If you're thinking about setting up a business in Dubai, a free zone is your smartest entry point. These hubs are purpose-built for foreign investors, offering massive advantages like 100% foreign ownership, a much simpler setup process, and significant tax breaks. For international entrepreneurs, it's the clear choice.

Why a Dubai Free Zone Is Your Strategic Business Hub

Choosing a location for your business isn't just about finding an address. It's a strategic move that dictates everything from your supply chain to the talent you can hire. A business setup Dubai free zone is more than just a place to work; it's a launchpad that positions you at the very crossroads of global trade between Europe, Asia, and Africa.

But these zones aren't just about favourable taxes. They are carefully crafted ecosystems, each one designed to support specific industries. This specialisation creates a powerful network effect, surrounding your business with potential clients, partners, and a highly skilled workforce right from the start.

An Ecosystem Built for Growth

Imagine you’re launching a tech startup. In a dedicated tech free zone, you're not just renting an office; you're plugging into a community of fellow innovators, VCs, and top-tier software engineers. The same goes for an e-commerce business operating from a hub with cutting-edge warehousing and direct links to air and sea cargo. This is the reality of Dubai's industry-specific free zones.

Here's what that means for you in practical terms:

- Complete Foreign Ownership: This is a big one. You keep 100% control of your company without needing a local Emirati sponsor—a huge advantage compared to a mainland setup.

- Pro-Business Governance: The rules inside free zones are clear, transparent, and designed to make life easier for foreign investors. No unpredictable red tape.

- World-Class Infrastructure: From sleek, modern office spaces to advanced logistics and high-speed internet, the infrastructure is built to support global operations.

The proof is in the numbers. Dubai's free zones have seen an explosion in company registrations, with over 60,000 companies now registered across its main hubs as of 2024.

This growth tells a compelling story. Take the Dubai Multi Commodities Centre (DMCC), for example. It ballooned from around 22,000 member companies in the early 2020s to over 38,000 by 2024, driven by a post-pandemic surge in commodities and fintech. With over 40 free zones across the UAE, these hubs have become magnets for foreign direct investment, thanks to incentives like a potential 0% corporate tax on qualifying income. You can find more insights on UAE free zone developments and their role in attracting foreign capital.

A Gateway to Global Markets

Location is everything, and zones like Dubai South (what used to be called DWC) offer logistics benefits that are hard to beat. Its direct proximity to Al Maktoum International Airport and Jebel Ali Port creates a seamless sea-air corridor where goods can move from a container ship to a cargo plane in just a few hours. For any business in trading, logistics, or e-commerce, this integrated infrastructure provides an almost unfair competitive advantage for regional distribution.

Choosing the Right Free Zone and Business License

Nailing your choice of free zone and business license is the single most critical decision you'll make when setting up in Dubai. This isn't just admin; it’s about plugging your business into an ecosystem that's already wired for its success. Get this wrong, and you're signing up for operational friction and costs you just don’t need.

First things first, stop thinking of all free zones as identical. They are highly specialised economic hubs, each with a unique industry focus, pricing, and set of facilities. Your job is to find the one that feels like it was custom-built for your business.

Matching Your Business to the Right Ecosystem

With over 40 free zones, it’s easy to feel overwhelmed. The trick is to filter them by industry. This simple step instantly cuts through the noise and puts the most relevant options on your radar.

Let's look at how this plays out in the real world:

- For E-commerce and Logistics: If you're moving physical products, logistics is everything. A zone like Dubai South is a game-changer. It's built right next to Al Maktoum International Airport and has a dedicated logistics corridor to Jebel Ali Port. This seamless sea-to-air link means you can shift goods from a shipping container to a cargo plane in a few hours—a massive advantage for regional distribution.

- For Global Trading: The Dubai Multi Commodities Centre (DMCC) is the place to be. It's a powerhouse for trading everything from gold and diamonds to coffee and tea, offering a purpose-built marketplace and infrastructure for traders.

- For Tech and Media: If you're in the digital space, you need a community. Zones like Dubai Internet City or Dubai Media City are packed with innovators and a skilled talent pool. They provide the network and infrastructure that digital businesses thrive on.

- For Financial Services: The Dubai International Financial Centre (DIFC) is in a league of its own. It operates under an independent, English common-law framework, making it the top destination for banks, asset managers, and fintech firms targeting the region.

This industry-first approach makes finding the right home for your business much more straightforward.

Here's a quick look at how some of the top free zones stack up for different types of businesses.

Dubai Free Zone Comparison for Popular Business Activities

Choosing the right free zone is about finding the best fit for your specific industry. The table below breaks down some of the most popular options to help you see which ecosystem aligns with your business goals.

| Free Zone | Primary Industry Focus | Ideal For | Key Advantage |

|---|---|---|---|

| DMCC | Commodities & Professional Services | Traders, consultants, crypto businesses | Prestigious address and a massive business network |

| Dubai South | Logistics & Aviation | E-commerce, freight forwarding, aviation | Unbeatable proximity to the airport and port |

| IFZA | General Trading & Services | SMEs, startups, consulting firms | Cost-effective and flexible licensing options |

| Meydan | Professional & Media Services | Consultants, tech startups, media agencies | Central location and mainland access perks |

| DIFC | Finance & FinTech | Banks, asset managers, wealth firms | Independent legal system and world-class regulation |

This is just a starting point, of course, but it shows how each free zone is tailored to support specific sectors, giving businesses within them a competitive edge.

Decoding Your Business License

Once you've shortlisted a few free zones, it's time to pick the right license. This is the legal document that officially defines what your company can and cannot do. A mismatch here can bring your operations to a dead stop.

You'll generally come across three main license categories:

- Commercial License: This is for any business involved in buying and selling goods. Think import/export, general trading, or running a retail shop. If your plan is to source products from Asia and sell them across the Middle East, this is the license you'll need.

- Professional License: Built for service-based businesses and skilled individuals. This covers consultants, marketing agencies, designers, accountants, and IT specialists. A marketing strategist advising clients on their digital campaigns would fall squarely into this category.

- Industrial License: As the name implies, this is for manufacturing, processing, assembling, or packaging goods. A company setting up a small workshop to assemble electronic components for export would require an Industrial License.

Expert Tip: Don't just think about what your business does today; think about where it’s headed. Some free zones let you list multiple business activities under a single license. It's often smarter to choose a slightly broader scope from the start to save yourself the hassle and expense of amending your license later on.

The details matter. A General Trading License, for example, gives you the freedom to trade a wide range of goods, but it usually costs more than a license for a specific product category. It’s a classic trade-off between flexibility and budget. This mirrors the bigger decision between setting up in a free zone versus the mainland, a topic we cover in depth in our guide comparing mainland vs free zone company formation in Dubai.

Ultimately, your free zone and license are the bedrock of your business. By focusing on your industry and your long-term vision, you can make these foundational choices with confidence and set your company up for success in Dubai.

The Complete Company Formation Process Explained

Let's be honest, the administrative side of a business setup in a Dubai free zone can look like the most daunting part of the whole adventure. But I've walked countless entrepreneurs through this, and I can tell you it's a lot more straightforward than it seems. Think of it less as a bureaucratic maze and more as a clear checklist that takes you from idea to a fully licensed, operational company.

The whole point of the formation process is to build your company's legal foundation, one step at a time. You’ll kick things off with the basics—like your company's name and what it will do—and move through approvals and legalities until you're holding your trade license. Getting your documents right from the start is the secret to making this a smooth ride.

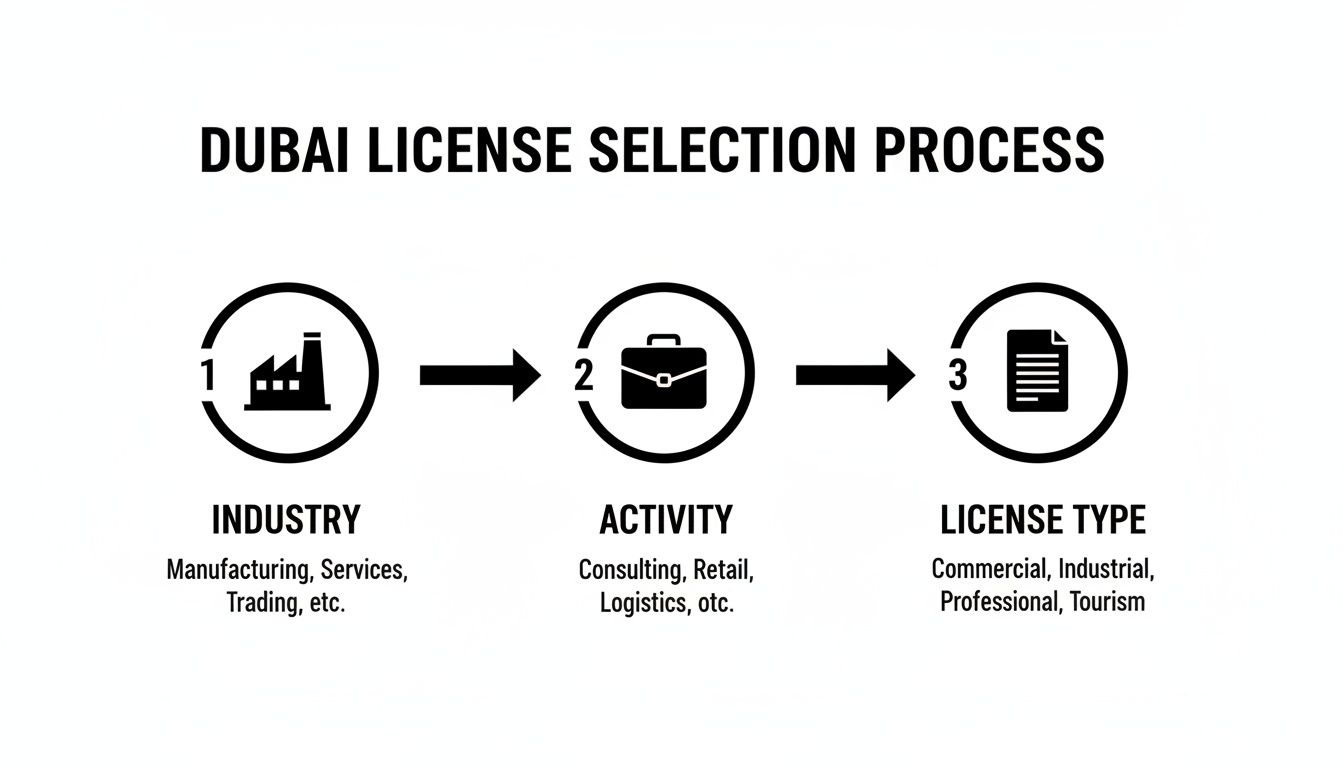

This flowchart gives you a simple visual of how the initial decision-making works, flowing from your broad industry choice down to the specific license you'll need.

As you can see, it’s a bit like a funnel. You start with your general industry, which helps you pinpoint your specific business activities, and that, in turn, tells you exactly which license to apply for.

The Initial Application Phase

Your journey officially starts when you submit an initial application to your chosen free zone authority. This is where you put your plans on paper and give them the foundational details of your proposed business.

At this point, you'll tackle two key decisions:

- Company Name Reservation: You need to submit a few trade name options for approval. The name has to be unique and follow UAE naming rules, which typically means steering clear of religious references or names of well-known global organisations.

- Activity Approval: The free zone authorities will look over the business activities you've listed to make sure they match the license you're going for and are actually permitted within that specific zone.

Having your paperwork in order here is non-negotiable. The essentials are usually clear, colour passport copies for every shareholder and the appointed manager, plus their visa pages if they already live in the UAE.

Preparing Your Core Documents

Once your company name and activities get the green light, it's time to submit the core legal documents. This is where paying attention to the small details saves you from massive delays down the road. A solid business plan is often a must-have, especially for certain professional services or if you're planning to apply for a number of visas.

Don't worry, your business plan doesn't need to be a 100-page novel. It just needs to be a concise document that clearly lays out:

- Your business model and what you aim to achieve.

- The background and experience of the key people involved.

- A basic financial forecast.

- Who your target customers are.

This document simply gives the free zone authority the confidence that your venture is well-thought-out and has a real shot at success.

Insider Tip: I've seen so many applications get held up by simple mistakes—a blurry passport scan, an incomplete form, or a business plan that's too vague. Do yourself a favour and double-check every single file before you hit 'submit'. It'll save you from getting sent to the back of the queue.

Finalising Your Legal and Physical Presence

With your legal paperwork in and under review, the next move is to lock down your company's address. Every company in a free zone needs a registered office, but the good news is there are flexible options designed for different types of businesses.

You’ll need to sign a lease agreement for one of the following setups:

- Flexi-Desk: This is essentially a shared workstation. It's perfect for solo entrepreneurs and consultants who need a minimal physical footprint and a cost-effective option.

- Serviced Office: A private, fully-furnished office space ready to go for small teams.

- Physical Office/Warehouse: These are larger, dedicated spaces for companies with more significant operational requirements.

This lease agreement is one of the final, critical pieces of the puzzle. Once it's signed and your legal documents are fully approved, the free zone will issue an invoice for your registration and license fees. As soon as you've paid that, you're on the home stretch. The authority will issue your official trade license, company registration papers, and Memorandum of Association. Just like that, you are officially in business.

Cracking the Code on Costs and Timelines

When you're budgeting for a business setup in a Dubai free zone, don't get fixated on a single, all-in-one number. The real cost is a mix of one-time setup fees, predictable annual renewals, and other bits and pieces that depend entirely on what your company needs. Getting a grip on this breakdown is the key to planning your finances properly and avoiding any nasty surprises down the line.

Think of it in two parts. First, there's the initial investment to get your company legally registered and licensed. That's your foundation. After that, you'll have recurring annual costs to keep your business compliant and running smoothly.

Your Initial One-Time Investment

The first major expense is the package of registration and licensing fees paid directly to the free zone authority. These are non-negotiable and form the core of your setup cost. This phase also includes paying for your first year's office solution, which is a must-have for every company.

Here’s a look at what typically falls under one-time costs:

- Registration and License Fees: This is the main charge for establishing your company and getting your trade license. The amount can vary wildly from one free zone to another.

- Establishment Card Fee: This little card is a big deal. It opens your company's immigration file, which is essential before you can apply for any residency visas.

- Office Lease (First Year): Whether you go for a budget-friendly flexi-desk or a private office, the first year's rent is almost always paid upfront.

- Visa Application Costs: Each visa comes with its own set of fees for processing, the mandatory medical test, and Emirates ID issuance.

For example, a solo consultant grabbing a flexi-desk in an affordable zone like IFZA or Meydan might see initial costs starting around AED 15,000 to AED 20,000. On the other hand, a small trading company with three employees needing a small physical office in a premium zone like DMCC could easily be looking at an initial outlay of AED 50,000 or more.

To give you a clearer picture, here's an illustrative breakdown of what a small service-based company might expect to pay.

Estimated Cost Breakdown for a Dubai Free Zone Setup

| Cost Component | Estimated Cost Range (AED) | Frequency |

|---|---|---|

| Trade License & Registration | 12,000 – 25,000 | One-Time (then annual renewal) |

| Establishment Card | 1,500 – 2,500 | One-Time (then annual renewal) |

| Flexi-Desk/Office Lease | 5,000 – 15,000 | Annual |

| Owner's Residency Visa | 3,500 – 5,500 | One-Time (per visa) |

| Medical Test & Emirates ID | 1,200 – 1,800 | One-Time (per visa) |

| Total Estimated Initial Outlay | 23,200 – 49,800 | – |

Remember, these are just estimates. The final figure will depend on your specific free zone, license activity, and how many visas you need.

Annual Recurring Costs You Must Plan For

Once you're up and running, the financial focus shifts to annual maintenance. These are predictable expenses you can, and should, budget for each year to keep your company in good standing.

The main recurring costs are pretty straightforward:

- Trade License Renewal: This is the annual fee you'll pay to the free zone to keep your license active. It’s usually close to the initial license fee.

- Office Lease Renewal: You have to maintain a registered address, so your flexi-desk or office lease needs to be renewed every year.

- Establishment Card Renewal: This immigration card also needs an annual renewal to process new or existing visas.

- Corporate Tax Compliance: Even if your tax rate is 0% on qualifying income, filing an annual corporate tax return is mandatory for all businesses in the UAE.

A classic mistake I see new entrepreneurs make is underestimating these recurring costs. You absolutely have to factor license and office renewal into your second-year budget from day one. It’s not a surprise expense; it’s a planned one.

Mapping Out Your Setup Timeline

Money is one part of the equation, but time is the other. The entire journey—from submitting your first application to having a fully functional bank account—doesn't happen overnight. It’s crucial to have a realistic timeline in mind.

Here’s how the process usually unfolds:

- Initial Approval & License Issuance (3-7 Business Days): Once you’ve submitted all the correct documents, most free zones are pretty quick on the uptake. Getting the trade license is often the fastest part of the whole process.

- Visa Processing (2-4 Weeks): After your license is in hand, you can kick off the residency visa process. This involves getting an entry permit, completing the medical fitness test, and giving your biometrics for the Emirates ID.

- Corporate Bank Account Opening (2-6 Weeks): This step often runs in parallel with your visa processing, but it can sometimes be the longest pole in the tent. Banks here perform thorough due diligence, and the timeline really depends on their internal backlog and how clear your paperwork is.

All in all, a realistic end-to-end timeline from submission to being fully operational with your visa and bank account is typically between four to eight weeks. Keep this in mind so you don't set unrealistic launch dates.

For a more granular look at the expenses, our guide breaks down the full cost of starting a business in Dubai.

Life After Your License: Visas, Banking, and Compliance

Holding your new trade license feels like crossing the finish line, but in reality, it’s the starting pistol for the next crucial phase. While your business setup in a Dubai free zone is now legally complete, the real work of making it operational begins. This is where you dive into residency visas, corporate banking, and ongoing compliance.

These next steps are what turn your business from a stack of legal papers into a living, breathing entity. Getting them right from day one is essential for hiring staff, managing your money, and operating legally within the UAE’s framework.

Securing Your Residency Visa

Your trade license is the golden ticket to your UAE residency visa. This is your gateway to living and working in Dubai legally, and it's a non-negotiable step for any business owner planning to base themselves here. The good news is that it’s a clear, multi-stage process that is very manageable when you know what to expect.

Here’s how the visa process usually unfolds:

- Entry Permit: First, your free zone authority applies for an entry permit for you. This document allows you to enter the UAE specifically to finalise your visa.

- Status Change: If you're already in the UAE on a tourist visa, you’ll do an "in-country status change" once the permit is issued. It’s a simple step that avoids the need to exit and re-enter the country.

- Medical Fitness Test: This is a standard government requirement involving a blood test and a chest X-ray to screen for any communicable diseases.

- Emirates ID Biometrics: You'll visit a designated centre to provide your fingerprints and have a photograph taken for your official Emirates ID card.

- Visa Stamping: Once your medical results are clear, the visa gets stamped into your passport, and your Emirates ID card is printed and delivered.

The entire journey, from permit to stamping, typically takes between two to four weeks. It's a well-oiled machine, but any inaccuracies in your documents can cause delays, so attention to detail is key.

Opening Your Corporate Bank Account

With your license and visa underway, it's time to tackle what is often the most challenging part of setting up: opening a corporate bank account. UAE banks are incredibly thorough with their due diligence and compliance checks to meet global anti-money laundering (AML) standards.

You can't just walk into a bank and expect to leave with an active account. Preparation is everything.

I’ve seen many entrepreneurs get frustrated at this stage. The trick is to understand what the banks are looking for: a clear, transparent picture of your business. Go in with a solid business plan, be upfront about your funding sources, and have details of your potential clients or suppliers ready. The more you give them, the smoother it goes.

To give yourself the best shot at a quick approval, make sure your application file is complete and looks professional. It should include:

- Your new company formation documents (license, memorandum of association, etc.)

- Passport, visa, and Emirates ID copies for all shareholders

- A well-written business plan detailing your operations

- CVs or professional profiles of the business owners

- Six months of personal or corporate bank statements to show financial history

The process can take anywhere from two to six weeks, but having your paperwork in perfect order can definitely push you toward the shorter end of that timeline. For extra guidance, our detailed guide on securing a non-resident bank account in Dubai is a great resource.

Managing Ongoing Compliance

Your responsibilities don't stop once the business is up and running. Staying in good legal and financial standing is an ongoing commitment, and the UAE has several regulations that every free zone company must follow.

Value Added Tax (VAT) is a big one. You are legally required to register for VAT if your company's taxable supplies and imports cross the AED 375,000 threshold in a 12-month period. It’s crucial to track your revenue and register proactively to avoid hefty penalties.

Then there's Corporate Tax, introduced in 2023. While free zone companies can get a 0% tax rate on "qualifying income," it isn't automatic. You must register with the Federal Tax Authority (FTA) and file an annual tax return, even if you don't expect to owe any tax.

Finally, most free zones require you to submit an annual audit report when you renew your license. This means appointing an accredited auditor to prepare and sign off on your financial statements each year. Keeping your books clean from day one will turn this from a stressful scramble into a simple annual formality.

Your Top Dubai Free Zone Questions Answered

When you're diving into the world of business setup in a Dubai free zone, a lot of questions pop up. It's completely normal. We hear them all the time from entrepreneurs just like you. Here are some clear, straightforward answers to the most common queries we get.

Can My Free Zone Company Do Business in Mainland Dubai?

This is the big one, and a crucial point to understand. A free zone company is licensed to operate within its designated zone and internationally. So, if you want to sell your products directly to a shop in the Dubai Mall, you can't just send them an invoice from your free zone entity. It doesn't work that way.

You have a couple of solid workarounds, though:

- Team up with a local distributor or agent. They need to be licensed by the Department of Economy and Tourism (DET) and can handle mainland sales for you.

- Open a dedicated mainland branch of your free zone company. This involves getting a separate license but gives you direct access to the local market.

Is It Mandatory to Rent a Physical Office?

Not at all. This is one of the best things about free zones today. Gone are the days when you had to commit to a costly physical office right from the start. Most free zones now offer smart, flexible options that make getting started much more affordable.

For consultants, freelancers, or small startups, a flexi-desk package is often the ideal choice. It gives you a legitimate business address, access to shared workspaces when you need them, and—most importantly—makes you eligible for residency visas without the overhead of a full-time office.

What Is the Minimum Share Capital Requirement?

Here’s another huge plus for setting up in a Dubai free zone: most of them have no minimum share capital requirement. Unlike other parts of the world where you have to lock up a significant amount of cash in a bank just to register, Dubai makes it much easier to get off the ground.

That said, while you might not need to show proof of paid-up capital during the setup process, having a solid financial runway is non-negotiable. Your business plan should always account for enough funding to see you through at least the first six to twelve months of operations.

How Many Visas Can I Get with My License?

The number of residency visas you can apply for is tied directly to the type of facility or package you choose. While each free zone has its own specific rules, the general principle is simple: more space equals more visas.

A standard flexi-desk package will typically get you one or two visas. As your team grows and you need to bring on more people, you'll need to upgrade your package to a serviced office or a larger physical space to increase your visa allocation. It's a scalable system designed to grow with your business.

Ready to move past the questions and into action? The team at Smart Classic Business Hub is here to give you personalised advice and manage the entire setup process for you. We'll handle the red tape so you can focus on building your business. Get in touch with us at https://smartclassic.ae to start the conversation.