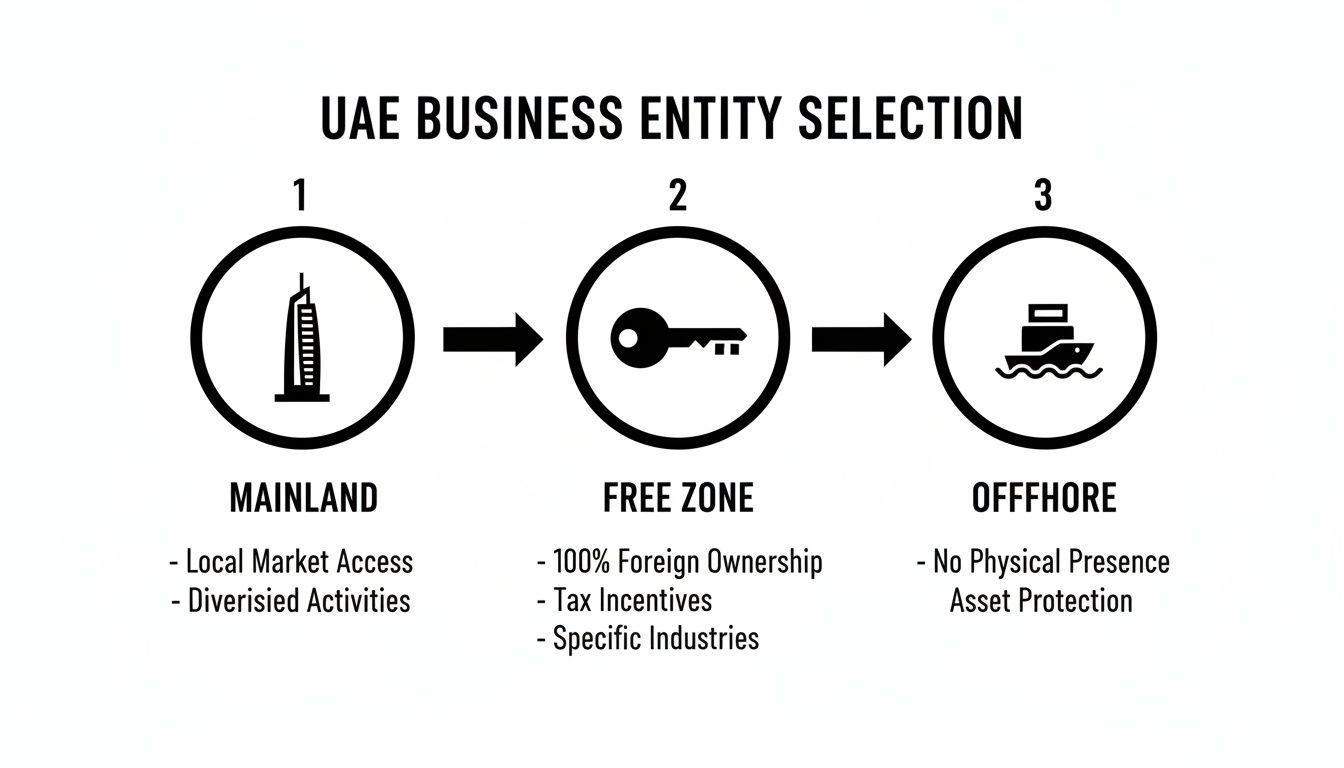

To get right to the point, let's break down the three main jurisdictions available. Each one is built for different business models and goals, so understanding the core differences is key.

Here’s a quick look at how Mainland, Free Zone, and Offshore setups compare.

UAE Business Jurisdictions At a Glance

| Feature | Mainland Company | Free Zone Company | Offshore Company |

|---|---|---|---|

| Market Access | Can trade directly within the entire UAE market. | Restricted to trading within its specific Free Zone and internationally. | Cannot trade within the UAE; for international business only. |

| Ownership | 100% foreign ownership is available for most activities. | 100% foreign ownership is standard for all companies. | 100% foreign ownership is a core feature. |

| Office Space | Requires a physical office space registered with Ejari. | Flexible options, including virtual offices and flexi-desks. | No physical office requirement within the UAE. |

| Visas | Visa eligibility is generally tied to office size. | Visa packages are included with the company licence. | No eligibility for UAE residence visas. |

| Primary Use Case | Best for businesses serving the local UAE population. | Ideal for international trade, startups, and service providers. | Suited for asset holding, international invoicing, and investments. |

As you can see, the right choice really depends on what you want to achieve. If your target customers are in Dubai or Abu Dhabi, a Mainland company is likely your best bet. If you’re focused on international trade or services, a Free Zone offers incredible flexibility. And for asset protection or international invoicing, an Offshore entity is purpose-built.

Choosing Your Business Jurisdiction and Licence

Deciding where to anchor your business in the UAE is easily the most critical choice you’ll make at the start. This isn’t just about picking an address; it’s about defining your company's entire operational blueprint—who you can sell to, your ownership rights, and your tax responsibilities.

The path you choose—Mainland, Free Zone, or Offshore—lays the foundation for everything that comes next. Each has a distinct set of rules and benefits designed for very different business models. Getting this right from day one is crucial.

The Mainland Advantage: Direct Market Access

If your game plan is to trade directly with customers and businesses anywhere in the UAE, then a Mainland company is your ticket. Registered with the Department of Economic Development (DED) in your chosen emirate, this setup gives you unrestricted access to the entire domestic market, from Dubai to Abu Dhabi and beyond.

The big win here? You can bid on lucrative government contracts, a massive opportunity often closed off to other structures. You also have the freedom to set up your office or shop in any commercial district you like, putting you right where your customers are. And while a local partner used to be a requirement, recent legal reforms now allow 100% foreign ownership for most business activities.

Free Zones: The Global Business Hubs

For international entrepreneurs, Free Zones are often the go-to choice. The UAE has over 40 of them, and many are tailored to specific industries, creating powerful ecosystems of talent and opportunity. Think Dubai Media City for creatives or DMCC for commodity traders.

The appeal is undeniable:

- 100% Foreign Ownership: You keep full control of your company, no local partner needed.

- Tax Exemptions: Most Free Zones offer 0% corporate and personal income tax.

- Customs Duty Waivers: A huge cost-saver for businesses involved in import and export.

But there’s a key trade-off to remember. A Free Zone company is primarily designed to do business within its zone and internationally. To tap into the UAE mainland market, you’ll generally need to work with a local distributor. For a closer look at how these two stack up, check out our guide comparing Mainland vs Free Zone setups in Dubai.

This business-friendly environment is why the Global Entrepreneurship Monitor (GEM) consistently ranks the UAE as the best place in the world to start a business. The nation topped the charts on 11 out of 13 key indicators, a direct result of its massive investment in innovation hubs across fintech, AI, and blockchain.

Offshore Companies: For International Assets

An Offshore company serves a completely different, very specific purpose. Registered with authorities like JAFZA or RAK ICC, this structure isn't for doing business inside the UAE. Instead, it’s a legal tool for international trade, protecting assets, and holding investments.

Think of it as a corporate shield for your global dealings. You can't lease a physical office in the UAE or get residence visas for staff with an Offshore company. Its power lies in holding real estate, owning shares in other international companies, and handling global invoicing with maximum confidentiality and tax efficiency.

The right jurisdiction isn't about which is "best"—it's about which is best for your business. Aligning this choice with your long-term goals is the first real step toward a successful launch.

Matching Your Activity to the Right Licence

Once you’ve picked your jurisdiction, the next puzzle piece is your business licence. This document officially outlines exactly what your company is legally allowed to do. They generally fall into three main buckets: Commercial, Professional, and Industrial.

- Commercial Licence: This is for any business buying and selling goods. Think general trading, retail shops, real estate agencies, and import/export firms.

- Professional Licence: This is for service-based businesses that rely on professional expertise. This covers consultants, marketers, lawyers, IT specialists, and auditors.

- Industrial Licence: If you’re making, manufacturing, or processing anything, you'll need this. It applies to factories, workshops, and companies that turn raw materials into finished products.

It’s absolutely vital to list every single activity you plan to conduct. Operating outside the scope of your licence can lead to heavy fines, so getting this right ensures your business is compliant from day one.

The Registration and Documentation Process

Once you’ve locked in your jurisdiction and licence type, it’s time to get into the nitty-gritty of the setup process. This part is all about taking sequential, practical steps and managing your paperwork with precision. Getting this right from the beginning is the key to avoiding frustrating delays and ensuring your new company gets off to a smooth start.

The first move is always reserving your company’s trade name. This isn’t just about picking a name you like; it has to follow local naming rules and, of course, can't already be taken. Once your name is approved, the next step is getting the Initial Approval. Think of this as the government's preliminary nod, giving you the green light to move forward with drafting your legal documents and finding a business location.

A Practical Walkthrough: Setting Up a Marketing Consultancy in a Free Zone

Let's put this into a real-world context. Imagine you’re launching "Innovate Digital FZ-LLC," a new marketing consultancy in a Dubai free zone. With your trade name and business activity approved, your next big job is drafting the Memorandum of Association (MOA). This is a critical legal document that spells out your company’s structure, who the shareholders are, and how it will operate.

At the same time, you need to sort out your office space. This is where free zones really shine, offering everything from a full physical office to a more budget-friendly flexi-desk or even a virtual office package. Your choice will come down to your budget and how many visas you need. After signing the lease and finalising the MOA, you’ll submit the whole package to the free zone authority to get your final trade licence.

The flowchart below gives you a high-level view of the decision-making process between the main UAE business jurisdictions.

As you can see, your business goals are the primary driver for whether a Mainland, Free Zone, or Offshore setup makes the most sense.

Compiling Your Essential Documents

If there’s one place where things get held up, it’s with documentation. Getting your paperwork in order from day one is non-negotiable. The specific documents you'll need can vary a bit, mainly depending on whether the shareholders are individuals or an existing company.

For individual shareholders, the list is quite straightforward:

- Passport Copies: Clear, colour copies for every shareholder and the appointed manager.

- Visa & Entry Stamp: If you're already in the country, you'll need a copy of your current visa and your last entry stamp.

- Emirates ID Copy: Required for any shareholders who are current UAE residents.

- Proof of Address: A recent utility bill (no older than three months) usually does the trick.

The process gets a bit more involved if a corporate entity is a shareholder. You’ll need to provide attested and legalised copies of the parent company's key documents, like its Certificate of Incorporation and MOA.

Key Takeaway: Document attestation is a step you cannot afford to overlook. It’s a multi-stage verification process that starts in the document's home country and is then finalised by UAE authorities. Underestimating the time this takes is one of the most common reasons for delays in company setup.

Understanding the Timeline

So, how long does all of this actually take? Having a realistic timeline is crucial for planning your launch. While some free zones might advertise setups in just a few hours, the complete end-to-end process has several distinct stages.

Here’s a breakdown of a typical timeline:

- Trade Name & Initial Approval: This is usually quick, often taking just 1-3 working days.

- Document Preparation & Submission: This phase is entirely on you. If your documents are ready and attested, it’s fast. If they need attestation, that process alone can take weeks.

- Lease Agreement & MOA Signing: Expect this to take another 2-5 working days, depending on the authority's speed and coordination.

- Final Licence Issuance: Once everything is submitted and all fees are paid, the trade licence is generally issued within 3-7 working days.

Going back to our "Innovate Digital FZ-LLC" example, a well-prepared entrepreneur could realistically have their licence in hand within two to three weeks—as long as all documents were correct from the start.

For a deeper dive into the specifics, check out our complete guide on how to register a company in the UAE, which breaks down every single step. Honestly, having an expert guide you through this can save you from common mistakes and get your business up and running much faster.

Securing Visas and Managing Post-Setup Formalities

Getting your trade licence is a huge milestone, but it's really the starting pistol, not the finish line. Now the real work begins: turning that licensed company into a fully functioning business. This means getting your residency sorted and tackling the all-important financial and compliance tasks.

Your very first move is to activate your company's immigration file. This starts with getting an Establishment Card (sometimes called a Company Immigration Card). Don't let its small size fool you; this card is the key that unlocks the entire visa system for you, your partners, and any staff you plan to hire. It officially registers your company with the immigration authorities.

Navigating the UAE Residence Visa Process

With your Establishment Card in hand, you can kick off the residence visa application. It’s a multi-stage process that thousands of entrepreneurs go through every year. While it’s straightforward, you need to pay close attention to the details and timing to avoid delays.

Here’s how it usually unfolds:

- Entry Permit: First, an entry permit is issued. This allows you to be in the UAE specifically to complete the residency steps. If you’re already inside the country on a tourist visa, you’ll do what's known as an "in-country status change."

- Medical Fitness Test: Every visa applicant has to pass a mandatory medical screening. It’s a quick process involving a blood test and a chest X-ray to check for certain communicable diseases.

- Biometrics for Emirates ID: Next, you'll visit a government service centre. They’ll take your fingerprints and a photo for your Emirates ID application. This card will be your official identification for everything in the UAE.

- Visa Stamping: Once your medical results are clear and the Emirates ID is processed, your passport gets the final residence visa sticker. Congratulations, you're officially a UAE resident.

From start to finish, the visa process typically takes between 10 to 20 working days. Keeping things on track really comes down to scheduling your appointments efficiently and submitting everything on time.

Opening Your Corporate Bank Account

This is often the biggest post-setup challenge for new businesses. Opening a corporate bank account in the UAE isn't just a formality. Banks here have very strict Know Your Customer (KYC) and anti-money laundering rules, so they scrutinise every application. Simply having a licence is no guarantee of an account.

To give yourself the best shot, you need to come prepared. Banks want to see a real, credible business. Be ready to provide:

- A Solid Business Plan: It needs to clearly explain what you do, who your customers are, and how you'll make money.

- Your Founder Profile: Details on your professional background and experience in your industry.

- Proof of Business Activity: Things like early-stage contracts, agreements with suppliers, or even just a professional website can make a big difference.

- Source of Funds Declaration: A clear statement on where your initial investment capital came from.

Banks are on high alert for shell companies, so proving you have substance is absolutely essential. The process can easily take several weeks, and you should expect to attend in-person meetings. My advice? Start this the moment your trade licence is issued.

Meeting Your Tax and Accounting Obligations

Getting your financial house in order from day one is non-negotiable. The UAE introduced Value Added Tax (VAT) back in 2018, and understanding your duties to the Federal Tax Authority (FTA) is critical to avoid trouble down the line.

VAT registration is mandatory if your taxable sales and imports top AED 375,000 in a 12-month period. You can also register voluntarily once you cross the AED 187,500 threshold. Missing the deadline for mandatory registration comes with hefty penalties.

But it’s not just about tax. The UAE Commercial Companies Law legally requires you to maintain proper accounting records. This isn't just red tape; it's smart business. Good bookkeeping helps you:

- Track your financial health and make better decisions.

- Produce clear financial statements for loans or investors.

- Sail through annual audits and licence renewals.

Hiring a professional accountant can save you from making expensive mistakes and frees you up to focus on what you’re here to do: grow your business. Getting these post-setup steps right builds a solid foundation for everything that comes next.

Budgeting for Your UAE Business Launch

Let's talk numbers. Nailing down a realistic budget is the absolute bedrock of a smooth business launch here in the UAE. It's easy to focus on the headline trade licence fee, but that’s really just one piece of the financial puzzle. To avoid any nasty surprises down the line, you need a clear picture of everything—from the initial, one-time setup charges to the recurring annual fees that keep your business running.

Thinking about the total investment isn't just about paying the first invoice. It's about building a sustainable financial model for your new venture from day one.

Breaking Down the One-Time Setup Costs

Your initial outlay is going to cover a handful of mandatory government and administrative fees. Think of these as the essential costs to get your company legally registered and on the grid before you even think about day-to-day operations.

Typically, your one-time costs will include things like:

- Trade Name Reservation: A fee to secure your chosen company name.

- Initial Approval Certificate: The charge for the authorities to give your business activity a preliminary green light.

- Registration and Licence Issuance Fees: This is the main government fee for getting your trade licence in hand.

- Document Attestation: If you have any foreign documents (like a university degree or incorporation papers), they’ll need to be legally attested, which has a cost per document.

- Establishment Card Fee: A crucial one-off payment that registers your new company with the immigration authorities.

These figures can swing quite a bit depending on where you set up (Mainland vs. Free Zone) and how complex your business activity is.

Factoring in Recurring and Variable Expenses

Once you’re officially licensed, your financial focus shifts to the ongoing costs. These are the expenses you'll need to budget for every year to keep your company in good standing. The biggest and most important is your annual licence renewal—it's mandatory to continue operating legally.

Beyond that, you have other recurring costs to keep on your radar:

- Office Rent: Whether you've got a physical office on the Mainland or a flexi-desk in a Free Zone, this is a major annual expense.

- Visa Costs: Each residence visa for you or an employee comes with its own string of fees for medical tests, Emirates ID, and processing.

- PRO Services: Many businesses hire a Public Relations Officer (PRO) to handle all the government paperwork and legwork. This can be a yearly retainer or a pay-per-service fee.

- Corporate Bank Account Opening: While banks don't usually charge a direct "opening fee," the process can have indirect costs and requires a significant investment of your time to prepare the right documents.

For a really detailed look at what to expect, check out our complete guide on the cost of starting a business in Dubai, which gets into the nitty-gritty of budgeting.

A common pitfall we see is underestimating visa costs. Each visa is a multi-step process with individual fees for the entry permit, medical test, Emirates ID, and the final visa stamping. A safe bet is to budget around AED 5,000 to AED 8,000 per visa to be safe.

The UAE's startup scene is buzzing with activity and attracting serious investment. Between 2020 and 2024, GCC venture capital saw an estimated 19% compound annual growth rate, and UAE-based startups are grabbing a huge slice of that pie. As you can read in this PwC report on the GCC's venture capital market, this investor confidence just underscores how vital it is to have a rock-solid financial plan from the get-go.

Sample Startup Budget for a UAE Free Zone Company

To put this all into perspective, let's sketch out a sample budget. The table below gives you a realistic breakdown of costs for a small consulting business setting up in a popular Dubai Free Zone with one investor visa.

| Cost Item | Estimated Cost Range (AED) | Frequency |

|---|---|---|

| Trade Licence Package (incl. registration, trade name, virtual office) | 15,000 – 25,000 | One-Time |

| Establishment Card | 2,000 – 3,000 | One-Time |

| Investor Residence Visa (1 person) | 5,000 – 8,000 | One-Time |

| Annual Licence Renewal | 12,000 – 20,000 | Annual |

| Corporate Bank Account Assistance | 2,500 – 5,000 | One-Time |

Keep in mind, these numbers are estimates. They can easily change based on the specific Free Zone, the package you choose, and any promotions they might be running. Still, this gives you a solid baseline for what a new entrepreneur should plan to invest in their first year. Good financial planning isn't just about paying the bills; it's about building a stable foundation for growth.

Common Questions About UAE Company Formation

Even with the clearest plan, you're bound to have questions when setting up a company in the UAE. It's just part of the process. We hear a lot of the same queries from entrepreneurs, so let's tackle the most common ones head-on and give you the practical answers you need.

Can I Really Get 100% Foreign Ownership?

For the vast majority of businesses, the answer is a resounding yes. Major legal changes have pretty much done away with the old rule requiring a local Emirati sponsor for Mainland companies. This was a huge shift, making Mainland ownership much more like the 100% foreign ownership model that Free Zones have always offered.

That said, a few strategic sectors, like banking and insurance, still have rules about local partnerships. The key is to always double-check the specific regulations for your business activity with the Department of Economic Development (DED).

Is a Local Sponsor Still Necessary for a Mainland Company?

For most entrepreneurs, no. As we just covered, the days of needing an Emirati partner to hold 51% of your Mainland LLC shares are over for more than a thousand different business activities.

The role that's still around is the Local Service Agent (LSA). This is only for professional service licences—think consultancies, clinics, or law firms—set up as a Sole Establishment on the Mainland. An LSA has zero ownership and no control over your business. They're simply paid an annual fee to be your official link to the government.

What Is the Realistic Timeline for the Entire Setup Process?

This is a big one, and the timeline can swing quite a bit. A good, realistic window to plan for is anywhere from two to six weeks, from getting your company name approved to holding your trade licence and Establishment Card.

So, what makes it faster or slower?

- Your Chosen Jurisdiction: Some Free Zones are just built for speed and have faster processing times.

- How Prepared You Are: This is the biggest factor we see. If you have documents from abroad that need to be attested, that process alone can take weeks before your UAE application even begins.

- Extra Approvals: Businesses in fields like education or healthcare need a green light from other government bodies, which naturally adds more time to the clock.

Here’s a pro tip from years of experience: A complete, well-organised application will always move faster. Trying to rush with incomplete paperwork is the single best way to create delays for yourself.

How Much Capital Do I Need to Start My Business?

Unlike a lot of other countries, the UAE doesn't have a one-size-fits-all minimum share capital rule. For most LLCs, whether Mainland or Free Zone, the amount is up to you. You just state it in your company's Memorandum of Association (MOA).

Now, some very specific business activities or jurisdictions might have their own capital floors. But honestly, the more important thing is having a solid budget that covers all your setup fees, visa costs, and at least six months of running expenses. Being financially ready is far more critical than depositing a specific amount of share capital.

Navigating these questions is much simpler with an expert partner. Smart Classic Business Hub provides end-to-end guidance on company formation, ensuring every detail is handled correctly so you can focus on building your business. Get in touch with us today to start your journey.